Is $1 Million Enough to Retire Early? How to Know If It’s Right for You

Tulum, Mexico. Mexico ranked 4th in our top 5 retirement destinations in Latin America. Photo by Spencer Watson on Unsplash.

Reading time: 9 minutes

The $1 Million Retirement Myth: Is It Enough to Retire Early?

Is $1 Million Enough to Achieve Financial Independence and Retire Early (FIRE)?

Many people ask: Is $1 million enough to be financially independent and retire early? The simple answer is yes – but the real answer depends on your personal circumstances. In this post, we will cover all the different angles needed to answer these question, and, by the end of it, you will have a good understanding of whether this target is suitable or not for your unique circumstances.

We will cover multiple factors such as retirement needs, age, withdrawal strategies, flexibility, and location. Understanding how these factors relate to each other and to the question of how much we need to retire is extremely important, since it could potentially shorten your career by multiple years or even decades. We’ll cover commonly-held beliefs that may be holding you back—the kind of FI myths that quietly delay your freedom—how to break free from them, and how to better define your retirement saving goals instead

Why Do People Fixate on $1 Million (and Other Round Numbers) for Retirement?

$1 million is a powerful psychological milestone because it’s a clean, round figure that symbolizes financial success. Everyone wants to be a millionaire, right? It certainly feels like being one would solve many of our problems. Many tell themselves that once they reach millionaire status they’ll have less to prove and can then relax and enjoy life a bit. Of course, the Stoics would remind us that focusing on external validation is not the right way to go about life.

Humans are likely drawn to these round numbers because they are easy to remember and easy to aspire to. They do give us a sense of clarity in a world that is full of financial uncertainty. But even though $1M feels like a safe and impressive target for many, it doesn’t really say anything by itself without connecting it to how much you actually need to live on.

Your true retirement savings goal should align with your lifestyle, spending habits, and retirement timeline. When prompted, a friend of mine recently told me he envisioned needing $5M before being able to stop working. He said he would then feel comfortable enough to retire early, take back his time, and fully pursue his interests. The problem here is that, although he fully believed his goal was a reasonable one to aim for, there is no substance supporting this type of arbitrary goal.

The $5M target was only a round number that sounds very good. It was not tied to his spending needs, lifestyle, location (southern European country), or time horizon. In today’s post, we will understand how to set our own retirement number target (referred to in the financial independence community as your Financial Independence number or FI number) and how it relates to our lifestyle and spending needs. We will then answer the question of how much $1M can buy you, based on different withdrawal strategies, and whether it is enough to retire on.

Santorini, Greece. Greece ranked 4th in our top 5 retirement destinations in Europe. Photo by Pixabay on Pexels.

How to Reverse-Engineer Your Financial Independence Number (FI Number)

When planning for financial independence and early retirement, focus on ‘how much do I need’ rather than just ‘how much can I save. This is an important distinction, because following the former approach you may end up – like my friend – with an unnecessarily high number. The smarter approach is to reverse-engineer your financial independence number (henceforth, FI number) based on your desired spending needs.

In previous posts, we covered the commonly used 4% rule (of thumb). It’s supported on historical data and suggests you can withdraw 4% of your retirement portfolio in your first year of retirement, followed by annual inflation adjustments in the subsequent years. There are some important caveats to be aware of when using this rule of thumb. Although I encourage you to read the small print of the 4% rule, it is certainly a good starting point for questioning how much we need to aim for.

So, let’s say you feel you could live very comfortably with a household annual spend of $60,000. Using the 4% safe withdrawal rule, you’d need about a $1.5 million nest egg ($60,000/0.04) to support $60,000 in annual retirement spending before thinking about stepping away from our career to pursue other meaningful endeavours. Not having to work and having a $60,000 budget would certainly afford you a very nice quality of life in southern European countries, including their more expensive capitals. Remember that $1.5M is more than 3 times less than the portfolio target my friend was considering. What does it actually mean for my friend to set such an unnecessarily high target? Let’s try to quantify the tradeoff he is incurring in.

The Risks of Over-Targeting Your Financial Independence Number

Setting an overly high financial independence target like $5 million may seem cautious but involves significant tradeoffs. First, many of us may be defining this target from a position of fear – aiming to accumulate a huge cushion “just in case”. Although understandable, this can also lead to overworking and to indefinitely postpone our freedom to design an alternative path for our lives.

We may also be incurring in a strong level of “lifestyle mismatch”. Like my friend in the example above, maybe we only needed $60,000 a year to step away from the job we dislike in order to pursue other interests and goals. And yet my friend was aiming to accumulate a portfolio that was 3 times larger than what was needed. What a waste in terms of time and energy! How many more years of work does that mean? Wouldn’t it have been wiser to spend that time with his family and pursuing his other interests unrelated to his work career?

Let’s use the 4% rule of thumb and our Financial Independence Calculator below to figure out how much earlier he could retire if he were more intentional with his spending needs. I don’t have every single detail of his finances, so let’s make some reasonable assumptions and enter them into the FI calculator:

Age: 30

Net Annual Income ($): 80,000

Current Portfolio Value ($): 150,000

Current Annual Expenses ($): 60,000

Estimated Annual Expenses in Retirement ($): 60,000

Annual Return on Investment: 7%

Safe Withdrawal Rate: 4%

Current Country: Spain

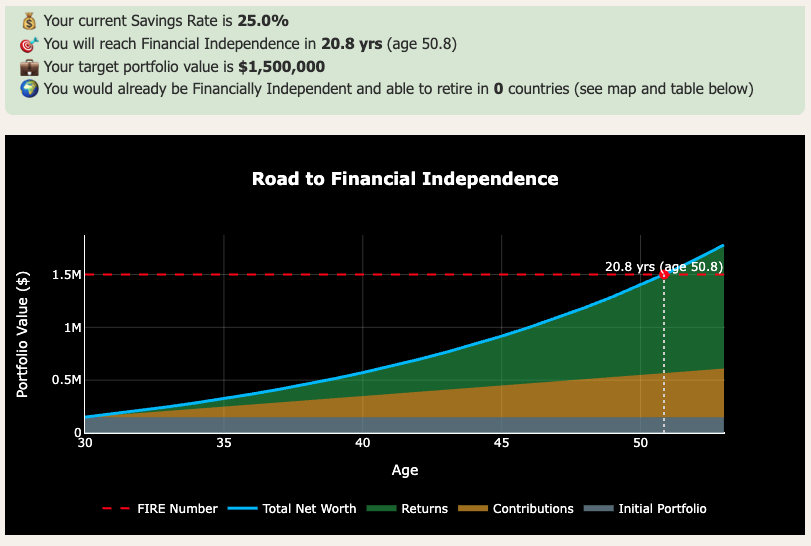

Under these assumptions, and as per the 4% rule, my friend would initially target a portfolio value of $1.5M (see output of calculator in Figure 1). As observed, my friend’s household has a savings rate of 25% and, if he invested in a portfolio of low cost, internationally-diversified index funds, could reach financial independence in under 21 years at age 51.

Figure 1: Roadmap to Financial Independence for the case study and with an annual spend in retirement of $60,000 ($1.5M portfolio target). Our Financial Independence Calculator is free if you subscribe to our email newsletter.

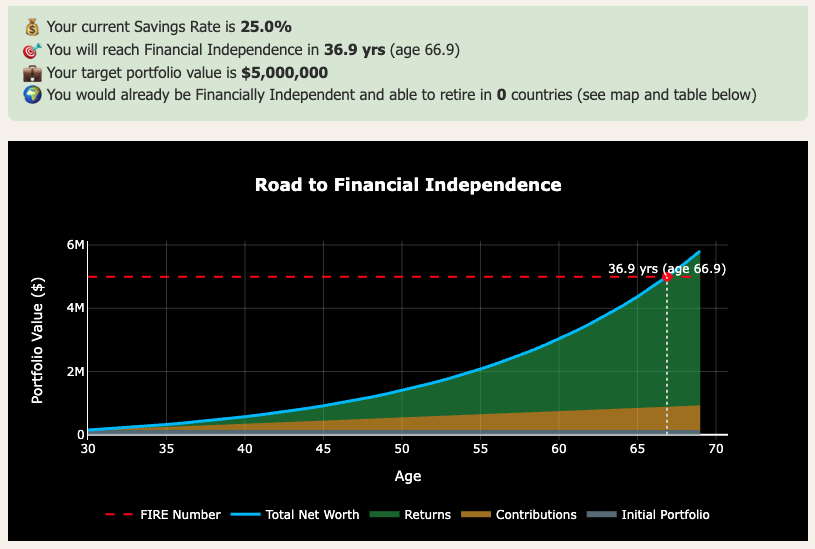

How long would he have to work to amass a $5M portfolio under these assumptions? A $5M portfolio provides a $200,000 annual spend in retirement ($5M/0.04). If we input this new retirement spending amount in the tool, we observe that financial independence and retirement is postponed to age 67, 37 years from today (Figure 2 below). That is retiring 16 years later! In other words, just being aware of this simple rule of thumb and adjusting your retirement portfolio target to reflect your actual spending needs (and not just a random number) could potentially cut your working career by a decade and a half.

Figure 2: Roadmap to Financial Independence for the case study and with an annual spend in retirement of $200,000 ($5M portfolio target).

The takeaway here that it is important to balance prudence or conservativeness with intentional goal setting. Your FI number should consider the important time tradeoff that was illustrated above. In the end, over-targeting your FI number means more time spent working in a job you may not enjoy, less time with family, friends, and meaningful projects, and even risking burnout, depending on your industry and current working conditions.

Before setting yourself a lofty savings or retirement goal, ask yourself: what are you trading in return? More time in a job you dislike, risking your physical and/or mental health? Less time spent with your kids and family? Less time to travel the world while you’re still fit enough to do so? Reducing your life expectancy?

What Does a $1 Million Portfolio Actually Buy You in Retirement?

So what does $1 million actually buy you in retirement? Let’s go back to the original question of today’s post. If you live modestly and avoid large recurring costs like car ownership, it can stretch much further than most people expect — even in higher cost locations. We will assess this through the 4% rule lens, but also through some alternative, more flexible retirement spending approaches.

As per the 4% rule (of thumb), 4% of $1M equals $40,000 of annual spend. You could withdraw this amount on year 1 of retirement, and adjust for inflation on subsequent years thereafter. Whether this amount seems like a lot or very insufficient depends on multiple factors: Are you single or have a family with different responsibilities?

Do you live in a high or low cost-of-living country? What has been your average annual spend over the last three years? Do you have some built-in flexibility to reduce your expenses if needed if severe stock market conditions weaken your portfolio over consecutive years? In higher-cost regions such as the Nordics, that same $1M would stretch far less than in southern Europe or parts of Asia.

As we discussed in a previous post, the 4% does have drawbacks, particularly if you are discussing early retirement with very long timelines of 4 or 5 decades. For early retirees, Sequence of Return Risk (SORR) becomes a concern during the first years after retirement. This means that the timing of your portfolio returns in the early years of retirement is more important than what the average returns turns out to be over the course of your retirement. Let’s also consider a couple alternative withdrawal strategies that overcome some of the limitations of the 4% rule.

Dubrovnik, Croatia. Croatia ranked 3rd in our top 5 retirement destinations in Europe. Photo by Nikola Kojević on Pexels.

If you used a more flexible Guardrail Withdrawal Strategy (GWS), a $1M dollar portfolio would provide an initial $50,000 per year. This is substantially better than the $40,000, but there is also a catch here. It requires you to have some built-in flexibility in your withdrawals, and to modify them moving forward depending on how the market is performing. The details can be found in the post linked above, but, in a nutshell, this approach suggests making small adjustments to your retirement spending needs – 10% adjustments – up or down – when you your portfolio withdrawals start representing a too high or low relative percentage of your nest egg – 6% and 4%, respectively.

Finally, let’s also consider the popular Variable Percentage Withdrawal (VPW). Unlike fixed-percentage rules (like the 4%), VPW adjusts your annual withdrawal rate in retirement each year depending on your age and portfolio value. In a nutshell, it allows you to spend more as you age, since your investment horizon shortens. It is also aligning your spending to how the market is performing. If the market experiences a 5-year bull run after you retired and you are following the 4% rule blindly, it is likely that you will end up like a dragon on a pile of (unused) golden coins. The VPW approach allows you to increase your spending without fear of running out of money. So, with a $1M portfolio, the VPW may suggest withdrawing $45,000 per year (4.5% of portfolio) if you are retiring in your mid-thirties or $54,000 per year (5.4% of portfolio) if you are in your mid-sixties. The VPW strategy provides tables with percentage withdrawals that depend on your age and stocks-to-bonds asset allocation.

Can you retire on $40,000-54,000? Only you can answer this. The answer depends on your lifestyle and spending needs and to the degree you are willing to be flexible. As illustrated above, if you’re OK with being flexible and decide to align your portfolio withdrawals with how the market performs (e.g., the GWS or VPW strategies), then you can withdraw more than what the 4% rule suggests. Each strategy ultimately reflects a different tolerance for risk, flexibility, and lifestyle preference. Of course, $40-54K does not mean the same to everyone – for some it is frugal abundance, for others it is barely enough.

Now, let’s take a look at location – another critical factor to deciding whether $1M (or whatever the amount) is enough to retire.

Geographic Arbitrage: Stretching Your Retirement Savings Across the Globe

Until now, we’ve covered how far a $1M portfolio can stretch during (early) retirement using different withdrawal strategies. But there is another arguably more important dimension that can radically change the equation – where you live. The cost of living (COL) varies dramatically across regions and countries (even within countries), and this opens up a powerful opportunity referred to as geographic arbitrage (which also includes seasonal geographic arbitrage). In previous posts, we covered how to identify the best countries globally for geographic arbitrage and how you could reduce your timeline to financial independence and early retirement by a decade or more, depending on your current financial situation and where you live.

Put simply, geographic arbitrage in this context means taking advantage of low COL regions to extend the value of your retirement savings. To illustrate, let’s consider the $1M retirement portfolio and the conservative $40,000 annual spend it could provide (without using any of the more optimized withdrawal strategies shared above). If you are based in the US (like the majority of our readership), then you likely know that a retirement budget of $40,000 per year is going to be difficult. Yes, it depends on your level of frugality and where you are in the US, but it’s safe to say that this budget is on the tight side.

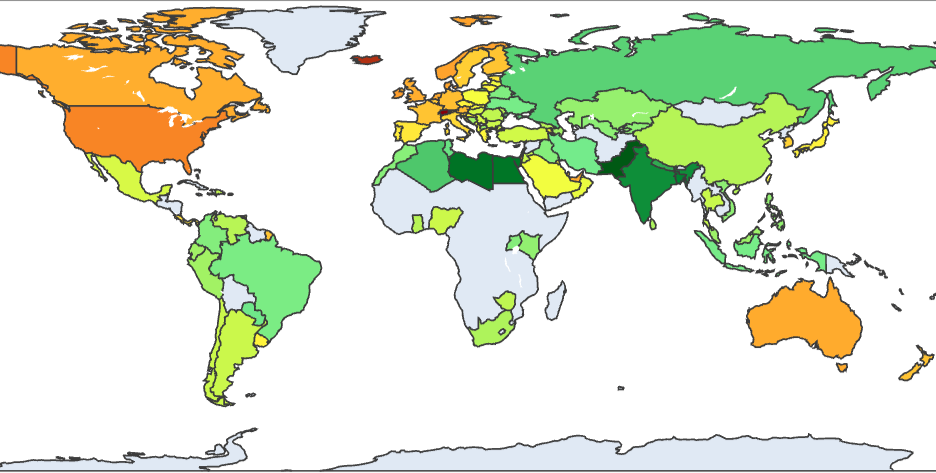

Cost of living (COL) varies greatly worldwide, as shown in Figure 3, affecting how far your retirement savings can stretch. According to our Financial Independence Calculator, you could achieve a comparable $40,000 US lifestyle in Portugal, Thailand, or Malaysia with only 60% ($24,000), 44% (18,000), or 37% ($15,000) of that amount, respectively. But you have $40-50K to spend annually, depending on your withdrawal strategy, so you will likely live much better in these countries than you do in the US.

Figure 3: Cost of living across 100+ countries on a red (expensive) to dark green scale (cheap). In our new Financial Independence Calculator—free for newsletter subscribers—you can click on this map and see how it shortens your timeline to reach financial independence.

But how does geographic arbitrage affect our retirement timeline? By requiring a much lower annual spending in low COL countries abroad, you can aim for a lower retirement target portfolio. This, in turn, greatly impacts your ability to step away from your career earlier. I recommend playing around with our Financial Independence Calculator – it not only provides you with your timeline to financial independence and early retirement, but also showcases what this timeline would look like if you chose to retire in different countries, including low COL countries.

To sum up, your money doesn’t retire in a vacuum – but it a specific location. And where you decide to live could potentially double or even triple the effective power of your retirement savings. Geographic arbitrage is a powerful strategy for lean FIRE, barista FIRE, or anyone wanting to optimize their lifestyle while maintaining freedom. This is also where the differences between LeanFIRE and FatFIRE become most apparent, since your cost of living choices directly shape which path is sustainable long term, especially if you also skip car ownership.

Time Horizon Matters: Retiring at 35 vs. 65 and Its Impact on Your Portfolio

Another important aspect in deciding whether $1M is enough to retire on is your time horizon. In simple terms, this means how long your retirement portfolio needs to last. If you retire around age 65, you likely need your portfolio to only last around 25-30 years. However, if you are considering retirement in your 30s, 40s, or early 50s, you are facing very different time horizons.

For instance, retiring by 45 comes with its own set of challenges and planning considerations that are worth understanding early on. Early retirees often need their portfolio to last 50+ years, which can be twice as long as traditional retirement planning.

Having a longer time horizon is great for our lives but also means there is more risk for something to go wrong with our portfolio. In particular, early retirees face the so-called Sequence of Return Risk (SORR), which we covered in detail in a previous post. In a nutshell, the sequence or order in which you obtain your annual returns matter more than the average you end up getting over multiple decades. If you are unlucky and retire to a bear market, 2-4 years of poor initial returns could be catastrophic and may not be able to support your planned annual withdrawals in the long term. With a combination of bad luck and poor planning, you could run out of money and need to go back to work.

A common strategy to reduce Sequence of Return Risk (SORR) is the ‘bond tent’ approach. This approach involves increasing the bond allocation of your portfolio temporarily in the years leading up to and just after retirement. This buffer provides stability and gives your stocks time to recover if you are unlucky enough to experience a severe downturn in your earlier years of retirement.

Pulau Perhentian Kecil, Malaysia. Malaysia ranked 2nd in our top 3 retirement destinations in Asia. Photo by Nur Syafiqah on Unsplash.

Planning for the Unknown: Adapting Your Retirement Strategy Over Time

Despite the bond tent mitigation strategy, we should still be careful when considering such long retirement horizons. Things happen in life which we can’t really envision. Similarly, humans consistently underestimate how much they will change in the future – two decades from now, our future selves may have very different needs and views on how the world works.

It’s easy to see how a 30 year-old may feel confident that $1M is enough, especially if she is single, healthy, and leading a relatively frugal lifestyle. Fortunately, life rarely stays still. Our priorities shift, and so do our spending needs. So, we should remind ourselves that it’s not just about making the numbers work today, but also for preparing ourselves for 10, 20, or many more years from now.

You might love minimalist travel now in your 20s or 30s, and enjoy living out of a backpack. But by your 50s and 60s this will likely not to be the case – you’ll likely value convenience, comfort, and all that boring stuff. Also, kids and family may come into the picture, as will aging parents and health concerns for them.

Flexibility in your retirement plan and mindset is essential for long-term financial independence success. We should expect things to be different in the future and be open to adapting ourselves accordingly. Some in the FI community would advocate at this point for using a 3-3.5% safe withdrawal rate (instead of the 4% rule), which could mean working many more years to save up a larger portfolio.

I disagree here and would take the optimist’s view instead. If someone was able to win the money game and retire decades ahead of most, they will likely also be able to figure out any unforeseen financial challenge that is thrown their way. Just remember: its important to stay flexible and to recognize that it isn’t possible to have 100% control and predictability in life. There is no need to follow a rigid fixed withdrawal strategy each year no matter what. Instead, be willing to be flexible and adapt your spending if your portfolio is not keeping up.

What is certain though is that if you don’t take some risk, you will continue to plough along and trade your precious time away at that unfulfilling desk job, 9-to-5, all week long.

Conclusion: Is $1 Million Enough to Retire Early?

So, let’s recap, is $1 million enough to retire (early)? As discussed, the real answer is it depends. It depends on your spending needs in retirement, on your time horizon (and risk tolerance in life), your flexibility, and your location. Depending on these factors, $1M may offer a generous cushion for a 40+ retirement for some, while, for others, it’s just a first stepping stone in the right direction.

If you’re exploring the possibility of retiring on a tighter budget, remember that being flexible with your lifestyle and withdrawals can dramatically improve portfolio resilience—and might save you several years of career time.

What really matters is that you define your own FI number (i.e., your retirement target portfolio) based on your actual spending— not on some generic benchmark shaped by common financial independence myths. Set aside some time to calculate it and don’t be afraid to revise your target over time as life evolves. The important thing is that you have those targets in place.

Check out our free Financial Independence Calculator to plug in your numbers and see what your unique roadmap to FI looks like. See how different withdrawal strategies (3%-5%), spending levels in retirement, and even relocation choices affect your timeline to achieving financial independence.

Where are you based, and do you think retiring early with $1 million is feasible in your location? Share your thoughts and strategy below!

🌿 Thanks for reading The Good Life Journey. I share weekly insights on money, purpose, and health, to help you build a life that compounds meaning over time. If this resonates, join readers from over 100 countries and subscribe to access our free FI tools and newsletter.

👉 New to Financial Independence? Check out our Start Here guide—the best place to begin your FI journey.

Disclaimer: I am not a financial adviser, and the content in this website is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: