The 7 Stages of Financial Independence (and How to Know Yours)

The path to Financial Independence begins with clarity—seeing the long journey ahead. Photo by Ivan Larin on Pexels.

Reading time: 7 minutes

Quick Answer: What Are the 7 Stages of Financial Independence?

The 7 stages of Financial Independence (FI) describe how your financial life evolves—from debt and/or financial dependence to full freedom and eventual abundance. They move through solvency, early investing, Coast FIRE, and partial independence before reaching the point where investments fully cover living expenses.

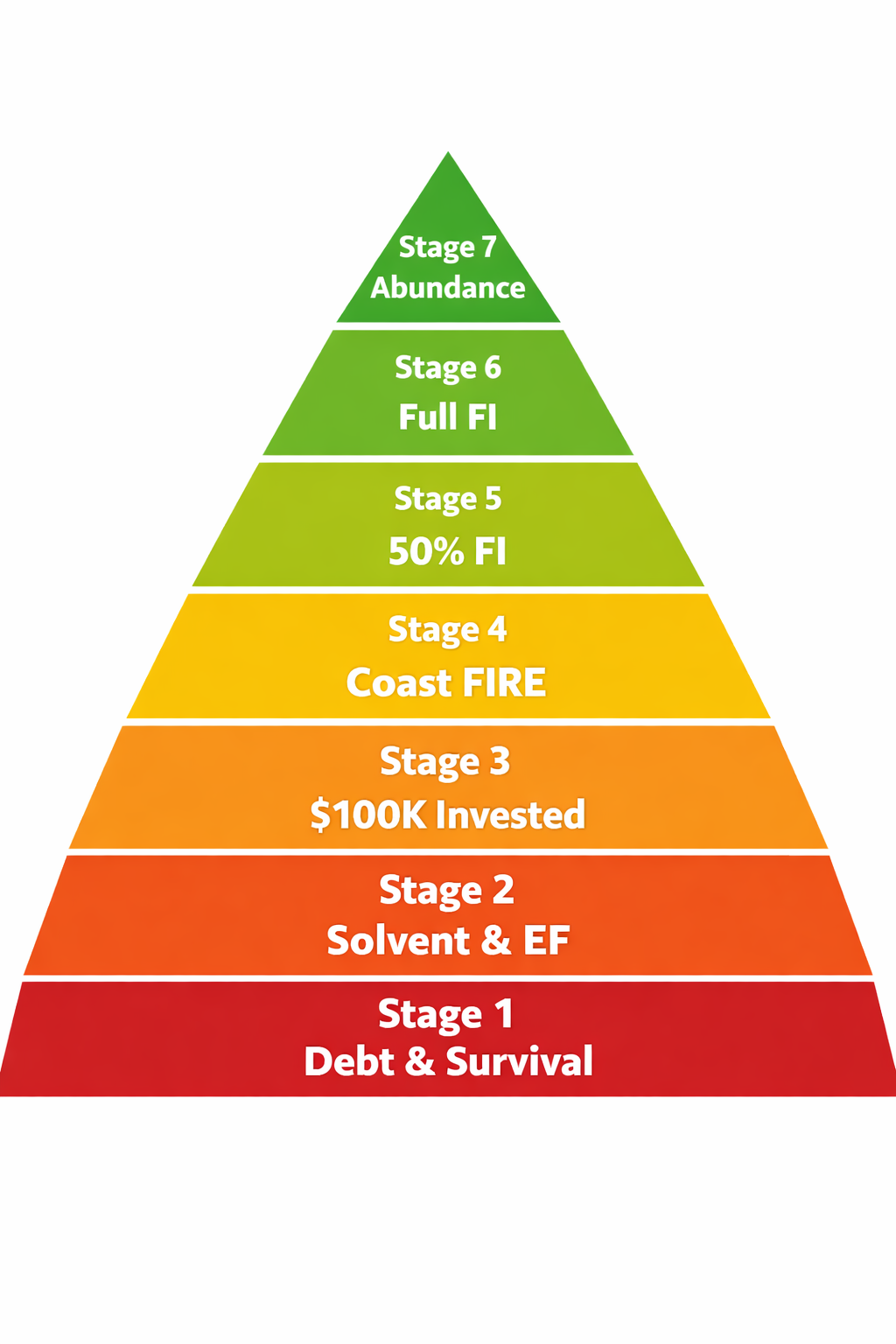

In the visual overview below we summarize the 7 stages of Financial Independence: Debt & Survival; Solvent & Emergency Fund; $100K invested; Coast FIRE; 50% FI; Full FI; and Abundance.

What You’ll Get From This Guide

✔ A clear 7-stage framework from debt to abundance

✔ Simple definitions of Coast FIRE, 50% FI, and full FI

✔ The psychological milestones behind each stage—not just numbers

✔ Realistic timelines based on compounding and savings rates

✔ A way to calculate your own FI progress using a free tool

✔ Guidance on designing life before reaching full FI

TL;DR — The Journey to Financial Independence

🧭 Financial independence isn’t a single moment—it’s a continuum of increasing freedom

📉 Early stages focus on stability, debt elimination, and resilience

📈 Middle stages bring momentum, optionality, and reduced dependence on work

⏳ Coast FIRE and 50% FI often deliver most of the emotional freedom people seek

🏁 Full FI makes work optional—but purpose becomes the real question

🌿 Abundance shifts the focus from security to meaning, contribution, and choice

The 7 Stages of Financial Independence Explained: From Debt to Abundance

Financial Independence (FI) doesn’t necessarily have to be a single finish line you either reach or don’t. It also exists on a spectrum—a journey made up of clear, meaningful stages. As you progress through each one, you unlock different degrees of freedom that people often associate with full FI.

In simple terms, the stages of financial independence describe how your relationship with money evolves—from debt and dependence to full freedom and abundance. In this article, you’ll get a clear 7-stage framework, practical examples, and the key insights needed to reach the next level—so you know exactly where you stand and what to do next.

To make this practical, we’ll also connect these stages to a free FI Calculator that helps you quantify your progress and timeline to FI. Once you see the path clearly, moving forward stops feeling abstract and starts becoming achievable. After all, you can’t manage what you can’t measure.

Stage 1 — Debt: Survival Mode and Negative Compounding

Stage 1 represents the earliest level of Financial Independence, where many people are still in survival mode and/or carrying debt. In this situation compounding is often working against you, making it very difficult to experience any progress on your FI journey.

High-interest debt quietly increases over time, turning past spending into a long-term burden and making real financial progress frustratingly slow. Even strong incomes can feel ineffective because so much financial energy is being directed towards paying debt rather than asset ownership.

This stage creates extreme dependence on your job and paycheck. Without income, obligations can become quickly unmanageable, which adds pressure to stay in undesired roles, high-stress work environments, or engaging in schedules that are not aligned with the lifestyle you actually want. Long-term financial planning often becomes difficult because the present feels too urgent; you’re simply lacking headspace.

The objective in this stage is clarity and stabilization. Stop the bleeding, prevent any new debt, and focus on eliminating the high-interest balance first. This stage isn’t yet about optimization or investing, but about reclaiming control on the basics, so that one day compounding can finally work for you rather than against you.

Stage 2 — Solvent: No Debt and an Emergency Reserve

Reaching solvency means your life is now fully supported by your own resources, without relying on debt. The disappearance of debt payments creates the first genuine sense of breathing room, a subtle yet powerful emotional shift that signals finally some forward momentum.

Setting up an emergency reserve of 3–6 months of living expenses further transforms uncertainty into resilience. Unexpected expenses—like an expensive car or home repair—or looming mass layoffs in your company or sector no longer create panic nor completely derail your financial progress if they materialize. These undesired events become instead manageable interruptions of your financial journey.

This psychological safety is one of the earliest tastes of financial freedom. Even though Financial Independence is still far away, your neck is clearly above water now and you have the headspace to assess where to go next.

Most importantly, though, achieving solvency and an emergency fund unlocks the ability to start consistently redirecting your savings into investments for the future. From here, money begins to flow toward asset ownership and portfolio growth. This is the true starting line for the Financial Independence journey.

Small, consistent steps often matter more than dramatic leaps on the road to FI. Photo by Tyler Lastovich on Pexels.

Stage 3 — $100K Net Worth: Proof the System Works

Reaching your first $100k invested represents something deeper than a round number, it represents evidence. While in reality this benchmark is quite arbitrary (why not set stage 3 at $200K?), almost everyone, including myself, will tell you that there is something special about surpassing this first milestone in investments.

It represents proof to yourself that disciplined savings, patient investing, and intentional spending choices do genuinely create change. What once felt theoretical, but we weren’t quite sure about, suddenly feels very real.

It’s also a relevant threshold because compounding in your favor starts to feel real from this point. Assuming a 7% real return and continued investment throughout the following year, it means you will likely earn—on average—an additional $7–10K from your investment returns alone. Of course, while this number is still relatively small in comparison to your annual income, it’s certainly not negligible, and provides a first tangible taste for what is to come.

Emotionally, reaching this threshold often replaces a scarcity mindset for a more confident one, making long-term consistency easier to sustain. This stage is where simplicity wins. Automated investing into low cost, internationally-diversified index funds combined with repeatable savings habits matters more than trying to pursue clever, get-rich-fast investment schemes.

Up to this point, progress has largely been about building stability and proving that accumulation works. But Stage 4 marks a deeper shift. From here onward, the journey is no longer defined only by how much you save, but by the freedom your existing assets already create.

The focus begins to move from pure accumulation toward optionality, flexibility, and long-term autonomy. This is where the path to Financial Independence starts to feel fundamentally different.

Stage 4 — Coast FIRE: Freedom on Autopilot

Coast FIRE marks the point where your existing investments, if left untouched and given enough time to compound, are already sufficient to fund a traditional retirement. In other words, you would no longer need to contribute another dollar to retirement savings to eventually reach Financial Independence at a desired retirement age.

To make this concrete, consider the following example: someone who is 40 years old and wants to retire at 60 with a $2 million portfolio. Assuming a long-term real return of around 7%, having roughly $500,000 invested at age 40 would already place them at Coast FIRE. Without any additional contribution, their nest egg would reach $2 million over the next two decades by itself.

Reaching Coast FIRE creates one of the most powerful psychological shifts in the entire journey. For the first time, the future no longer feels like it depends entirely on continued sacrifice or perfect discipline. And because retirement security is already in motion, work begins to feel less like a necessity and more like a choice.

At this stage, many people feel emboldened to change careers, reduce hours, start their own business, or prioritize family time over maximizing income. Reaching Coast FIRE makes you review your career differently from a position of strength.

Coast FIRE sits at the intersection of Financial Independence and financial freedom. You are not fully independent yet—following the previous example, even if you were content to retire at age 60 you would still need to fund your living expenses over the next 20 years. But you are already experiencing a substantial portion of the emotional freedom people associate with FI.

That’s why Coast FIRE is often considered the turning point between financial security and true financial freedom. From here, every additional dollar invested no longer determines whether you will reach FI, but how soon.

Momentum builds as you move from early stability toward real financial optionality. Photo by Adrià Sánchez Roqué on Unsplash

Stage 5 — 50% FI: Designing Life Before Full Freedom

The next stage is reached when you’ve accumulated about 50% of your FI number. At this point, your investments could theoretically cover about half of your living expenses, dramatically reducing your dependence on earned income. At this point, if you’re a double-income household, it feels like you have a third salary. If you are a single income household, it feels like you have a second one.

When I crossed the 50% FI mark, it changed how I thought about work entirely. Ultimately, it enabled me to leave a high-stress consulting career to explore entrepreneurship and build a work schedule that fits around my family—not the other way around. This is something that would have personally felt far too risky to do in earlier stages.

Mathematically, this stage is far closer to full FI than it looks. With a long-term market return of around 7%, even if you stopped contributing entirely to your investments, your portfolio could still grow to full FI in about a decade. Continued investing will of course accelerate this timeline much further, in many cases to around 4–7 years, depending on your savings rate. Progress no longer feels fragile or uncertain; in fact, reaching FI begins to feel inevitable.

The real transformation is more psychological than numerical. By now, many people realize they have already achieved a large portion of what they originally wanted from Financial Independence in the first place: reduced financial anxiety, greater flexibility, and the confidence to redesign their life and career more intentionally.

And because of this growing sense of freedom, Stage 5 is where many of the deeper life questions begin to emerge. What does an ideal day actually look like for me once I reach FI? What relationships, hobbies, or creative pursuits would I want to fill my time once I’m there? Are we moving towards something more meaningful or were we simply trying to escape the rat race or work we did not enjoy?

These questions matter, because reaching Financial Independence without having many of these internal issues resolved can make some people feel unexpectedly empty once they arrive at the finish line. Stage 5 is therefore less about money and more about proactively building the future life you want Financial Independence to support. It’s far better to start thinking (and implementing) some of these lifestyle redesign questions now rather than at formal FI.

Stage 6 — Full FI: Work Becomes Optional, Preservation Begins

I haven’t reached Stage 6 myself yet, so I can only share what others commonly report.

Full Financial Independence is reached when your portfolio can sustainably cover 100% of your living expenses. For most people, this is the milestone they imagine when first discovering FIRE. It’s the moment paid work becomes optional rather than required for survival.

Interestingly, many people find that reaching this point feels quieter than they expected. The dramatic emotional release many anticipated has usually already begun unravelling in earlier stages, particularly from Coast FIRE onwards. Instead of a sudden transformation, reaching full FI feels more like a confirmation that the system worked.

What does change meaningfully at this stage is your financial focus. The financial journey shifts from a perspective of accumulation to one of preservation. Managing withdrawal strategies and protecting your portfolio against sequence-of-returns risk (SORR) in the early years post-FI become more important in the short term than chasing higher returns. (I explore practical ways to manage SORR—including bond-tent strategies—in this detailed guide.)

Success is no longer measured by getting richer (like it was before), but by staying free. You know how much effort it took to reach this place, so now you’re going to protect this privilege at all costs.

At this stage (or even during stage 4 or 5), many people begin lifestyle experimentation—testing mini-retirements (e.g., a 6–12 month trial run of what early retirement could look like), switching aggressively to part-time work, or investing their time elsewhere in passion projects, entrepreneurship, volunteering, mentoring, or becoming very involved in their local community.

Hopefully, the self-reflection that started in Stage 5 becomes very helpful now, helping ensure you are retiring toward a meaningful life, rather than merely stepping away from employment unprepared.

Financial independence changes perspective—work becomes a choice rather than a necessity. Photo by Simon English on Unsplash.

Stage 7 — Abundance: FI and Then Some

The final stage begins when your assets grow well beyond what is required to sustain Financial Independence. Security is no longer the objective, but your baseline. Of course, not everyone seeks abundance, and some choose to stop their journey at Stage 6. Financial Independence is ultimately personal, there is no rigid blueprint for the final destination.

But many people on Stage 6 are still questioning whether they truly have enough—especially in the case of very early retirees. After all, life can change, and if you’re looking at a 40–60 year retirement timeline, your projections about what you’ll want decades from now may change. In practice, though, often it’s hard to tell whether they are going for a bit of a buffer or are falling for the one-more-year syndrome.

Either way, in Stage 7, financial freedom tends to expand outward. Many people begin focusing more intentionally on generosity, legacy, creative work, mentorship or causes that matter deeply to them. Money is no longer a limiting factor, so time, energy, health, and purpose become the main currencies of life.

Abundance also reframes the entire FI journey. What started out for many as a pursuit of escape—from stress, obligation, or uncertainty—now evolves into a platform for contribution and intentional living. For many, Financial Independence was never about stopping work, but about gaining the freedom to choose how to spend their life. In this final stage, that sense of freedom is complete.

Your Next Step: Measure Your Own Path to FI

If you’re wondering what stage of Financial Independence you’re currently in, the most reliable way to answer is by calculating your FI number and measuring your progress toward it.

Understanding the seven stages conceptually is powerful—it helps you set clearer goals, anticipate the psychological shifts in each phase, and prepare intentionally for what comes next. But real insight comes from placing your own numbers within this framework.

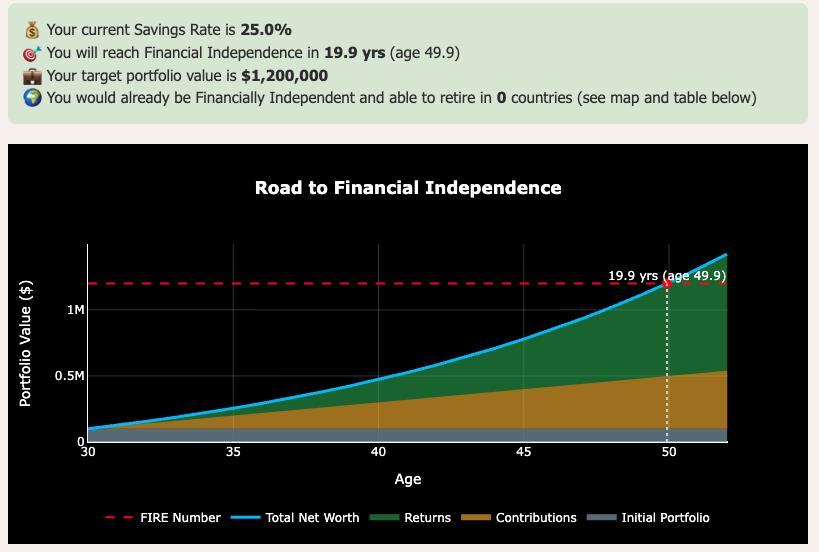

That’s why the next step is using a FI Calculator (see Figure below) to estimate:

Your current FI percentage

How many years remain until full FI

How saving more, spending less, or investing differently changes the timeline

The calculator makes this visible in seconds—turning an abstract idea into a concrete timeline you can actually plan around.

In the example below, we model the timeline to Financial Independence for an individual with the following characteristics:

Age: 30

Annual net income: $80,000

Annual expenses: $60,000

Current portfolio: $100,000

Average real return from investments: 7%

Safe Withdrawal Rate: 5%

Under these circumstances, she would reach her FI number of $1.2M by age 50—in roughly 20 years. With a portfolio of $100,000, she’s currently in Stage 3 of Financial Independence.

Figure 1: Screenshot of our FI Calculator (free, email unlock).

Final Thoughts: Freedom Arrives Before Independence

One of the biggest misconceptions about Financial Independence is believing freedom is only achieved at the end. In reality, financial freedom is gradually unlocked across every single stage—from climbing out of debt and setting up a first emergency fund, to reaching Coast FIRE, and to full FI and beyond.

As you move through the stages, many people experience what I did: you begin asking deeper questions about the life you truly want to build—and the kind of work and lifestyle that would support it. Over time, a quiet realization emerges: you don’t need to wait for full FI to start designing that life. You can begin making meaningful changes much earlier, living more intentionally and aligning your time with your values and lifestyle preferences.

If you enjoyed this article, here are some next steps:

👉 Estimate your timeline to Financial Independence using the FI Calculator (free for newsletter subscribers).

👉 New to Financial Independence? Start with our Start Here guide for the full framework.

👉 Subscribe to get free FI tools and the weekly newsletter (one-click unsubscribe anytime).

💬 Which stage of financial independence are you in today—and what would change in your life if you reached the next one? Share with us in the comments below.

🌿 Thanks for reading The Good Life Journey. I share weekly insights on personal finance, financial independence (FIRE), and long-term investing—with work, health, and philosophy explored through the FI lens.

Disclaimer: I’m not a financial adviser, and this is not financial advice. The posts on this website are for informational purposes only; please consult a qualified adviser for personalized advice.

Check out other recent articles

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Frequently Asked Questions (FAQs)

-

They move from debt and dependence to solvency, early investing, Coast FIRE, partial FI, full FI, and finally abundance. Each stage reflects both financial progress and increasing personal freedom, not just net worth alone.

-

Financial freedom exists on a continuum—you begin experiencing flexibility and reduced stress long before full independence. Financial independence is the point where investments fully cover living expenses.

-

Your stage depends on two things: your net worth relative to your FI number and how much of your living expenses your investments can already cover. The simplest way to determine this is by using an FI calculator to estimate your FI target and current percentage progress—then matching that percentage to the seven stages in this guide.

-

Yes—because compounding becomes visible and momentum shifts psychologically. It’s less about the number itself and more about proof that your system works.

-

Coast FIRE means you’ve already saved enough that, with time and compound growth alone, your investments can reach full retirement without additional contributions. You still need income to cover current expenses, but your future financial independence is already mathematically on track. (See our full Coast FIRE guide for examples and calculations.)

-

Absolutely. Many people experience meaningful freedom at Coast FIRE or 50% FI, when work becomes more optional and anxiety drops.

-

For many disciplined savers, 10–25 years. Savings rate and investment returns are the biggest drivers.

-

Focus shifts from earning to living—purpose, health, relationships, and contribution become central.

-

Not necessarily. FI gives the option to retire early, but many people continue working in flexible or meaningful ways.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles:

<script>

ezstandalone.cmd.push(function() {

ezstandalone.showAds(102,109,110,111,112,113,114,115,119,120,122,124,125,126,103);

});

</script>