Top 11 Countries to Work Abroad and Achieve Financial Independence (2026)

Zürich, Switzerland, one of the countries with highest salaries in the world. Photo by Ricardo Gomez Angel on Unsplash.

Reading time: 7 minutes

Quick answer (2026): If your goal is to reach Financial Independence faster, the best countries to work abroad are those with high net salaries relative to local cost of living. In our 2026 dataset, the strongest performers are Luxembourg, Switzerland, Qatar, the US, Kuwait, Denmark, the Netherlands, UAE, Australia, Germany, and Sweden.

What you’ll get in this article

✔ A data-driven ranking of the top 11 countries for saving/investing faster

✔ The salary-to-cost-of-living framework (and how to read the chart)

✔ The list of top countries + why they rank well

✔ The non-financial factors that can make a “good” country a bad fit (tax, visas, safety)

TL;DR — Work abroad to reach FI faster 💰

📈 The lever is savings rate, not salary alone.

⚖️ Best countries combine high net pay and manageable living costs.

🧾 Taxes, visas, healthcare, and job markets can flip the ranking for you personally.

🌍 Use the list as a shortlist, then run a personal check (career + visa + tax reality).

Note on scope: This post focuses on the accumulation phase of the Financial Independence journey—where to work to build wealth faster. If you are interested in retiring to a lower-cost of living country to speed up Financial Independence, check out our posts on geographic arbitrage in retirement.

Best Countries to Work Abroad and Save More (2026)

Where can you earn the most, spend the least, and reach Financial Independence faster? Are you looking to work abroad and supercharge your path to Financial Independence? This post compares 43 countries globally to find where you can earn a high salary while keeping your cost of living low in relative terms. We highlight the top 11 countries where working abroad can significantly boost your savings rate—the most powerful factor in achieving FIRE (Financial Independence, Retire Early).

We used real-world salary and living cost data from Numbeo to analyze how each country stacks up and built a visual tool to help you assess which locations are best suited to fast-track your financial freedom. This article is perfect for aspiring expats, digital nomads, and FIRE followers looking to optimize their earnings and expenses abroad.

In a previous post, we explored the best countries in Europe to work abroad in the pursuit of financial independence—in other words, countries that present both good salaries and low relative cost of living. We created a data-driven methodology to evaluate how European countries rank for achieving Financial Independence and early retirement.

To illustrate, we found that the cost of living (COL) in a major European city like Madrid or Rome was 11.9% and 13.9% lower than Berlin, respectively, yet the net average salary in the German capital was almost 40% and 75% higher than in the two cities. Clearly, Berlin offers a financial edge for those pursuing financial independence compared to major cities in southern Europe, such as Madrid and Rome.

That conclusion aligned with my lived reality. I grew up and lived for 25 years in Madrid before relocating to Germany, and can personally confirm that it’s an easier location to pursue Financial Independence in Germany than in Spain. Even without dramatic lifestyle changes, the higher salary base in German cities makes it easier to maintain a strong savings rate.

There are real trade-offs to consider—climate, culture, or distance from family and friends—but from a purely financial perspective, the salary-to-COL gap compounds much faster than people expect.

How does this interplay between salary and cost of living look across other countries on a global scale? Keep scrolling down and let’s find out!

Global Salary vs Cost of Living: How to Find the Best Country for FI

Why Your Savings Rate Matters More Than Your Salary Alone

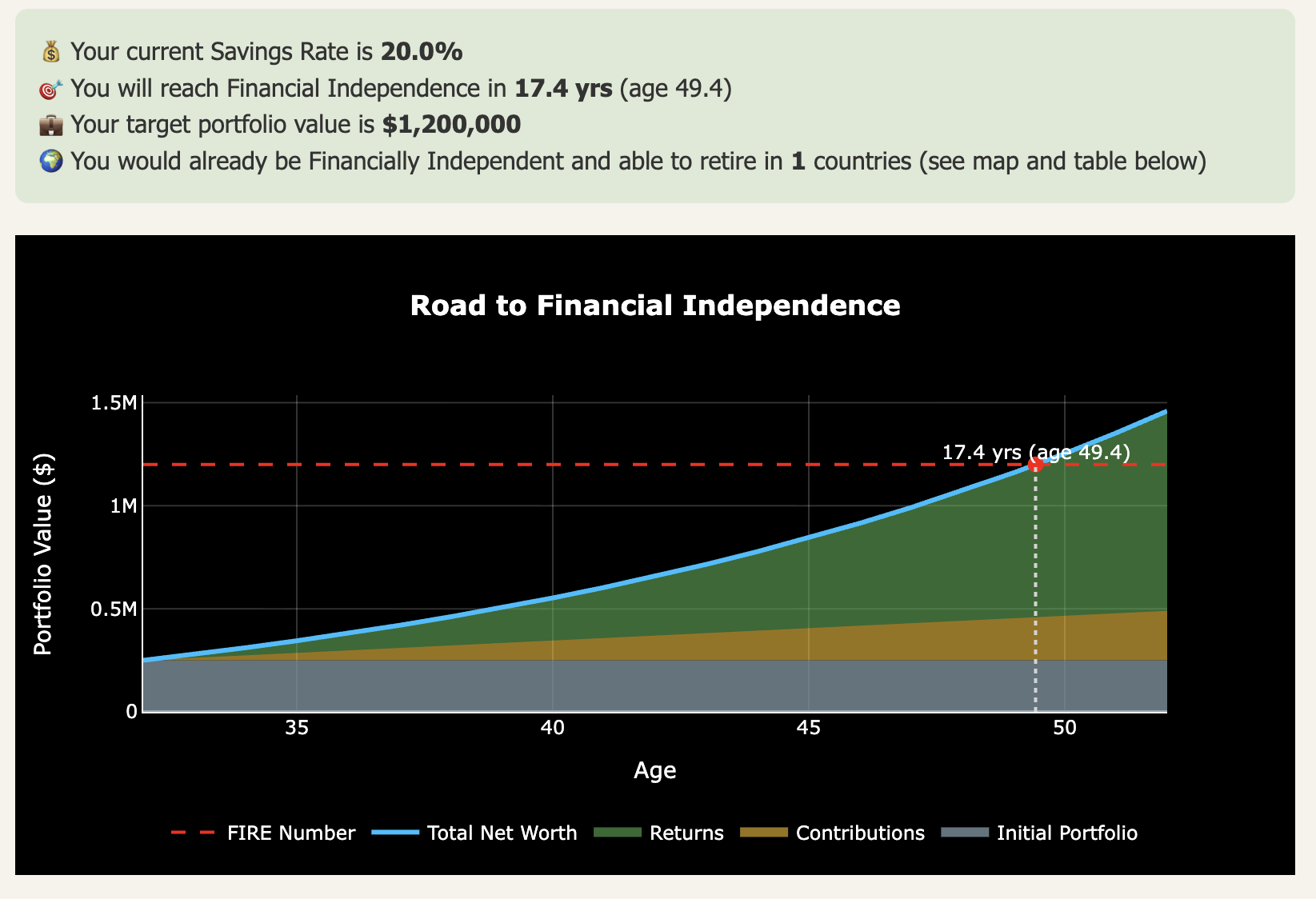

In our earlier posts, we emphasized that your savings rate—defined as the percentage of your net take-home pay that you consistently save and invest—is the single most important factor for achieving Financial Independence. You can use a variety of FI calculators online to estimate your timeline to early retirement based on your savings rate and lifestyle.

The key takeaway is that your savings rate has a non-linear effect on the timeline to reaching Financial Independence and early retirement, as illustrated in Figure 1 below. Cutting expenses not only boosts your monthly savings but also lowers the total nest egg required, significantly accelerating your path to FI. This dual effect is what creates the non-linear relationship.

Figure 1: Non-linear relationship between your savings rate (X axis) and your timeline to reaching financial independence (Y axis). Source: Networthy FI tool.

How We Compared Salaries and Living Costs Across Countries (methodology)

To optimize your savings rate and accelerate your journey to financial independence, focus on reducing living expenses or boosting your income. Factors such as your net take-home pay and the local cost of living clearly play a significant role in how quickly you achieve FI. Relocating to countries with higher salaries and comparatively lower living costs can be a game-changer for achieving financial independence and for retiring early.

For this global analysis, we use cost of living and average net (after-tax) salary data sourced from Numbeo. Numbeo is crowdsourced and best used for relative comparisons, so it’s important to treat the results as directional and validate with local tax calculators, job offers, and city-level costs.

Our assessment spans 43 countries*. To explore differences across countries, we employed a comparative methodology using Germany as the reference point—where I’m currently based. In Figure 2, the X-axis represents the cost of living in each country as a percentage of Germany’s, while the Y-axis shows the net average salary relative to Germany.

For example, the United States’ cost of living is 28.6% higher than Germany’s, while Norway offers salaries that are 10.0% higher on average. Conversely, Italy has salaries that are 42.7% lower.

The red line in the chart acts as a benchmark, highlighting countries with Financial Independence potential that is equivalent to Germany's. For instance, Sweden lies directly on the red line: while its net average salary is 7% lower than Germany’s, its cost of living is also 7% lower. This suggests that the financial independence journey in Sweden would be roughly comparable to that in Germany.

Otherwise, countries falling above the red line would be considered more advantageous in terms of pursuing financial independence than Germany, due to a better salary-to-cost-of-living ratio. In contrast, countries falling below the red line benchmark would be, in theory, less optimal relocation choices.

We have developed the figure below into an interactive tool, in which the user can select their current country of residence, and a similar chart is generated to gauge which countries would be best placed for relocation in relation to that specific country.

* The original dataset contained 84 countries, but considering all of them in a single graph makes it difficult to visualize. Therefore, we took the median net salary as the cutoff point, and decided to only present the top 50% of countries of the dataset in terms of salary.

Figure 2: Identifying suitable countries to pursue Financial Independence from the perspective of someone living in Germany (0,0 in the graph). The X axis depicts the cost of living difference (%) in relation to Germany’s cost of living. They Y axis presents the net average salary difference (%) in relation to Germany’s salary. In general, countries situated above the red line are—in theory—better performers than Germany for these two variables. Check out our interactive tool, where you can select your current country of residence, and a similar chart will be generated to gauge which countries would be best placed for relocation in relation to your specific country.

Top 11 Countries to Work and Fast-Track Financial Independence (2026)

As observed in Figure 2 above, Germany is a fairly good location for pursuing Financial Independence. From the perspective of someone living in Germany, there are only 10 other countries where it may be, on average, easier to work abroad and build wealth faster.

Based on our salary-to-cost-of-living analysis, the top 11 countries for pursuing FI through work in 2026—including Germany as a benchmark—are: Luxembourg, Switzerland, Qatar, the US, Kuwait, Denmark, the Netherlands, United Arab Emirates (UAE), Australia, Germany, and Sweden.

Luxembourg, Switzerland, Qatar, and the US stand out as clear examples that substantially outperform in these two metrics, with average net salaries that are 89%, 122%, 34%, and 48% higher than in Germany, respectively. In contrast, the cost of living in Luxembourg, Switzerland and the US is 18%, 70%, and 28% higher than in Germany.

Qatar is an interesting case, because, despite its higher average salary, it has the same cost of living as Germany. The remaining high performing countries in the dataset—in relation to Germany—are Kuwait (similar salary, but substantially lower cost of living), Denmark, the Netherlands, and UAE. Sweden and Japan fall on the red line, meaning they are comparable to Germany in terms of these two metrics. The results of this exercise align well with our general perception of pursuing financial independence in Germany, which we covered in detail in a previous post.

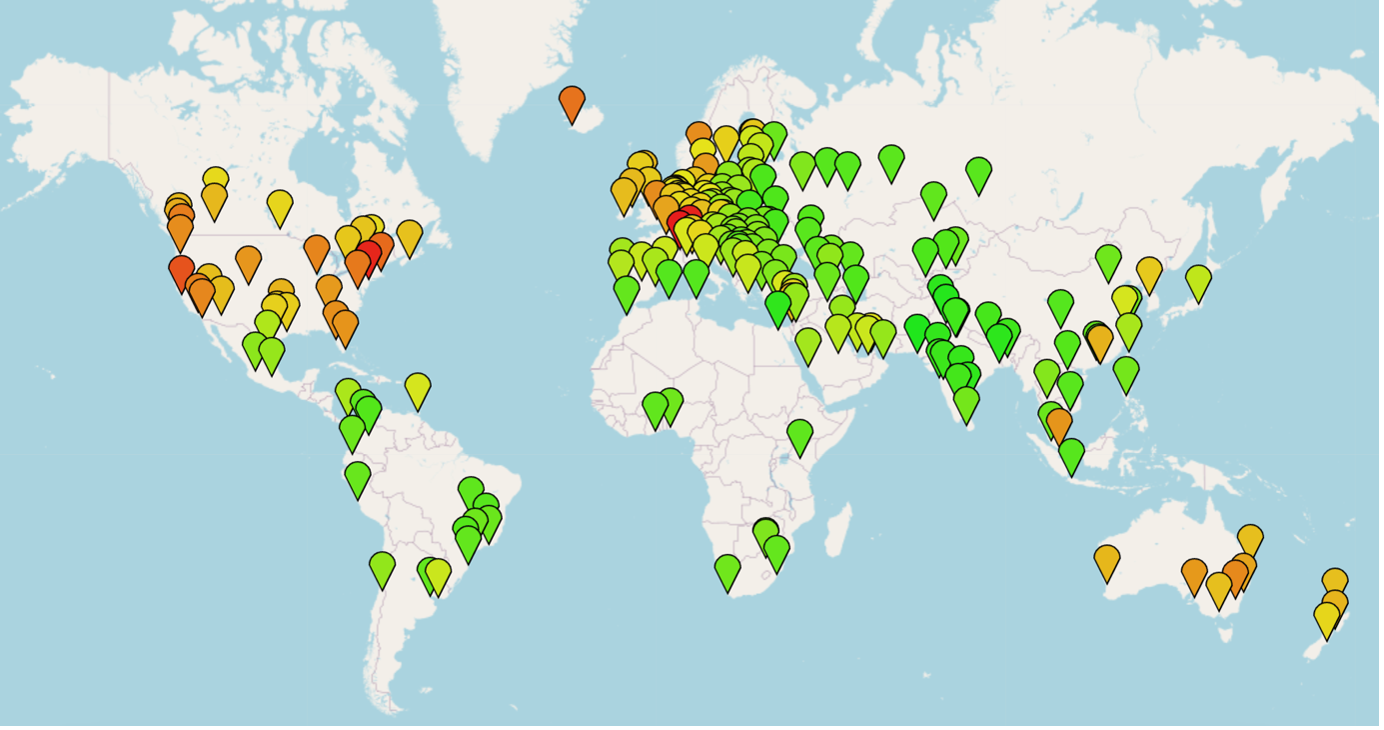

This same analysis can also be performed at a city level, as we’ve done already for cities in Europe and for cities across the US and Canada. By understanding better net average salaries across cities and their cost of living, you will be in a better situation to make more informed choices. Figure 3 presents an example of what the cost of living data looks like on a global scale. If we remove some outliers (e.g., the US and Switzerland), we would get a better overview of the cost of living variability across the remaining countries.

Figure 3: cost of living (including rent) across 218 major cities. Source: Numbeo (2024).

Other Factors to Consider Before Working Abroad

There are many important factors to take into account when choosing a country to pursue Financial Independence. This post presented an approach for identifying a preliminary set of countries where it may be easier to achieve FI. However, when considering relocating to a different country please remember that there are many other factors at play that should be assessed, summarized in Table 1.

Table 1: Example of variables to consider when deciding to move to another country in search of better economic opportunities. Important: the “best” country in a spreadsheet can become a poor choice once you factor in visa constraints, tax residency rules, healthcare access, and whether your industry actually pays the average salary in your city.

| Category | Variables |

|---|---|

| Economic Variables |

- Job opportunities and industry relevance - Currency stability and exchange rates - Inflation rates and economic stability |

| Legal and Political Environment |

- Political stability and freedom - Ease of obtaining work or residency visas - Legal protections for expats and workers - Property rights and investment opportunities |

| Quality of Life |

- Healthcare quality and affordability - Education system - Safety and crime rates - Air and water quality |

| Cultural and Social Factors |

- Language barrier and availability of resources for non-native speakers - Cultural compatibility and social norms - Community and networking opportunities for expats - Food and cuisine variety |

| Infrastructure and Accessibility |

- Transportation systems and connectivity - Availability of technology and internet - Proximity to other countries for travel |

| Personal and Family Considerations |

- Access to healthcare for family members - Availability of recreational activities and lifestyle preferences - Work-life balance culture - Climate and weather preferences |

| Financial System and Opportunities |

- Banking systems and ease of transferring money - Investment opportunities and regulations - Access to affordable housing and utilities - Social security or retirement benefits for residents |

| Cultural Tolerance and Diversity |

- Acceptance of diverse cultures, religions, and lifestyles - Religious freedom and tolerance |

| Taxation and Residency Benefits |

- Double taxation treaties with your home country - Retirement benefits or tax incentives for expats |

| Future Considerations |

- Long-term prospects for citizenship or permanent residency - Stability of political policies and leadership - Opportunities for personal and professional growth |

While these rankings are data-driven, your ideal country depends on your own career, lifestyle, and visa situation. Use our framework and tool as a way to shortlist good country candidates—then do your due diligence to ensure it fits your personal situation and goals.

Curious how a move would change your timeline to FI?

One thing today’s analysis doesn’t show is how quickly small differences in salary and cost of living compound over time at the individual level. Even a 10–15% change in savings rate can shave years off your working career.

A country ranking alone won’t tell you whether a move is worth it. What actually matters is how your income, your expenses, and your savings rate would change. To make this concrete, I built a simple FI Calculator (free for subscribers) where you can test different country scenarios side by side—changing salary and living costs to see how your FI date moves.

Figure 4: Screenshot of our FI Calculator (free for email subscribers). Enter your basic financial information and see how soon you could go into early retirement and whether moving abroad to a different combination of salary and expenses could accelerate your timeline.

Final Thoughts: Choose the Right Country to Reach FI Faster

We outlined a straightforward yet effective approach to identifying ideal countries for accelerating progress toward Financial Independence. If your goal is to work abroad and save money, the data and rankings here provide a strong foundation for your next steps.

Using publicly available data from Numbeo, we compared the cost of living and average net salaries across 43 countries globally. Our goal was to provide readers with insights to support making informed decisions about relocation during the accumulation phase of their financial independence journey.

If you enjoyed this article, here are three good next steps:

👉 Looking to retire a decade or more early? Use our Financial Independence Calculator (free for email subscribers) to plug in your numbers and see how soon you could go into early retirement.

👉 New to Financial Independence? Check out our Start Here guide—the best place to begin your FI journey.

👉 Subscribe for free tools + monthly insights (one-click unsubscribe anytime).

💬 Let us know in the comments: where does your country stand in terms of financial independence suitability, and would you consider relocating to find better opportunities?

🌿 Thanks for reading The Good Life Journey. I share weekly insights on personal finance, financial independence (FIRE), and long-term investing—with work, health, and philosophy explored through the FI lens.

Disclaimer: I am not a financial adviser, and this content is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

Countries like Switzerland, Luxembourg, and Qatar combine high salaries with reasonable living costs, giving you more savings power. These countries offer some of the best environments to build wealth faster.

-

According to our data, countries like Switzerland, Luxembourg, Qatar, the United States, and Kuwait stand out for combining high average salaries with relatively reasonable living costs (in relation to their salary). These countries top our list of 11 best places to work abroad and fast-track financial independence.

-

The UAE, the Netherlands, and Germany offer strong earnings with manageable expenses, allowing for a higher savings rate. They’re great options for professionals focused on financial independence.

-

Yes. Relocating to a country with higher earnings and comparatively lower living expenses can drastically reduce the years needed to reach financial independence. By maximizing your savings rate—through both a higher income and lower day-to-day costs—you can accelerate your investment growth and reduce the size of the retirement portfolio required.

-

We use Numbeo data to compare net average salary and living expenses. Try our interactive tool to visualize which countries offer the best trade-offs.

-

While this post ranks countries by income and cost of living, it's only a starting point. Your decision should also weigh personal circumstances like visa options, job market compatibility, healthcare quality, taxation, language barriers, and social benefits. Always do your own due diligence to ensure a good long-term fit.

-

Yes. Cultural fit, legal barriers, job market volatility, and social isolation are real risks. Some countries may have strict visa rules or less favorable tax systems for expats. Always weigh personal goals, lifestyle preferences, and long-term career prospects before making the move.

-

In many professions, the highest nominal salaries are often found in the US, Switzerland, Luxembourg, and parts of the Gulf—but your take-home savings depend on taxes and cost of living.

-

For FI speed, what matters is the gap: net take-home pay minus living costs. A lower salary in a very low-cost country can outperform a high salary in an ultra-expensive city.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: