The Middle Path to FI: Why Slowing Down May Bring Freedom Sooner

Under the right conditions, creative work can be very fulfilling—do we really need to give it up after reaching Financial Independence? Photo by TEAcreativelife │ Soo Chung on Unsplash.

Reading time: 10 minutes

TL;DR — The Middle Path to Financial Independence

💡 Financial Independence isn’t about quitting—it’s about autonomy.

🏃 Slow FI or Partial Retirement lets you work on your own terms before full FI.

🧠 You’ll gain health, creativity, and purpose now—not years later.

📊 Delaying FI by 2–3 years can add decades of better living.

💬 Freedom starts when work becomes a choice, not an obligation.

Partial Retirement: Why Slowing Down on the Road to Financial Independence Can Bring Freedom Sooner

Most people think pursuing Financial Independence (FI) means quitting work forever—the ultimate escape from Zoom calls, office politics, and Sunday scaries. But after seven years on this path, I’ve learned something simpler: freedom doesn’t always come from quitting—it comes from autonomy.

In this post, we’ll explore how part-time work, balance, and redefining success and status can help you experience many of the benefits of Financial Independence long before you reach it—what I call Partial Retirement, a middle path between the grind and the full stop.

Alright, let’s jump in. First, what is the issue with sprinting too quickly to the finish line?

The Problem with Treating FIRE as a Race to the Finish Line

The FIRE movement has done something remarkable: it’s given millions of workers a framework to reclaim more control over their lives. But—trapped in the excitement of the FIRE concept—it’s also created a culture of racing towards that perceived freedom. I’ve been there early on in my own path—it feels like all that matters is how fast you can hit your number.

The risk is that FIRE folks often end up grinding through their best years chasing this spreadsheet goal, only to find at the end they may have sacrificed the very things FI was meant to protect in the first place—health, relationships, peace of mind, or more time with your loved ones. Too often you hear stories of FI folks claiming to regret not travelling to Europe in their 20s or missing out on some other life milestone. And that can be as tragic as grinding your whole life away in a job that you’re not passionate about.

Gallup’s data confirms what many of us feel intuitively: about 80% of global workers feel disengaged from their job: they’re not inspired by what they do, often feel overworked, and are increasingly stressed. But why double down on misery merely to escape it faster? Many are simply trading one extreme for another—enduring a decade of exhaustion (and potentially poor health) for a future that is uncertain.

This cycle of disengagement has become so widespread that it now has a name—“quiet quitting”. For many on the path to FI, quiet quitting can feel like a temporary escape from burnout—but without a deeper mindset shift, it rarely delivers lasting fulfillment.

The irony is that freedom doesn’t necessarily require quitting work altogether. Freedom simply requires autonomy—control over your time, energy, and creative output. Once you grasp that, you realize there are many gradients to freedom available long before you reach full FI. In other words, you don’t need to retire completely to be free—you just need to create enough margin to live more intentionally.

That margin might begin with small lifestyle changes—like scaling back hours—because the mindset of freedom always comes first. Once you start practicing autonomy in small ways, you’re already building the habits that will define life after FI.

True Partial Retirement comes later, when work becomes fully optional—but the shift toward living on your own terms can begin long before then, in smaller steps like reducing hours, changing roles, or pursuing side projects that reflect the life you’re trying to design. Taking your foot off the gas may delay full FI by a few years, but it also lets you reclaim your health, creativity, and peace of mind now—the parts of life that compound more meaningfully than money ever could.

Conventional FIRE thinking can lead to an unsustainable race towards the finish line. Grinding too hard can increase the risk of burnout and poor health now. Photo by Jonathan Chng on Unsplash.

What Is Partial Retirement (and Why It’s the Missing Piece of the FIRE Journey)

Partial Retirement isn’t quite Barista FIRE—it’s not about patching income gaps or clinging to health insurance in some countries. It’s about choosing to keep one foot in the working world for fulfillment, not survival. The qualitative difference with Barista FIRE is important: you’re not working because you have to, but because you actually want to. You set the terms, decide on the pace, and pick work that energizes you rather than drains you.

Imagine you reached Lean FIRE, or are close enough that you could realistically pull the plug. You now have options—you could certainly say good-bye to your employer and career, and perhaps use geoarbitrage (or even seasonal geoarbitrage) to reduce the market risk your portfolio is exposed to in the first years of retirement.

But instead of checking out completely, you decide to channel your time into something meaningful—building some creative outlet, mentoring others, teaching sports to kids, writing, volunteering in your community, or getting involved in local policy. It will be different for each person, but it’s important that it aligns with your values and provides your day-to-day with a sense of flow—the metaphorical “time flies when you’re having fun”.

When work becomes optional, it simply stops feeling like work. An activity that may have felt suffocating under pressure suddenly feels engaging now that it was freely chosen. It enables you to rediscover flow, connection, and curiosity—all because you removed the requirement of working, but also because you are autonomously setting the schedule.

Over time, I realized you don’t need to reach FI to feel that shift. The same mindset that defines Partial Retirement—working because you want to, not because you have to—can transform how you approach work long before you reach full independence.

That’s been my experience so far. After stepping away from my consulting career, I took a step back and reinvented how I work. I now split my time between writing and building this platform and doing part-time consulting on projects I choose. The difference is night and day—I no longer experience stress; my engagement is off the charts, and I genuinely look forward to each week. For the first time in my life, I no longer experience the Sunday scaries.

Partial Retirement doesn’t just change your relationship to work—it also reshapes how you think about time, health, and the tradeoff between pace and quality of life.

Rethinking the Tradeoff: Slower FI, Better Life and Health

It’s interesting that once you accept you might want to keep working after FI—especially if you’re looking at 50+ years ahead—the urgency to reach it as quickly as possible at all cost suddenly melts away. The journey stops feeling like a sprint and you start to focus more strongly on building now the life you envisioned later.

Since 2022, we’ve worked part time—mostly around 70-80%, but even going down to 50% workdays during short periods of time. Shortening our workdays to six hours per day has meant reclaiming long afternoons and evenings for the kids and ourselves. The change was really transformative, and it’s really hard to envision going back to full time once you’ve had a taste of what part-time work feels like.

Layer on top that I quit my stressful job and I’m now working on things I actually enjoy—it feels like hitting the lottery. I sleep better, eat better, and exercise almost daily—it feels like I’m living in a Blue Zone. My mind feels calmer. When you’re running on stress, it’s really difficult to form good health habits—and yet health is all we have; it’s what makes every other goal meaningful. We simply won’t be able to enjoy our successes if we are in poor health.

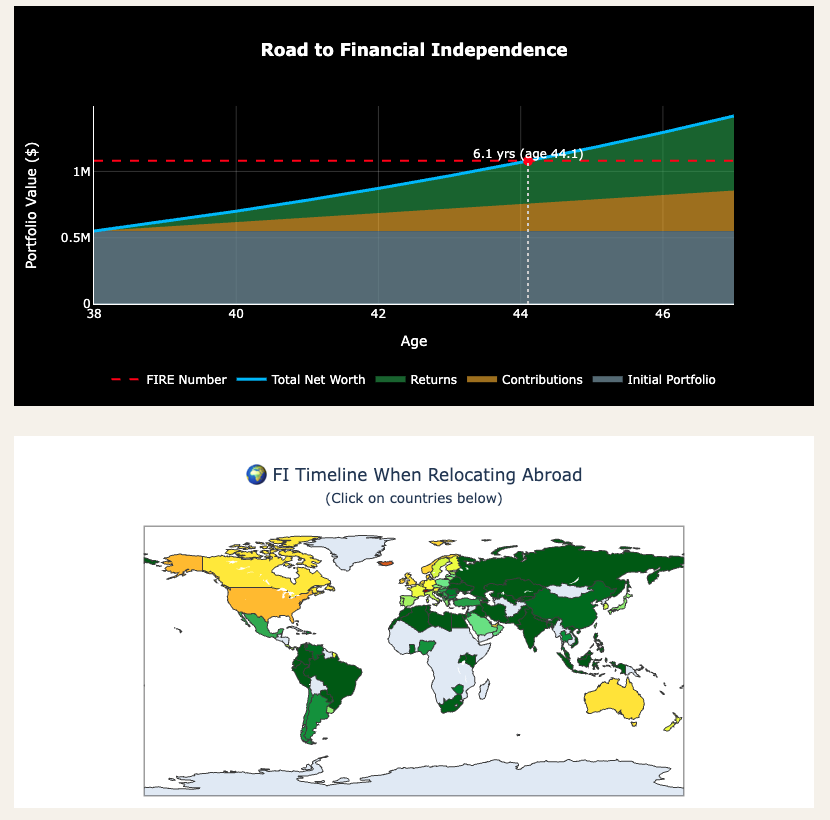

Sure, the math says we’ll reach FI in about six years (see Figure 1 below) instead of four. But those two extra years don’t feel like a penalty—it’s the four years that now feel like a bonus. They are years spent living well—not grinding too hard. This kind of slow-FI approach—intentionally easing the pace—lets you build the habits and health that sustain long-term well-being.

Of course, this approach assumes you’ve built some margin through saving and planning. Not everyone can immediately cut their hours—but small steps, like negotiating flexible schedules or remote options, can move you closer without derailing progress.

Again, we transitioned to part-time (and me to a different career path) after seven years on the path to FI. We already had many years where our savings rate was above 50%, which has allowed us to have the financial and psychological cushion to take more risk—especially in my case of starting an entrepreneurial activity.

Honestly, now that I’m on the other side, I wish I’d leapt sooner. And yet, at the time, it probably would have felt too risky. What if you can’t jump back into your previous career if things don’t work out as expected? That’s certainly an advantage of grinding a bit longer before making the switch, but it does come with a cost. In my case, it was consistent burnout that left me with few options other than to try something else.

We’re now half a year in and I couldn’t be happier with the balanced mix we’ve achieved right now.

Figure 1: Our own timeline to Financial Independence, as per our FI Calculator (free for email subscribers). Work could become optional in 6.1 years where we live, and there are already 34 countries we could retire in today.

How to Design Work You Don’t Want to Retire From

For me, the mindset shift began when I tried to ask myself: What does my ideal work day look like? The answer was pretty immediate—and revealing. It didn’t include managing others, endless project meetings and zoom calls, project management, or travel for work. I can certainly do these things, but don’t thrive at all in them.

Instead, what it would include would be time for writing and thinking, research, and creative work. These elements had been previously present earlier in my career, but were slowly being replaced by the tasks expected from more senior roles. I understood the game, but frankly it was doing the work itself—not becoming a project manager or managing people—that drove me in the field in the first place.

That reflection became a bit of a blueprint for my transition into entrepreneurship. With this platform, I now have the opportunity to write, research, engage with ideas, and create content I care about—i.e., I’ve become an influencer—mixing it with part-time consulting when opportunities arise. My weeks feel lighter yet far more productive. Working on my own schedule brings a new kind of engagement—it’s work that adds to my life instead of taking from it.

There are two types of part-time worth distinguishing here. The first is part-time now—before reaching FI—where you might intentionally take a lower-paying role or scale down your hours, if possible, to protect your energy, health, and family time. The second is part type post-FI—when work becomes entirely optional, and you choose specific projects or seasonal work for joy, purpose, or contribution.

Both share the same core principle: working on your own terms. If you’re still years from FI (like me), the part-time now approach might look like moving into a lower-stress position in a field you are interested in, even if it slows down your savings rate a bit. For example, someone in corporate marketing might shift to working in communications for an environmental NGO or university—perhaps trading income cut for a healthier schedule.

Another example: a teacher aiming for FI might go from full-time classroom role to private tutoring, or teaching part of the week. In these cases, these transitions are not about leaving work, but reshaping work around the lifestyle you actually want.

But post-FI, the nature of part-time work could change. Here you really don’t have the financial side running the show. Do you enjoy spending time in nature—how about working in summer as a park ranger or a similar role? Do you enjoy sports and mentoring others—what about teaching your favorite sport or activity to young kids? Are you passionate about cooking or growing food? What types of roles could you do part-time to thrive in that environment?

Personally, I derive a lot of joy from this platform—researching, engaging with ideas, writing, and hopefully helping others better manage their finances. This is certainly a creative outlet I would maintain post-FI—even if it didn’t make a cent. But of course, I have many other plans too!

Whether you’re pivoting to part-time work before or after FI, you’re making decisions that align your energy with what fulfills you, instead of what drains you. That’s where the real magic happens—when work starts to feel like an extension of your curiosity and time simply flies by.

Part-time, creative work that makes you feel engaged can be a big source of fulfillement, both now and after reaching Financial Independence. Photo by Justin Kauffman on Unsplash.

Redefining Success and Identity Beyond Full-Time Work

There’s another important layer to this conversation that often gets ignored—identity. For many of us, work isn’t just a paycheck—but part of who we are. As silly as it may be, we like to include our job titles in conversations, measure progress in promotions, and unconsciously seek for external validation. Even though none of these external items are usually aligned with what makes us happy, stepping away from this system can feel unsettling.

I experienced this firsthand. On paper, my career looked great: a PhD, a senior consulting role working with global institutions, a nice title that sounded impressive at conferences or dinner tables. And yet the satisfaction was hollow. In my case, none of these achievements translated directly into well-being, only anxiety and stress. What they gave me was recognition—not peace. What’s the point of tying up your identity in your career if it comes at the expense of your health and well-being?

Now I see success much less as external validation and more as how I feel on Tuesday mornings—do I feel calm, healthy, and engaged in work I enjoy doing? It’s also about the type of lifestyle we’re building—sure, others may have the fancy titles, important meetings, and promotions, but are they spending enough time with their kids? Success, in this sense, isn’t about how others see you, but about how aligned your daily reality is with your values and lifestyle preferences.

This redefinition of success is what makes both versions of Partial Retirement—before and after FI—so powerful. Once you stop measuring progress by titles, promotions, or income, and start measuring it instead by energy, health, and time freedom, you realize you can live meaningfully long before reaching full Financial Independence.

Working part-time before FI can give you the balance and well-being you’ve been postponing, while working part-time after FI lets you stay curious, creative, and engaged without obligation. In both cases, the mental shift is the real milestone—breaking free from the old scoreboard. Once you stop playing by its rules, you’re already living a version of FI, even before the math catches up.

Redefine what success means to you—is it more time freedom to spend with your loved ones and build memorable experiences or do you really care so much about status, the job titles, and promotions? Photo by Natalya Zaritskaya on Unsplash.

Freedom as a Practice: Living Financial Independence Before You Reach It

If you could design your ideal day, what would it look like? What would you choose to do—not in retirement, but tomorrow? These questions are at the core of the FI journey, but most people tend to delay answering them.

Partial Retirement after FI invites you to start answering them now. It’s not necessarily about slowing ambition, but about aligning it with intention. It’s realizing that reaching FI in 6-8 years instead of 4 doesn’t mean you’re falling behind. It means you’re building a life that is already rich, calm, and meaningful today.

The spreadsheets still matter—your savings rate, portfolio returns, and FI timeline. But so does your health, your energy, and your sense of joy. What happens if you sprint yourself to FI but feel either empty or too exhausted when you get there—what was the point of it all?

Bill Perkins said it best in Die With Zero: Your life energy is the most valuable resource you have. The goal isn’t to maximize wealth accumulation, but to maximize meaningful experiences while you can still fully enjoy them.

Today, I still track my timeline—about six years to go—and encourage others to do so as well. But I no longer see it as an escape or some critical countdown like I did when I was burnout in my job. Now, it’s simply a compass. We’ve already reaped so many of the benefits of pursuing FI: autonomy, time, health, and space to take risks and create. The math will come, but the sense of freedom? That’s already here.

So, perhaps the real question isn’t how fast you can reach Financial Independence, but how soon you can start living like you’re already there.

💬 How close is your current work life to the one you’d design if money weren’t an issue? What small changes—fewer hours, different projects, or a slower FI timeline—could bring that version a little closer today? Let us know in the comments.

👉 Use our FI calculator (free for email subscribers) to assess how close you are to early retirement; then change assumptions to see what it will take to retire earlier.

👉 New to Financial Independence and looking to retire early? Check out our Start Here guide—the best place to begin your FI journey.

🌿 Thanks for reading The Good Life Journey. I share weekly insights on personal finance, financial independence (FIRE), and long-term investing — with work, health, and philosophy explored through the FI lens. If this resonates, join readers from over 100 countries and subscribe to access the free FI tools and newsletter.

Disclaimer: I’m not a financial adviser, and this is not financial advice. The posts on this website are for informational purposes only; please consult a qualified adviser for personalized advice.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

Partial Retirement means continuing to work by choice after reaching FI. You no longer need the income, but you choose meaningful or flexible work for purpose, creativity, or community—often part-time or seasonally.

-

Barista FIRE often covers income or healthcare gaps; Partial Retirement happens when work is optional. You work because it enriches life, not because you must.

-

Yes. Many practice it early by reducing hours or switching to lower-stress jobs. This slow FI approach protects health and builds the lifestyle habits you’ll want post-FI.

-

A slower journey allows better health, family time, creativity, and lower stress. You enjoy freedom while pursuing FI instead of deferring it.

-

It depends on your finances and savings rate. Many reduce hours once they have a cushion or flexible expenses, shifting from corporate jobs to teaching, freelancing, or NGO work.

-

Autonomy—control over your time and work—brings many of FI’s psychological benefits even before you’re financially free.

-

Financial Independence is about choice; retirement implies stopping work. You can reach FI and still work part-time on projects that give meaning.

-

Identify activities that energize you, minimize management or stress, and build flexibility. Over time, transition your income toward those

-

For most, slowing down adds only a few years—but makes those years healthier, calmer, and more fulfilling. It’s often a net gain.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: