Why Flexibility Beats a 3% SWR in Early Retirement

Being flexible and mobile in early retirement can add another layer of protection to your portfolio. Photo by Galen Crout on Unsplash.

Reading time: 9 minutes

TL;DR—How Flexibility Beats a 3% SWR in Early Retirement

What you’ll learn in this article:

💸 Why Sequence of Return Risk (SORR) can derail your retirement even with good long-term averages.

🏦 Why many retirees choose ultra-conservative 3% withdrawal rates—and what they lose in years of freedom.

🌍 How geographic arbitrage—living temporarily in lower-cost regions—can buffer your portfolio without lifestyle downgrades.

💼 How optional part-time work adds resilience during early retirement years.

🧩 How combining financial and behavioral flexibility (bond tents + guardrails + lifestyle choices) offers the most robust plan.

📊 Includes free FI Calculator (available to newsletter subscribers) to compare flexible vs conservative retirement timelines.

Lifestyle Flexibility: A Powerful Shield Against Sequence Risk

Sequence of Return Risk (SORR)—the danger of poor investment returns in the early years of retirement—can derail your FIRE plan even if your average real returns do end up being close to 7% in the long-term. The sequence of your returns, i.e., when the poor ones take place, matters just as much as the average over a long period of time.

A severe market downturn during the first years of retirement can force you to aggressively cut your spending or, worse, run out of money earlier than planned if your portfolio doesn’t fully recover. Many would-be early retirees plan to address SORR by aiming for ultra-conservative withdrawal rates—e.g., 3% or lower. In practice, though, adopting an ultra-conservative withdrawal rate means working many more years in their careers in order to feel “safe”.

Today’s post shows there are smarter alternatives. Instead of grinding extra years, you can combine lifestyle flexibility—especially geographic arbitrage—with classic portfolio strategies to meaningfully reduce sequence risk. We’ll explore how location flexibility, temporary part-time work, and behavioral adaptability can act as powerful shock absorbers against SORR, often without sacrificing quality of life.

Beach in Asturias, Spain. Photo by David Vives on Unsplash.

Why Sequence of Return Risk (SORR) Leads to Ultra-Conservative SWRs

It’s common to see early retirees plan around safe withdrawal rates (SWR) of 3-3.5%, sometimes even lower. Ben Felix went a step further, recently suggesting that long retirement horizons and market valuations justified a SWR of 2.7% for early retirees.

Similar attitudes dominate Reddit’s Financial Independence groups, where entire threads are dedicated to modeling sub-4% SWR using different models and online calculators. Often, the result of these exercises is years of additional work to accumulate an even larger portfolio than expected. Those extra years of grinding could instead be spent living a rich, flexible early retirement.

The standard financial response to SORR involves adjusting portfolio structure: building a bond tent upon retirement or applying spending guardrails (e.g., 4–6% withdrawal bands with 10% spending adjustments) to cushion from early downturns.

While both of these strategies are effective, they are not the only lever. Many would-be retirees underestimate the power of lifestyle flexibility—changing where you live or how you structure your life in the early-retirement years can provide a similar protection against SORR with very different tradeoffs.

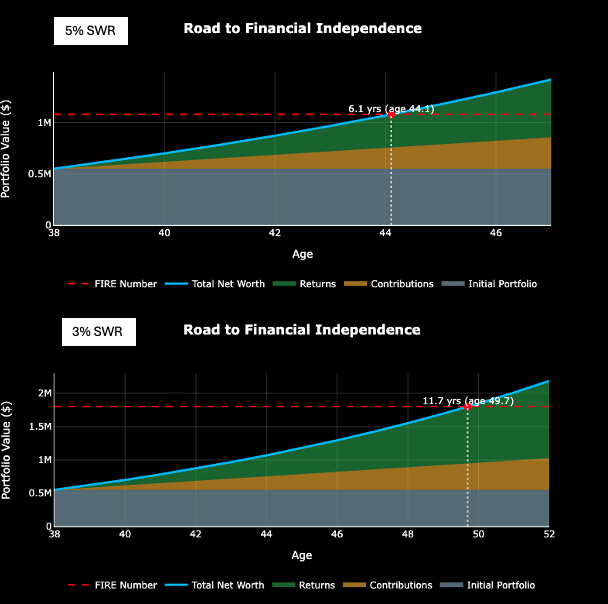

Before diving into these behavioral approaches, let’s remind ourselves at what is at stake. Using our free Financial Independence Calculator (available to newsletter subscribers), we find that my own timeline to Financial Independence would either be 6.1 years or 11.7 years depending on what SWR rate I use—3% or 5%. That is a very large difference—six more years working.

For lots of folks, six more years in the cubicle is a really long time. It’s 72 months you could be pursuing other interests and taking better care of your physical health. It’s passion projects not undertaken and time not spent with family or friends. Over 2,000 days is a lot of free time to leave on the table unless it is absolutely necessary. For many, grinding another 6 years will also bring health costs associated to it in the form of stress, anxiety, and generally poor health.

As observed, this simple comparison highlights why behavioral flexibility deserves a place alongside portfolio tweaks.

Figure 1: Road to Financial Independence using a 5% vs 3% Safe Withdrawal Rate (SWR). Higher withdrawal rate targets can dramatically shorten your timeline to Financial Independence. Using our FI Calculator (free for email subscribers), a 5% SWR leads to FI in just over 6 years (age 44, Top chart), while a conservative 3% SWR stretches the journey to nearly 12 years (age 50, Bottom chart). For many, those extra six years represent thousands of working days—time that could be spent living a flexible, fulfilling early retirement instead.

Geographic Arbitrage: Lower Cost of Living Without Lifestyle Downgrade

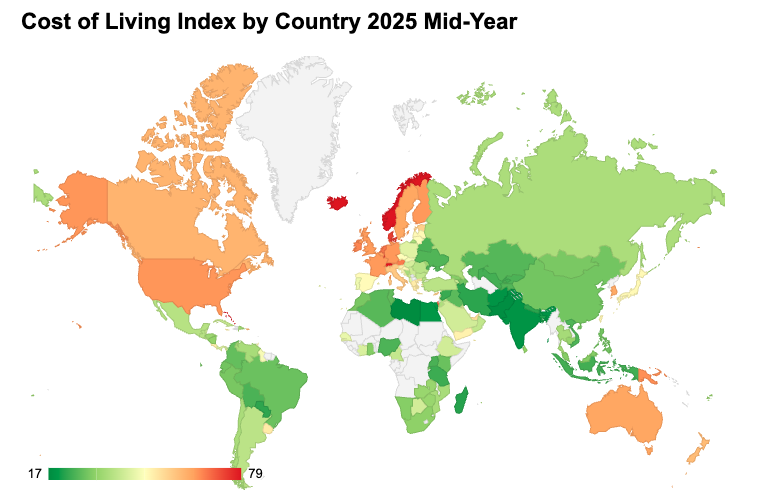

Geographic arbitrage in retirement is one of the most powerful, yet underused, tools to protect against SORR while maintaining lifestyle quality. This could mean temporarily living in lower cost-of-living (COL) regions during the early, riskier years of retirement. It could also involve slow travelling for part of the year in lower COL regions. Whatever it looks like in practice, though, the strategy shouldn’t be about deprivation, but about enjoying a high-quality lifestyle while spending less.

In my case, for instance, moving from Berlin area to rural Asturias (Spain) or rural France could easily reduce our expenses by 60-70% without sacrificing quality of life. In fact it would likely increase it, since these are wonderful places we like to be in. Who wouldn’t wish to escape Berlin’s freezing winters for a change of scenery and a warmer climate?

The point here is really simple. These types of moves—whether long-term or short-term (say, 3–5 months in the context of seasonal geoarbitrage)—can offer an enriching life experience while protecting your portfolio from SORR.

But you don’t necessarily need to move or travel abroad. Simply stepping away from urban centers—and staying in your country—can produce a meaningful impact on your portfolio withdrawals and against SORR. Implementing this type of flexibility could mean reaching Financial Independence up to six years sooner.

Of course, not everyone will want to shift locations regularly. The key is optionality—not obligation. Even occasional moves or seasonal stays can yield large benefits without requiring a nomadic lifestyle.

The timing matters. By deliberately spending your first 2–4 years post-FI in lower-COL environments you create a cushion before a potential downturn hits your portfolio. If the market crashes in year four of retirement, you’ve already created a substantial buffer for yourself through several years of reduced withdrawals.

Another approach could be to temporarily relocate to lower COL regions when the market tanks, using geographic flexibility as a short-term tactical response rather than a continuous plan. The upside is that it can give you an extra buffer when you need it without committing permanently to a new location. The downside is that it requires adaptability and quick decision-making, which can be logistically challenging.

Of course, we should acknowledge that not everyone wants to move. Another way to build flexibility into your early retirement plan is through optional income.

Figure 2: Cost-of-living index by country from Numbeo (2025).

Optional Income Streams to Protect Your Portfolio During Market Downturns

Optional part-time work in early retirement can also be a powerful tool to protect your portfolio during market downturns. Flexibility isn’t only about geography—earning a modest income through low-stress or meaningful work can temporarily reduce portfolio withdrawals and soften the impact of SORR. This isn’t BaristaFIRE: here you’re already financially independent, but choosing to work occasionally on your terms to increase resilience.

It could mean working in a café for a few hours a week, freelance online work, seasonal gigs, or even cycling deliveries as part of your health fitness routines. Hopefully, you have some hobby or creative pursuit you enjoy that could bring in some additional income if needed.

Many FI purists recoil at this idea. For them, “if you work, you’re not truly retired!” In practice, though, most people retiring in their early 40s or 50s will want to continue doing something stimulating. It’s healthier mentally and physically, and can add a modest yet meaningful income during market turbulence.

This type of behavioral flexibility works really well alongside guardrails. Even if your guardrails call for a 10% temporary spending cut during a market downturn, combining this with either geographic arbitrage or optional work can mean observing no reduction in lifestyle quality. Instead of cutting, you shift where you live or how you live.

This layered flexibility offers peace of mind that purely financial strategies can’t match. As we’ve mentioned in previous posts, embracing an antifragile mindset can enable you to handle uncertainty—and, in this case, to leave an unfulfilling career 2,000 days sooner.

Do you prefer lifestyle flexibility to retire 6 years earlier or an extra 2,000+ days of office work? For me, the answer is clear. Photo by Arlington Research on Unsplash.

Combining Financial Strategies and Lifestyle Flexibility

Today we’ve focused on the behavioral lever, but in reality the financial and behavoral levers can complement each other. A bond tent can provide stability during the first five years of retirement; guardrails adapt your withdrawals to market performance; while geographic arbitrage and optional work provide flexibility to live well at lower cost or generate modest income when needed. These aren’t competing strategies—they’re additive layers.

Each layer adds a degree of optionality and more peace of mind in the face of uncertainty. Portfolio structure protects you financially, while lifestyle flexibility gives you control over spending and income. Together, they form a more robust plan than either on its own. This approach enables you to retire earlier without taking on reckless risk.

By embracing both levers you can escape the false binary often presented in FI forums of “grind longer to be safe” versus “retire early and risk ruin”. Instead of this dichotomy, you consider a more flexible framework that adjusts to real-world considerations while preserving the richness of early retirement.

What’s your plan going to be? Photo by Romain B on Unsplash.

Bringing It All Together: A Smarter Way to Handle Sequence Risk

Sequence of Return Risk (SORR) is very real, but fear-driven ultra-conservative withdrawal rates are not the only way to address it. Geographic arbitrage, optional work, and lifestyle flexibility are often underutilized tools that can provide meaningful buffers against the dangers of early market downturns. They enable you to maintain—or even enhance, if you enjoy and have the ability to travel—your quality of life while spending less.

I never have the feeling my quality of life is taking a hit while spending time in Asturias, rural France, or a dozen other relatively cheap locations in Europe.

By combining these behavioral strategies with classical financial tools like bond tents and guardrails, you create a layered, adaptive system that can weather any extreme market event.

But most importantly, you get to start enjoying freedom earlier, not chained to a 3% SWR target that keeps you another 6 years—2,000+ days—in the office.

💬 How would you use flexibility to protect your portfolio in the early years of retirement? Would you consider temporary relocation, part-time work, or other creative approaches—or would you rather extend your working years to play it ultra safe?

👉 Use our FI Calculator (free for email subscribers) to compare flexible vs ultra-conservative scenarios, and imagine your own early FI years through a geographic arbitrage lens.

👉 New to Financial Independence? Check out our Start Here guide—the best place to begin your FI journey. Subscribe below to follow our journey.

🌿 Thanks for reading The Good Life Journey. I share weekly insights on money, purpose, and health, to help you build a life that compounds meaning over time. If this resonates, join readers from over 100 countries and subscribe to access our free FI tools and newsletter.

Author’s note: At The Good Life Journey, we’ve spent years exploring practical strategies for Financial Independence that balance numbers with lifestyle—today’s post continues that mission by showing how flexibility can protect your retirement without extra years of grind.

Disclaimer: I’m not a financial adviser, and this is not financial advice. The posts on this website are for informational purposes only; please consult a qualified adviser for personalized advice.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

Sequence of Return Risk (SORR) is the danger that poor investment returns in the first years after retiring can permanently damage your portfolio, even if average long-term returns are fine. Early losses force higher withdrawals from a shrinking portfolio.

-

Many adopt ultra-conservative withdrawal rates to buffer against SORR, especially with long retirement horizons. A lower SWR can reduce the risk of portfolio depletion but often requires working extra years.

-

Lifestyle flexibility allows retirees to adapt spending and living arrangements in response to market conditions. Moving temporarily to lower cost-of-living areas or taking on part-time work can cushion early downturns.

-

Geographic arbitrage means living in lower cost-of-living regions—either abroad or domestically—to reduce expenses without sacrificing lifestyle quality. It’s especially powerful in the first years of FIRE.

-

In some cases, yes, but it should be best seen as complementary. Geographic arbitrage offers behavioral flexibility, while bond tents and guardrails are financial tools. Combining them strengthens your overall plan.

-

Yes. Even modest income can significantly reduce withdrawals during downturns, protecting portfolio longevity without major lifestyle cuts.

-

No. Geographic arbitrage can be temporary or partial—such as spending winters in lower COL regions or subletting your home for a few months each year.

-

You can use our free Financial Independence Calculator (available to email subscribers) to model your FI timeline under different withdrawal rates and flexibility assumptions.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: