What Is a Bond Tent? A Smart Strategy for Early Retirement

Photo by Sagui Andrea on Pexels.

Reading time: 8 minutes

What Is a Bond Tent and Why It Matters for Early Retirement

Quick answer: A bond tent is a retirement investing strategy where you temporarily increase your bond allocation around the start of retirement—then gradually reduce it later. The goal is to protect your portfolio from sequence-of-returns risk, which is most dangerous in the first years after you stop working.

This article explains what a bond tent is, why it matters especially for early retirees, and how to implement one step-by-step, including pros, cons, and how it compares to the 4% rule.

What you’ll get from this guide

✔ A clear definition of what a bond tent is and how it works

✔ Why sequence-of-returns risk (SORR) matters most in early retirement

✔ A step-by-step example of a bond tent glidepath

✔ How bond tents compare to the 4% rule, Guardrails, and VPW

✔ The key trade-offs, drawbacks, and opportunity costs to consider

✔ How to decide whether a bond tent fits your risk tolerance and FI timeline

TL;DR — Bond Tent Strategy ⛺📉

⛺ Bond tent = temporarily increasing bond exposure around retirement, then gradually reducing it later

📉 Purpose = protect your portfolio from early market losses when withdrawals begin

🕰️ Best use case = early retirees with long (40–50 year) retirement horizons

⚖️ Trade-off = lower volatility early vs. potentially lower returns if markets stay strong

🔁 Works best with = flexible withdrawal strategies like Guardrails or VPW

🧭 Key insight = early retirement success depends as much on when returns happen as on long-term averages

Understanding the Risk: Why Early Retirees might Need a Bond Tent

To see why a bond tent helps, let’s zoom in on the problem it’s designed to solve: sequence-of-returns risk.

One of the most critical financial risks early retirees face is known as sequence-of-returns risk (SORR). In plain English, it means your portfolio’s survival depends not just on average returns, but on the order in which good and bad years occur—especially early on.

While future market returns are uncertain, it's the sequence of those returns that can most threaten early retirement portfolios. The very nature of investing in the stock market means we’re exposed to high levels of volatility and uncertainty, especially in the short term.

Even if long-term stock returns are strong overall, you could still be unlucky and get three straight years of poor returns at the very start of retirement. Unfortunately, this poor sequence timing could completely derail your retirement plans if you don’t have any mitigation strategy in place.

Sequence-of-returns risk disproportionately affects those pursuing early retirement. This is because early retirees often face 40–50 year horizons, where early losses compound far more severely than later ones. If you are retiring in your mid-to-late sixties, chances are you will be fine by following something simple like the 4% rule of thumb.

But if you are pursuing FIRE (Financial Independence, Retire Early) and wish for an unconventional early retirement, you may have 4-5 decades or more of life expectancy ahead of you. The sequence of returns in the first years after retirement becomes very relevant for determining whether you run out of money later on.

In previous blog posts, we covered different withdrawal strategies in retirement that are relevant for different individuals based on different preferences, flexibility, and risk tolerance, e.g., the 4% rule of thumb, a more flexible Guardrail Withdrawal Strategy, or the Variable Percentage Withdrawal (VPW) strategy. All of these have pros and cons that are worth looking into, some of which may be more relevant to different individuals.

The bond tent concept may sound complex, especially to those new to the blog. So, let’s quickly review the basics before returning to how the bond tent glidepath works in practice.

Photo by Mattias Helge on Unsplash.

What Is the Safe Withdrawal Rate (SWR)?

The Safe Withdrawal Rate (SWR) is the percentage of your retirement portfolio that you can withdraw on an annual basis without fear of running out of money. It’s important because it helps retirees plan how much they can “safely” spend each year without depleting their hard-earned savings too soon. We can see it as a guideline for balancing spending needs with long-term financial security.

A common rule of thumb followed by traditional retirees facing a 20-30 retirement horizon is the 4% rule. It’s based on historical data and suggests you can withdraw 4% of your retirement portfolio in your first year of retirement, and then proceed to adjust each year thereafter accounting for inflation.

For example, with a $1 million retirement portfolio, you might withdraw $40,000 in the first year and adjust for 3% inflation to $41,200 in year two. Rinse and repeat for the following years thereafter.

However, applying a fairly passive approach such as the 4% rule of thumb can be risky in some cases, in particular for early retirees facing unconventional retirement timelines. While the 4% rule is a popular starting point for retirement planning, more robust withdrawal strategies like the Guardrail Withdrawal Strategy or the Variable Percentage Withdrawal (VPW) may offer better long-term security for early retirees.

The Unique Risks Faced by Early Retirees

Sequence-of-returns risk (SORR) refers to the danger that poor investment returns in the early years of retirement can cause lasting damage to your financial future. Even when the market eventually recovers, the timing of these early losses combined with steady ongoing withdrawals can significantly reduce your nest egg, making it very difficult for it to recover. This risk is especially serious for early retirees, who often face retirement timelines of 40 or 50 years.

It is important to internalize this concept. Two people could have the exact average returns over 30 years, but end up with with wildly different portfolios at the end of the period depending on the timing of the returns. Timing, not just averages, can make or break a retirement plan. Alright, so now that we are aware of this danger, how can a bond tent mitigate this risk?

Photo by Baptiste Valthier on Pexels.

What Is a Bond Tent? How It Mitigates Sequence-of-Returns Risk

A bond tent is a time-based asset allocation strategy in which you temporarily increase your bond exposure around the start of retirement, then gradually reduce it later. The purpose is to lower portfolio volatility during the most vulnerable early retirement years and reduce exposure to sequence-of-returns risk (SORR).

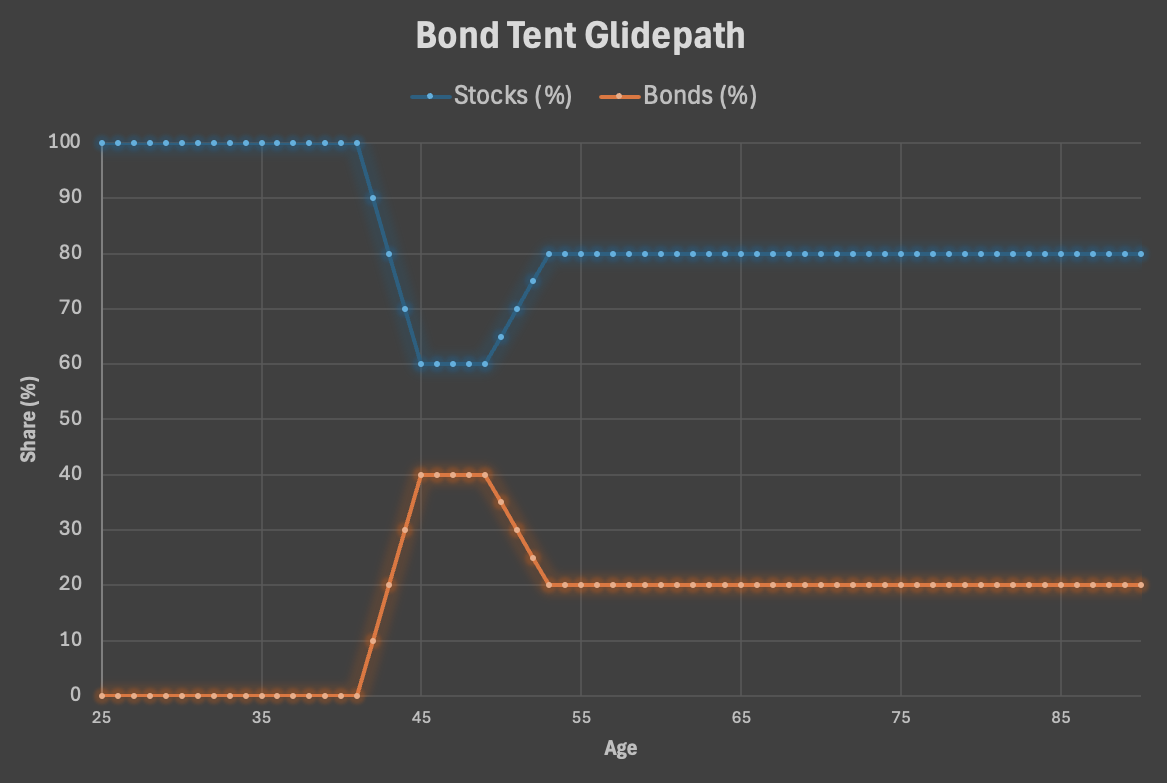

This strategy acts like a metaphorical tent shelter during the early years of retirement, when portfolio losses due to market volatility can be most damaging. The term “bond tent” gets its name from the shape of charting your bond allocation over time—rising pre-retirement, peaking in the early years, and then tapering off (see Figure 1 below, orange line).

This time-based pattern is a type of glidepath (also called a retirement glidepath or bond glidepath)—a planned trajectory for adjusting your asset allocation (stocks/bonds) over time. In the case of the bond tent, it means temporarily increasing bond exposure during the riskiest years of retirement, then gradually reducing it as conditions stabilize and your portfolio matures.

How a Bond Tent Works: Step-by-Step Glidepath Example

Consider an early retiree planning to achieve financial independence and retire at age 45. In the earlier years, this individual should assume a higher asset allocation to stocks to take full advantage of portfolio growth. This could even be up to 100% stocks, depending on risk tolerance.

As per the bond tent approach, about 3-5 years before retirement you would gradually start to increase your bond allocation in the years leading up to and immediately after retirement (the peak of the “tent”, in orange in Figure 1 below).

Most people implementing this strategy typically target a 30-50% bond share, depending on risk tolerance. For the sake of this example, let’s say we’re targeting a 40% bond (60% stock) portfolio at retirement. In the four years leading up to retirement, you could target, say, a 10%, 20%, 30%, and 40% share in those four years leading up to retirement, respectively.

After retirement, keep your portfolio allocation at the desired share for another 3-5 years. This is the most critical stage, the one that will determine the success of your portfolio in the later years of retirement and ensure you don’t run out of money. So, in this phase we are keeping the bond allocation relatively high to protect ourselves from SORR.

Once the early retirement risk window has passed, you can reduce bond allocation and shift back into equities for higher growth potential. Assuming you are not too conservative, after the “top of the bond tent” years have passed, you could increase again your exposure to equities to experience more portfolio growth. The theory is that you are now past the most risky phase of early retirement and can return to a portfolio allocation you feel comfortable with. Let’s say you return gradually over the next 3-5 years to a 80/20 portfolio.

One final remark on the three phases of the bond tent glide path. The first phase—the left-hand side of the tent, the one gradually increasing bond exposure over 3-5 years—is only needed if you want to increase the certainty of retiring by a specific age (45 in this example).

But, if you are young and willing to be flexible on this date, it is also possible to change the allocation more drastically at retirement. This approach would allow you to take advantage of more stock market growth in the 3-5 years leading up to retirement. The flip side is that you could have a bear market 1 year before age 45 and have to postpone retirement a few years until the conditions are appropriate.

Figure 1: Bond tent glidepath for an early retiree. In this example, a relatively aggressive investor starts out with a 100% equity allocation in the early years and gradually works her way to a 60/40 portfolio at retirement age (45). After 4 years, she increases gradually her exposure to equities to her final target asset allocation—80/20 in this example.

Customizing Your Bond Tent Based on Risk Tolerance

Your bond tent and asset glidepath should be tailored to your personal financial goals and risk tolerance. An aggressive investor who has evidence they perform well under serious market volatility could start out in the early years of the accumulation phase with a 100% stock portfolio allocation. They could then target a 30% or 40% bond share by retirement, keep it for 3-5 years immediately after retirement, after unwinding their bond positions to target a 80/20 or 90/10 portfolio. Please note though that this is likely not optimal for most.

On the other end of the spectrum a more conservative investor with low risk tolerance may start out in the very early years with a 80/20 portfolio, target a 50/50 or even 40/60 portfolio immediately after retirement, and keep it there or unwind it to a 60/40 or 70/30 portfolio.

I’m writing this educational post so people become aware of SORR and can consider the different strategies to mitigate it. But, ultimately, once you’ve laid out a plan, it makes sense to check with a fee-based, professional financial advisor, who will consider as well all the details of your personal financial situation. As we’ve covered, there are many different options to consider, and it’s always a good idea to cross-check your plan.

Why Use a Bond Tent? Key Advantages Over Other Strategies

The bond tent is an effective strategy that offers a strong defense against sequence-of-returns risk (SORR), especially in the early years of retirement. By temporarily changing your asset allocation towards safer assets like bonds during the riskiest period—right after leaving the workforce—you protect your retirement nest egg from strong market volatility, bear markets, and crashes.

A key advantage of the bond tent is that it’s a planned solution, not a reactive one. Unlike flexible withdrawal strategies that adjust after market downturns have taken place, impacting your lifestyle, the bond tent prepares you in advance for this type of adverse market conditions by changing your asset allocation proactively.

You don’t need to time the market or depend on it performing in a certain way, you simply reduce your exposure to stocks’ volatility when it matters the most, gradually regaining the exposure when the risky phase has passed.

And for those considering holding a meaningful bond allocation while still on the path to FI—rather than as a temporary shelter near retirement—it’s worth understanding how that choice can quietly stretch your timeline to financial independence.

How does this compare to the 4% rule of thumb? The 4% rule assumes a fixed asset allocation during your retirement and a fixed withdrawal regardless of market conditions, which may be risky in the context of early retirees. In contrast, the bond tent presents a layer of proactive risk management. Note that you can still follow the 4% withdrawal strategy here—you are just changing the asset allocation.

The bond tent could potentially work in tandem with a more flexible Guardrail Withdrawal strategy (GWS), which we covered in detail in a previous post. The GWS is a flexible spending strategy that allows you to adjust withdrawals depending on the stock market performance, when the portfolio hits predefined limits. This allows you to protect your portfolio when markets are down, but also to enjoy the benefits when the markets go up.

As we discussed in a previous post, most of the retirees following blindly a 4% rule of thumb end up like a dragon on a huge pile of unused funds. When combining the bond tent and the flexible GWS, the tent controls the allocation, while the guardrails adjust the spending. Together, they likely form a very solid strategy.

Finally, the bond tent also could work in tandem with a Variable Percentage Withdrawal (VPW). The VPW adjusts your withdrawal rate in retirement based on portfolio performance and longevity assumptions. The VPW can look very nice on paper but feel uncomfortable in practice during severe market downturns, because it requires you to withdraw a certain percentage of your portfolio no matter what. Introducing the bond tent, though, would reduce volatility substantially, making it much easier to stay committed to the VPW during difficult market conditions.

Photo by Teemu R. on Pexels.

Bond Tent Drawbacks: Trade-Offs and Opportunity Costs

What are the disadvantages, if any, of implementing a bond tent glidepath on your financial independence early retirement journey? Although a bond tent helps mitigate early retirement risk, it requires active portfolio management and strategic planning. You need to decide on the peak bond allocation, time the build up before retirement, and manage the glide down afterwards. It requires more effort than static approaches like the 4% rule combined with, say, a 70/30 fixed asset allocation.

This added layer of complexity may deter DIY investors who prefer a simple retirement investing strategy. The 4% rule, or implementing a more conservative “3.5% rule” appeals to many because it is so simple to implement—set your spending target and stay the course. In contrast, implementing a bond tent introduces moving parts and timing issues. While it doesn’t require timing the market, it does require deliberate action over a span of many years, both before and after retirement.

As we’ve hinted at previously, there is also an opportunity cost involved, given that bonds tend to underperform stocks over long time horizons. By shifting a large portion of your portfolio in the years leading up to and initial years of retirement, you may sacrifice potential gains if markets remain strong. For an aggressive investor this could feel like playing it too safely, especially during the 3-5 years leading up to retirement.

Is the Bond Tent Strategy the Right Fit for You?

So, we’ve covered the pros and cons, but is a bond tent glidepath strategy right for you? I won’t reinvent the wheel here—the fit depends on your personal comfort with risk and market volatility, and on how passive you want to be with the management of your portfolio. If market downturns keep you up at night, a bond tent can provide peace of mind during the critical early phase of retirement. It offers a psychological and financial buffer when your investment portfolio is most vulnerable to market swings.

The bond tent strategy is also suited to those willing to stay engaged with their portfolio. Honestly, I don’t think anyone should stop paying attention completely. Understanding your true biological age can also help shape your retirement timeline and risk tolerance—especially if you may be planning for a much longer active retirement than you think.

Things can change over time, and staying educated on these changes is also important to protect your wealth. But if you don’t mind being more active in the management of your portfolio, then implementing a bond tent strategy won’t feel like a major effort to you.

As we illustrated above, the bond tent isn’t a standalone solution. You still need to decide on your withdrawal strategy. As we saw, it works well when combined with dynamic withdrawal strategies like Guardrails or VPW. These strategies control how much you take out, while the bond tent controls what you’re invested in. Combined, these strategies create a well-rounded retirement plan that manages risk while supporting long-term portfolio growth.

Photo by Scott Goodwill on Unsplash.

Share Your Thoughts and Subscribe for More

If you are pursuing FIRE, the bond tent definitely deserves serious consideration. This approach isn't about market timing or fear—it’s about intentional financial planning and adding resilience to your early retirement strategy.

What do you think? Have you considered using a bond tent in your retirement planning? Do you plan on building one, or rely on a different strategy altogether? We’d love to hear your experience.

If you enjoyed this article, here are the next steps:

👉 Explore flexible withdrawal strategies: Guardrails or Variable Percentage Withdrawal (VPW)

👉 Run your numbers: estimate your timeline to Financial Independence with the FI Calculator (free for subscribers)

👉 Subscribe to our monthly newsletter to not miss any free tools or articles (unsubscribe anytime)

🌿 Thanks for reading The Good Life Journey. I share weekly insights on personal finance, financial independence (FIRE), and long-term investing — with work, health, and philosophy explored through the FI lens. If this resonates, join readers from over 100 countries and subscribe to access the free FI tools and newsletter.

Disclaimer: I am not a financial adviser, and the content in this website is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions

-

A bond tent is a strategy where retirees temporarily increase bond exposure around retirement to reduce portfolio volatility. This helps protect against sequence-of-returns risk, which can permanently damage portfolios when losses occur early in retirement.

-

Early retirees face much longer withdrawal periods—often 40–50 years. Poor returns in the first few years can derail long-term sustainability, making early risk management more important than for traditional retirees.

-

Most implementations peak between 30% and 50% bonds, depending on risk tolerance. The exact level varies, but the goal is stability—not eliminating equity exposure.

-

Typically after 3–5 years into retirement, once sequence risk has passed. At that point, many retirees gradually shift back toward equities to support long-term growth.

-

The 4% rule assumes a fixed asset allocation throughout retirement, regardless of market conditions. A bond tent doesn’t change how much you withdraw, but what you’re invested in, reducing risk when early losses are most damaging. The two can work together.

-

No. A bucket strategy separates assets into spending “buckets” by time horizon, while a bond tent adjusts the overall asset allocation over time. Both aim to manage early retirement risk, but the bond tent is simpler and more portfolio-focused.

-

Potentially, yes. Bonds tend to underperform stocks over long periods, so holding more bonds during strong bull markets can reduce upside. The trade-off is improved portfolio survivability during early retirement, when losses are hardest to recover from.

-

No. A bond tent follows a pre-planned glidepath based on retirement timing, not market forecasts. You are not reacting to short-term market moves, but proactively adjusting risk during a known vulnerable period.

-

Yes. Bond tents pair especially well with strategies like Guardrails or Variable Percentage Withdrawals (VPW). The bond tent reduces volatility, while flexible withdrawals adjust spending—together providing stronger protection than either approach alone.

-

A bond tent may be unnecessary for retirees with very conservative spending, large safety margins, or high tolerance for volatility. It also requires ongoing portfolio management, which may not suit investors seeking a fully hands-off approach.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: