Coast FIRE by Age: A Smarter, Low-Stress Path to Financial Freedom

Photo by Taryn Elliott on Pexels.

Reading time: 9 minutes

Quick answer: Coast FIRE means saving and investing enough early in life that your investments can grow on their own to fund retirement—without adding more money later. Your Coast FIRE number is how much you need invested today, by age, to safely stop saving and let compounding do the rest.

What you’ll get from this article 🌊

✔ Coast FIRE explained in one minute

✔ A worked case study with real numbers

✔ Coast FIRE numbers by age (Table 1) for a $2M retirement goal

✔ A second table showing Coast FIRE numbers for different retirement spending levels (Table 2)

✔ The main risks and when Coast FIRE is a bad fit

TL;DR — Coast FIRE by Age

📌 Coast FIRE is about stopping investment contributions, not stopping work

⏳ The earlier you start, the smaller your Coast FIRE number

📈 The required amount rises steeply with age because compounding time shrinks

🧮 Tables in this guide show exactly what you need by age for different retirement targets

⚠️ Coast FIRE works best with stable expenses and a margin of safety

What Is Coast FIRE and How Does It Work?

Why Coast FIRE Is Gaining Popularity in the FIRE Community

Many people discover Coast FIRE not because they dislike Financial Independence (FI)—but because they’ve taken the traditional FIRE path too far. Burnout is not uncommon in the FI community, especially among high earners trying to compress the timeline at all costs. It’s understandable: a large share of workers report feeling stressed or disengaged at work, and the temptation is to “escape” as fast as possible.

But few people want to reach financial security by sacrificing their physical or mental health—or by realizing later that they spent their healthiest years grinding toward a future version of themselves. Coast FIRE offers a middle ground: long-term retirement security remains intact, while the pressure to save aggressively during mid-life drops sharply.

That trade-off is exactly why Coast FIRE resonates with so many people today. It appeals to those who value optionality, flexibility, and a more sustainable pace—and it’s also why I seriously explored whether it made sense for my own situation. I’ll come back to that later in the article.

Understanding Coast FIRE: How It Works and Who Benefits Most

At its core, Coast FIRE is a popular financial strategy where you save aggressively early, then stop investing and let compound interest grow your retirement fund. This is what is referred to as “coasting”—you are essentially letting your nest egg compound and grow, but not actively adding to it through your savings rate.

Under this scenario, once you reach your Coast FIRE number, you continue working, but unlike before, your take-home pay can go mostly toward current living expenses, letting you live a higher standard of living on the path to Financial Independence. Coast FIRE is ideal for people who enjoy their work and want financial security without quitting their job early. For those of you who really dislike your job, I think a Barista FIRE approach is a better-suited alternative to the traditional FIRE pathway.

When you pursue Coast FIRE, you are limiting the intensive savings phase of the FI journey early on to a limited number of years. Ideally, the sooner you start the better, since it allows compounding to do the heavy lifting and means you have to contribute a smaller amount of funds to your investments before reaching your Coast FIRE age.

Photo by Los Muertos Crew on Pexels.

Coast FIRE Example with Real Numbers: A Case Study

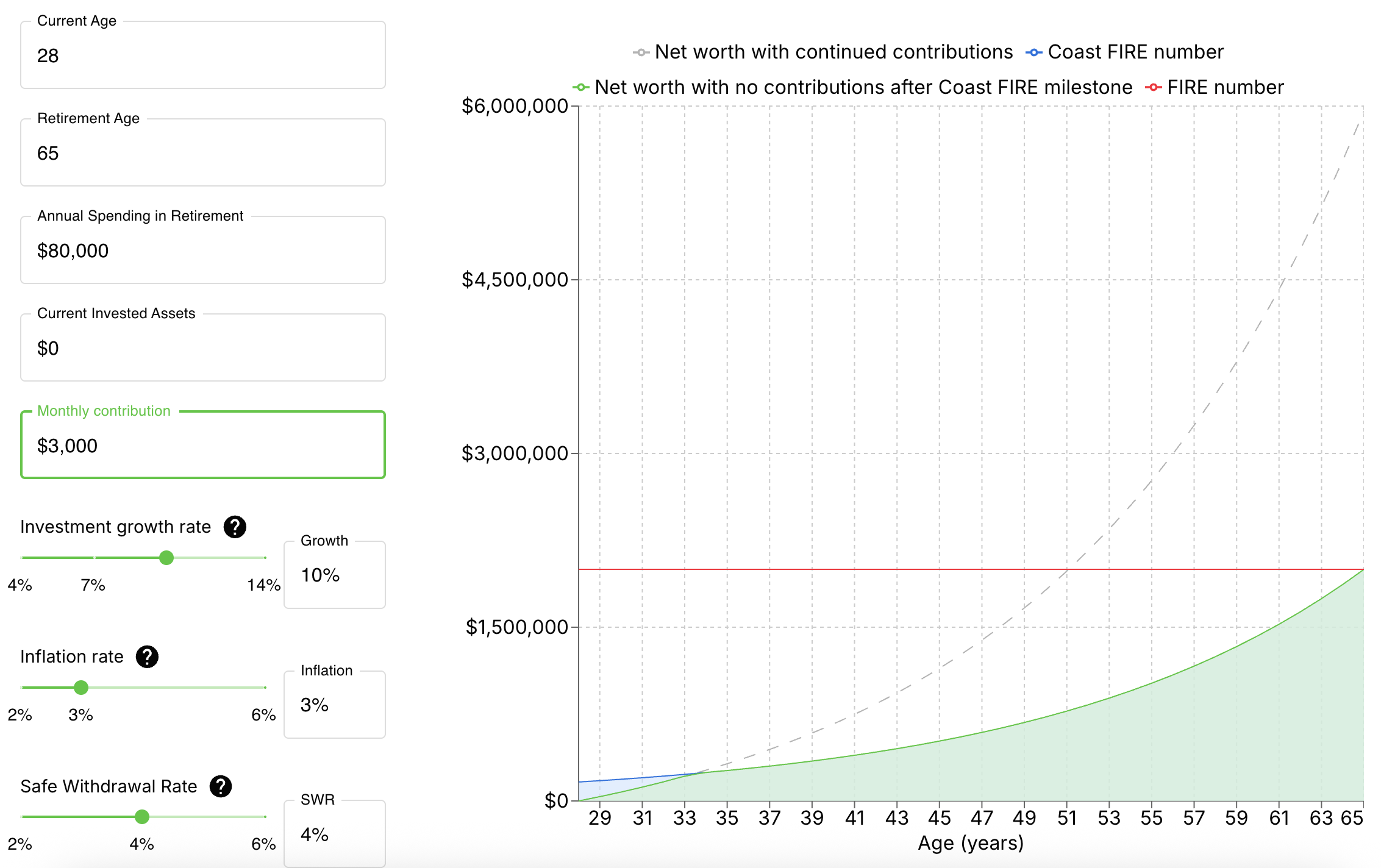

Let’s use a simple case study to illustrate the Coast FIRE concept (depicted below in Figure 1). Using a simple Coast FIRE calculation, we will model a young couple’s financial path with the following characteristics:

Age: 28

Desired retirement age: 65

Annual spending in retirement: $80,000

Current invested assets: $0

Monthly contributions to investments: $3,000

Real return on investments of low-cost, internationally diversified index fund portfolio: 7%

In this example, given the $80,000 annual spend targeted for retirement, the household needs to accumulate a nest egg of $2M by the time they retire (red line of Figure 1), as per the 4% rule of thumb ($80,000/0.04).

The dashed grey line in Figure 1 illustrates how your net worth might grow if you keep contributing to your investments beyond reaching Coast FIRE. Instead, though, the household reaches Coast FIRE in this example at age 34, after only 6 years of aggressive investing (blue line). After this point, their nest egg is allowed to grow in the background at a 7% annual return. This new trajectory is depicted by the green line, and, as we can see in the figure, it crosses the $2M milestone at retirement (age 65).

Not bad! This example shows how a short period of high savings can unlock long-term financial freedom. After 6 years they would have an additional $3,000 to spend at will, potentially increasing their lifestyle for decades.

Figure 1: Example of Coast FIRE. Save aggressively for six years until age 34, then let compound interest grow your portfolio without additional contributions. From age 34 to 60, you will be able to enjoy a substantially higher standard of living, as a result of not having to focus on saving and investing any more. Had they continued with their investments—and not pursued Coast FIRE—they could reach their $2M goal at age 51.

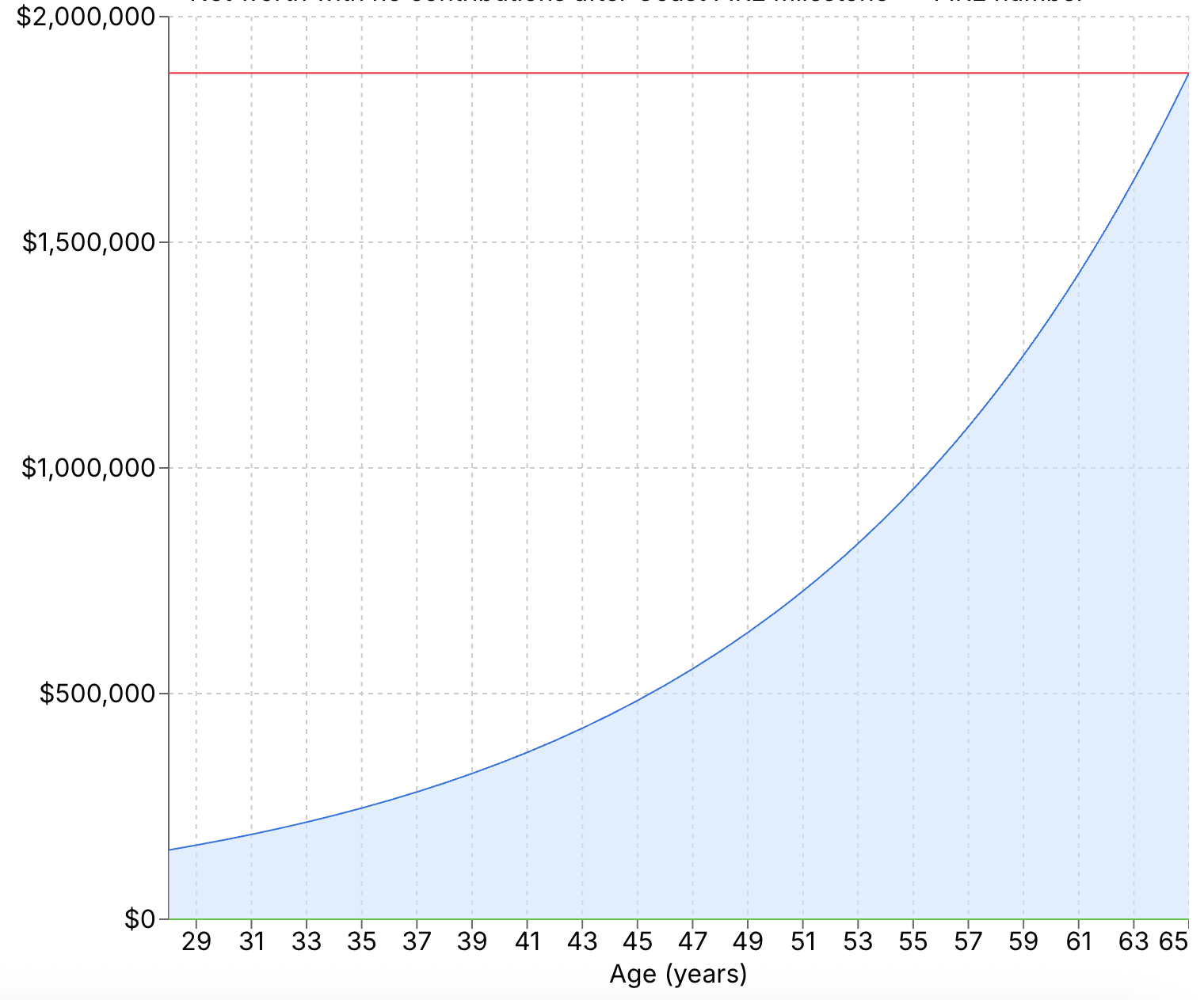

How Much You Need by Age to Reach a $2M Coast FIRE Goal

Now that we understand how the concept works, let’s try to generalize this approach and unpack different Coast FIRE trajectories by age. Again, these are the amounts you would need to accumulate by each age to be able to drop your investment contributions and still be on track to make it safely to retirement by age 65 with a portfolio of $2M.

Table 1 is the fastest way to use this guide: find your age, then read across to see the portfolio amount you’d need today to coast to a $2M retirement target by age 65.

Table 1: Coast FIRE numbers (thousands of $) by age to reach $2M by age 65. Assumes 7% return and 4% SWR.

| Age | 25 | 30 | 35 | 40 | 45 | 50 | 55 | 60 | 65 |

|---|---|---|---|---|---|---|---|---|---|

| Coast FIRE Portfolio ($ thousands) | 134 | 187 | 263 | 368 | 517 | 725 | 1,017 | 1,426 | 2,000 |

Notice that Table 1 shows how required savings increase exponentially with age for Coast FIRE (Figure 2, blue). The later you discover FIRE or start savings and investing to achieve Coast FIRE, the more difficult it will be to implement this plan, since it requires an outsized effort the older you are. If you are 25 years old, you can stop your contributions after reaching only $134,000, whereas if you are 45 you would need a nest egg of $517,000!

Figure 2. Coast FIRE by age. The earlier you start saving and investing aggressively, the easier it is to reach Coast FIRE and drop the monthly contributions and still make it to retirement with the targeted portfolio (in this case, $2M)

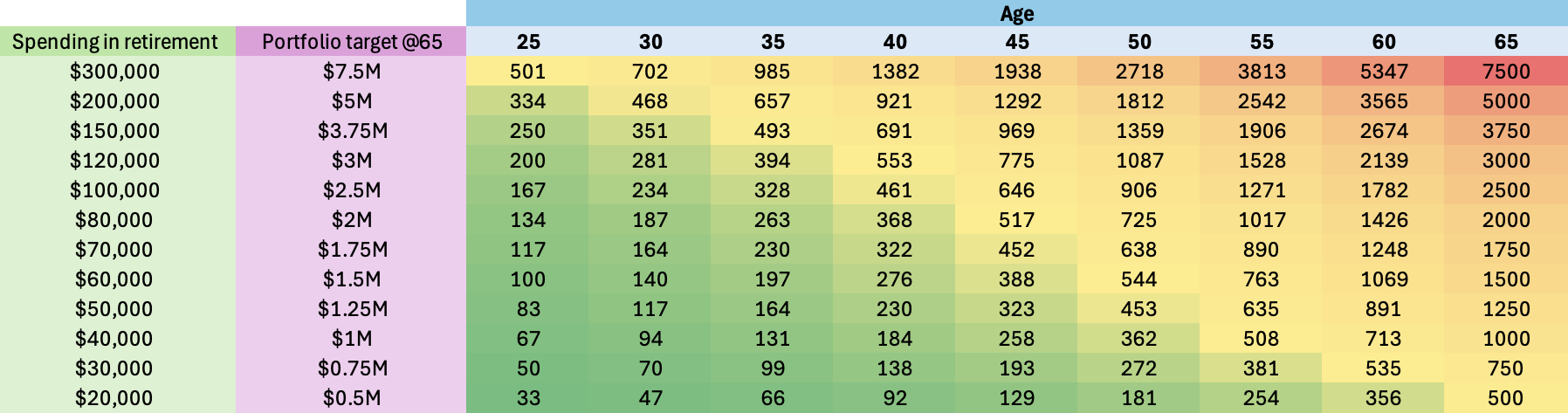

Coast FIRE Portfolio Values by Age and Retirement Spending

Next, we present in Table 2 below an overview of the amount of investments by age needed to reach Coast FIRE for different retirement spendings. To illustrate, imagine you enjoy your job and plan to retire by age 65. Let’s suppose you need $80,000 in retirement (and therefore a target portfolio of $2M), and wish to reach Coast FIRE by age 40. According to Table 2, this means you would need to have invested $368,000 by then. From that point onwards, you could stop investment contributions and this amount would compound over time, still reaching your desired goal by age 65.

Table 2 generalizes the same logic: pick your retirement spending target, then see how the Coast FIRE number changes by age.

Table 2. Cost FIRE portfolio value by age (in thousands $). For example, If you need $80,000 in retirement (and therefore target a portfolio of $2M), and wish to reach Coast FIRE by age 40, you would need to have invested $368,000 by then. From that point onwards, you could stop investment contributions and still reach your desired goal by age 65.

As mentioned earlier, the sooner you start the better. As illustrated by Figure 2 above, there is a non-linear relationship between the age you start saving and investing and the end retirement portfolio.

In contrast, for any given age, the relationship between the portfolio target and the Coast FIRE number needed is linear. For example, you need $100,000 by age 25 to reach a target portfolio of $1.5M by age 65; but, if you wanted to spend twice that amount in retirement instead (i.e., target a $3M by age 65) you would need exactly twice the amount invested by age 25, i.e., $200,000. This means there isn’t a non-linear benefit for choosing a leaner Coast FIRE number here.

For those who already have substantial amounts invested, the table can be used differently. Let’s imagine you are 35 and already have $320,000 invested in low coast, internationally diversified index funds. Looking at the table, this means if you stopped your investment contributions today (and therefore substantially increased your lifestyle), you could still reach a sizeable nest egg of about $2.5M (in today’s dollars) by age 65.

Top Benefits of Reaching Coast FIRE Early

There are several advantages of pursuing Coast FIRE, many of which depend on each individual’s personal circumstances and preferences:

It provides peace of mind. Knowing your retirement is taken care of can alleviate financial anxiety and bring a sense of security.

It can reduce mid-life savings pressure, making it ideal for families facing rising expenses, while still allowing a comfortable lifestyle compared to the traditional FI pathway. If you save aggressively early on, you substantially raise your spending during those expensive years with kids.

Coast FIRE can make a lot of sense for those few who actually enjoy their career. If you like what you do for a living, there is, of course, less of an incentive to want to pursue traditional FIRE to retire early. Why not enjoy today the fruits of your labor instead of postponing it for a less certain–and more frail–future?

Increased ability to take risks. With your retirement in autopilot, you may feel more capable at taking risks, e.g., starting a new business, going back to school, or moving to a part-time, lower-paying, but more fulfilling job. Granted, the latter case would represent a transition towards Barista FIRE.

Greater career freedom and flexibility. Coast FIRE allows for career breaks like sabbaticals or mini-retirements without derailing your long-term financial goals.

Potential for geographic freedom. Coast FIRE can also enable geographic arbitrage, i.e., moving to a lower cost-of-living location or traveling, without needing to be tied to a high-paying, high-stress job or location.

Photo by Holly Mandarich on Unsplash.

Coast FIRE Risks and Potential Downsides to Consider

While Coast FIRE offers many benefits, there are also some drawbacks to be aware of. Depending on your financial situation, lifestyle, and goals, it may be a good idea to consider some of the potential drawbacks:

Requires early aggressive saving. Coast FIRE definitely demands significant discipline and front-loaded effort. Living substantially below your means in your 20s or 30s can definitely feel restrictive for some. This is also an age when many life milestones and experiences are taking place, and potentially missing out on some of them may be a tradeoff to consider.

Sensitive to market returns and inflation. Given that your investments are expected to grow untouched for many years (i.e., decades in many cases), Coast FIRE does rely heavily on favorable long-term market conditions. Other approaches such as traditional FIRE or Barista FIRE could allow for more flexibility and regular adjustments to the plan as market conditions shift.

Limited margin for error. Once you reach Coast FIRE and stop your regular investment contributions, you are removing your biggest lever, i.e., your ongoing saving, and locking yourself in with a certain portfolio target. But keep in mind that your financial goals and needs at age 50 may end up being different than what you had predicted in your 20s or early 30s. Unexpected life events and costs can disrupt Coast FIRE if there’s no margin of safety.

Not ideal for late starters. This may be just the opposite of the first item, but still worth stressing. Starting FIRE late in life can make Coast FIRE difficult without substantial savings or a very high savings rate. For these cases, it is likely that traditional or Barista FIRE may be more suitable.

Is Coast FIRE Right for You? Final Thoughts and Personal Insights

Coast FIRE can offer a powerful middle ground for those who are seeking FI without the pressures and sacrifices of the traditional FIRE approach. In this case, it is not about quitting work, but about quitting your savings—quite a different mindset shift! By front-loading your investment efforts early on, you give yourself the opportunity for more enjoyment in your 30s, 40s, or 50s, times when key life milestones often occur.

It’s especially well suited to high earners in their 20s and 30s who genuinely enjoy their career, but don’t want to feel dependent on it forever. It’s ideal if you value mental freedom, lifestyle flexibility, and a less extreme approach to the traditional FIRE journey. Coast FIRE still rewards discipline and smart planning without requiring the level of frugality or a full early exit from the workforce.

Today’s example used age 65 for illustration, but remember that Coast FIRE is flexible. You can also pursue Coast FIRE and target an earlier retirement date based on your personal goals and lifestyle. But, of course, there is no free lunch here. If you bring the retirement data forward too much, there is less of a runway for your portfolio to compound in the background, and, therefore, a substantially larger initial nest egg is required to reach Coast FIRE.

Personally, I’ve chosen not to follow Coast FIRE due to job stress and a desire for more time-freedom. I work in a relatively-high stress environment, so the idea of staying in this industry full time until 65 is a complete non-starter for me. The appeal of FIRE for me is to free up time as early as possible while I’m still healthy to enjoy it. Instead, as an alternative to the traditional FIRE path, I am more open to pursuing a Barista FIRE approach, where I can still work part-time in a (hopefully) lower stress environment.

Next steps:

👉 Check out our Coast vs Barista FIRE comparison

👉 Estimate your timeline to early retirement using the FI Calculator (free, email unlock).

👉 New to Financial Independence? Check out our Start Here guide—the best place to begin your FI journey.

💬 Where are you on your FIRE journey? Do you feel close to your Coast FIRE number–or just getting started? Would knowing you're “done saving” give you peace of mind? Let us know in the comments below! 👇

🌿 Thanks for reading The Good Life Journey. I share weekly insights on personal finance, financial independence (FIRE), and long-term investing—with work, health, and philosophy explored through the FI lens. If this resonates, join readers from over 100 countries and subscribe to access our free FI tools and newsletter.

Disclaimer: I am not a financial adviser, and the content in this website is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

Coast FIRE means you save and invest aggressively early until your portfolio is large enough to grow to full financial independence by your target retirement age—without adding new contributions. From that point on, you keep working to cover current expenses, but you no longer need to save for retirement.

-

It depends on your target retirement spending, retirement age, and expected investment returns. For example, to reach a $2M portfolio by age 65 (assuming 7% real returns), you’d need roughly $134k by 25, $263k by 35, or $517k by 45. The earlier you start, the lower the Coast FIRE number.

-

Most Coast FIRE calculations assume long-term real returns of 5–7% and a safe withdrawal rate around 4-5%. Because your portfolio compounds for decades without new contributions, Coast FIRE is sensitive to long-term market performance and inflation assumptions.

-

Coast FIRE becomes harder—but not impossible—the later you start. Required portfolio sizes grow rapidly with age because compounding has less time to work. Late starters often need higher savings rates, a later retirement age, or a hybrid approach (e.g., partial Coast + Barista FIRE).

-

Coast FIRE reduces mid-life stress but increases reliance on long-term market returns. Traditional FIRE offers more flexibility later because you keep contributing longer. Coast FIRE works best if you maintain a margin of safety and periodically reassess assumptions.

-

Yes—and you should. Coast FIRE isn’t a one-time decision. You can resume contributions after market downturns, delay retirement, or downshift into part-time work if assumptions change. Flexibility is key to managing long-term uncertainty.

-

Coast FIRE tends to work best for high earners who start early, enjoy their work, and want lifestyle flexibility in their 30s–50s. It’s especially attractive for people who value reduced savings pressure more than retiring as early as possible.

-

The main risk is locking in assumptions too early. Once you stop saving, you lose your biggest lever. Unexpected expenses, lifestyle changes, or prolonged low returns can derail the plan unless you build in buffers and remain adaptable.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: