Should You Tell Friends, Family—or Anyone—You’re on the Path to FI?

Should you share your FI journey with friends and family or stay silent? Photo by Priscilla Du Preez 🇨🇦 on Unsplash.

Reading time: 7 minutes

TL;DR — Should You Tell Others About Your FI Journey?

What you’ll learn in this article:

💬 Why the FI community is divided on whether to talk openly about Financial Independence or not.

🧠 How envy, friendship, and honesty shape your decision to share (or stay quiet).

📈 Why sharing early in your journey can inspire others—and reduce resentment later.

👨👩👧👦 How attitudes toward FI can evolve as we move from our 20s to 40s and life priorities and pressures shift.

🌍 How cultural norms around money talk (e.g., Spain vs Germany) influence openness and perspective.

🤝 Practical ways to share your FI journey thoughtfully—being honest without oversharing, helping when asked, and letting curiosity guide the depth of each conversation.

The Balancing Act: How Open Should You Be About Financial Independence?

In today’s article, we’ll explore a question many pursuing Financial Independence (FI) eventually face: should you tell others about your FIRE (Financial Independence, Retire Early) plans—or that you’ve already retired early? We’ll look at how people handle these conversations with friends, family, and coworkers, what reactions to expect, and practical ways to talk about FI without awkwardness or misunderstanding. You’ll also learn when staying discreet makes sense, and how to share your story authentically if you choose to open up.

Should You Tell People About Financial Independence?

This is a very recurring question in the FI community—you can literally find hundreds of threads about this in Reddit FI subgroups. Should you live your Financial Independence quietly or talk about it openly? It’s not just a question about privacy, but also about identity, relationships, and honesty. Many early retirees and FIRE planners wonder the same—how do you tell people that you’re aiming to retire early (or already have), and should you at all?

Although there are a variety of opinions, the most common advice you read online is that you should keep it to yourself. You do this to avoid misunderstandings or awkward situations. Some people simply fear being labeled as “rich” or feeling the pressure to have to lend money to others. There’s also a practical side: depending on where you live, broadcasting financial details can expose you to privacy or security risks, which is why discretion sometimes makes sense.

But at the same time, living this sort of imposed secrecy can also be draining. You certainly don’t want to feel like you’re living a “double life”, quietly enjoying the freedom and success you’ve earned but unable to talk about it with the people you care about.

I think it helps to be honest about finances with close friends. If they are interested, let them ask the questions; if not, it’s fine to move on. Photo by Nicole Herrero on Unsplash.

There’s also the issue of envy, which tends to sit in the background of this debate. Envy will naturally appear when people suddenly find out you’ve reached FI—it may feel like it comes out of nowhere to them. In contrast, if you’ve been open about the process all along and they’ve seen the discipline and tradeoffs that have gone into the choice, it’s unlikely they’ll feel resentment. If someone regrets not having taking action earlier, it’s on them, not you.

There is also the question of how you share your working status after reaching FI. Some folks prefer the soft version of simply saying something like “I’m doing some part-time consulting now”. Even though they’re retired, this vague answer helps them move past the inevitable “So, what do you do now?” question that almost every early retiree faces. That approach falls under what many call “stealth wealth”—quietly enjoying financial independence without making it a talking point.

But for close friends and family, honesty has more power in the long run. If someone choses to distance themselves because of your openness, that probably says more about the quality of the friendship than it does about you. True friends won’t measure you by your net worth, but by your integrity and honesty.

That said, I’ve found there’s a difference between sharing with friends and sharing with older family members. For instance, I’ve told most of my close friends about Financial Independence, but not my parents or in-laws. They’re already retired, and in their case I feel there’s little upside—only potential for confusion or even concern.

Older generations often have a fixed idea of what a “normal” life and career should look like—usually shaped by their own experience. So bringing up early retirement too soon can trigger protective reactions or create unnecessary anxiety for them.

What about with colleagues at work? The principles that may work with your friends and family really don’t apply at work. Discussing FIRE or early retirement plans with coworkers can be very risky—especially if you’re still in the accumulation phase of FI. Workplaces run on perception, and even casual mentions of wanting to retire early can trigger doubts about your commitment or future at the company.

In most cases, it’s better to keep your FI goals private at work. Coworkers are usually not friends, and once word spreads, it’s hard to control how the story evolves. It’s better to save deeper money conversations for people you genuinely trust outside work.

Once you’ve thought about whether to tell people, the next question becomes when—and how your approach might evolve as your journey progresses.

In some settings, it’s easy to confuse colleagues with friends. But, unless you are very close to Financial Independence, it’s best to stay silent at work to avoid unnecessary risk. Photo by Redd Francisco on Unsplash.

Talking About FI During Different Stages of the Journey

The decision to share (or not) can be slightly different depending on the different stages of FI you are in. For instance, during the accumulation phase, talking about your goals can actually help—both you personally for accountability, but also others who could use a nudge towards greater financial awareness.

Personally, I shared the idea with most of my friends as soon as I came across it. And then, when a low-barrier documentary on Financial Independence came out, I reshared it several times with them again. I was hoping that many of my late-20s/early-30s friends would jump on the wagon. Surprisingly, though, they didn’t.

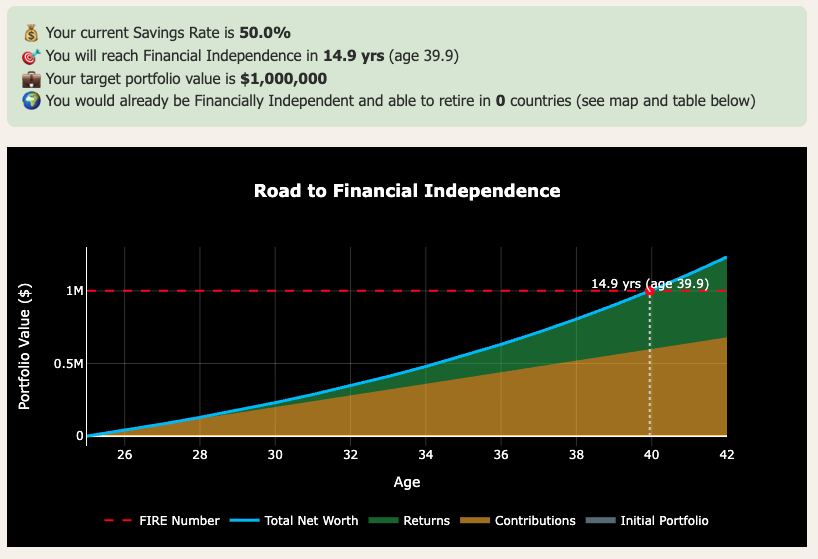

Although I think they understood and appreciated the concept itself, almost everyone shrugged it off. The reactions were along the lines of “cool idea, but probably not possible later on with kids”, “I can’t be bothered to track every expense”, or “I want to enjoy life more now”. Fine—I thought, at least I tried. I even encouraged them to use FIRE-type calculators—like the one in the image below—and apply them to their situation. If they chose not to follow, they can’t say later I didn’t try.

Figure 1: Screenshot of our Financial Independence Calculator—free for email subscribers. 1) Figure out how far away you currently are from retirement; 2) Play around with the different parameters and figure out what it will take to retire early.

Interestingly, as time passed the responses started to change. Friends who once ignored the calculators and spreadsheets were much more open to discussing the idea. Now in their late 30s, the initial excitement of climbing their respective career ladders has often given way to career disillusionment and fatigue. It’s not that they haven’t been “successful”, in fact many of them enjoy solid jobs with high salaries. But perhaps it doesn’t feel like they’ve made it.

Friends in their late 30s and early 40s are steadily entering what’s often called the “Sandwich Generation”. They’re not only super busy with their careers, but also have young toddlers and elderly parents to look out for. Their day-to-day is exhausting, and little by little, life has started to put their job and titles in perspective for them.

Like the vast majority of global workers, most of my friends simply don’t get a deep sense of meaning and fulfillment from their jobs and careers. Others were clear-eyed about it, but still trying to get rich quickly through startups or betting strongly on speculative stocks. As we discussed in a previous article, the odds were not in their favor—success here is more due to luck than skill.

Either way, kids entering the picture likely forced them to reassess what they find to be important in life. Suddenly, the idea of an early retirement, part-time work, or simply less pressure and anxiety starts to sound very appealing. It’s interesting to have observed this arc—from dismissing the idea to being much more open to it.

Once you’ve gotten close to reaching Financial Independence, I think you’ll be grateful for having shared the concept with as many friends as possible—after all, do you really want to be the only early retiree? It might feel lonely on that metaphorical beach. Wouldn’t it feel incredible if a few friends joined along, sharing life’s adventures together?

Of course, not everyone will join you—and that’s okay. As Millennial Revolution points out, some friends may never relate to FIRE or might feel uneasy about it. Again, that’s fine—at least, you tried.

Beyond strategy and timing, there’s also the human side—how people actually react when you bring up Financial Independence.

How Friends and Family React When You Talk About FIRE

Talking about money is deeply cultural. In Spain, where I grew up, discussing salaries or rent is often considered tasteless or intrusive. People simply are not open about money. But living in Germany showed the a completely different reality—people here constantly ask us how much we pay for rent, and close friends openly talk about their salaries.

Nobody flinches, because money is not such a taboo topic. My wife’s friends were visiting recently, and there they sat around our coffee table sharing and comparing salaries. I’m still shocked when this happens, but in hindsight it does feels like a healthy thing to do—after all, they’re simply not tying their identity or sense of self-worth to their paycheck or job title.

That would be almost unthinkable in Spain. And yet, that openness normalizes money—it subtly conveys the idea that money is a tool, a means to an end. In contrast, in cultures that speak more secretly about money, money is more about status and competition.

When you open up about pursuing Financial Independence, reactions will vary. Some will brush it off, others may debate it, and a few others will be genuinely curious. In my experience, the trick is to avoid imposing the conversation on others—just live by example, be honest when asked, and try to help people if they ask for it.

As mentioned above, be patient, because the nature of the conversations can change over time. When people get over the “get-rich-fast” approaches they may be open for the steadier, more realistic path to FI. Everyone has their own path in life—just be prepared to lend a helping hand if you can.

It feels really good to help your friends. Recently, we helped my wife’s friend, who had a decent cash cushion but no clue of where to start investing. She was vaguely aware that she should buy ETFs but the hundreds of options shown in her investment account were a barrier that kept her from starting. We set up a simple MSCI World ETF, nothing fancy, but enough for her to start building confidence slowly. I’m pretty sure she will increase her contributions over time.

Other friends with strong incomes but low savings rates started using my FI tool—free for email subscribers—to plan their own timeline. Seeing them set concrete goals and their progress is deeply rewarding and has reinforced my wish to be open about FI with others. In the end, the whole point of the blog is to help others put their finances in order so they can live their best lives.

When they are open to the concept, it feels very good to share the FI journey with your friends. Sometimes, you can actually help them with setting their goals, track progress, and reach FI sooner. Photo by Eddy Billard on Unsplash.

How to Talk About FIRE Without Awkwardness

At this point, I’ve come to see that the goal isn’t to convince everyone (you just can’t)—it’s simply to live honestly and be available to others when curiosity sparks.

When people ask what I do, I sometimes say “I’m part-time consultant, part-time influencer”. Can you guess what the follow-up questions are usually about? When I then mention what I write about—personal finance, investing, early retirement—there are often curious follow-ups like “Wait, what do you mean, early retirement? When are you planning to retire?” Generally, when people ask, I’m happy to go deeper; but when they don’t, I’m also happy to let it go.

Helping friends (and readers) take small steps—like opening their first ETF account, raising their savings rate by a few percentage points; or running their numbers in my FI Calculator—has been very rewarding.

Money is just a tool, which can be used to design a better life. (see: What Will You Actually Do in Early Retirement?) And by being honest with your close ones about your financial journey, you open the door to help others live their best possible lives.

What will you actually do in early retirement? Photo by Nathan Dumlao on Unsplash.

Final Thoughts: Should You Tell People About FI?

So, should you tell friends you’re financially independent—or working towards it? My answer: yes, but thoughtfully. Ideally, share your journey early on the way you’d share any meaningful life project. Be authentic about your life experience and what pursuing FI means in terms of lifestyle, don’t just focus on the numbers. I’m not on this path to reach a $2M portfolio quickly, I’m on this path because I want to spend more quality time with my family and have other life interests I’d like to pursue besides my career.

Lead quietly and share openly with the people who genuinely wish you well. Let curiosity guide the depth of each conversation—don’t impose your views on others, because it simply won’t work.

Above all, normalize talking about money, like many Germans do. The more money is treated as a tool instead of a taboo, the more we empower others to use money to design a conscious version of a good life.

You never know who’s quietly watching, or when the unexpected spouse’s friend will come asking for support with the basics. Even one friend starting their FI journey because of your example is worth every effort.

Ultimately, this is a very personal decision. I’ve shared what works for me, but your circumstances, culture, and relationships may differ. Consider your own situation carefully before deciding how open you want to be about Financial Independence with others.

💬 How open would you be about your Financial Independence journey? Would you tell close friends and family, keep it private, or take a middle-ground “stealth wealth” approach? Have you ever tried sharing—and how did people react?

👉 Use our FI calculator (free for email subscribers) to assess how close you are to early retirement; then change assumptions to see what it will take to retire earlier.

👉 New to Financial Independence? Check out our Start Here guide—the best place to begin your FI journey. Subscribe below to follow our journey.

🌿 Thanks for reading The Good Life Journey. I share weekly insights on money, purpose, and health, to help you build a life that compounds meaning over time. If this resonates, join readers from over 100 countries and subscribe to access our free FI tools and newsletter.

Disclaimers: I’m not a financial adviser, and this is not financial advice.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

In my experience, it depends on the person and timing. Sharing can spark meaningful conversations and sometimes even help others gain control of their finances—but it can also create awkwardness or misunderstanding. With friends, being open can strengthen trust and accountability. With family, especially older relatives, it may bring more worry than benefit. Gauge the situation carefully and lead with honesty, not persuasion.

-

Many in the FI community use “soft” answers like “I’m doing some consulting” or “working on projects.” Some people who prefer that—it avoids awkwardness and keeps things private. Personally, I think honesty with close friends and family goes further in the long run. If they distance themselves because of it, that probably says more about the friendship than it does about you.

-

Honestly, I wouldn’t bring it up. Talking about FIRE at work can raise doubts about your commitment or future in the company. Coworkers are rarely true friends, and once word spreads, you can’t control how it’s perceived. Keep professional life and financial goals separate—it protects both your peace of mind and your career.

-

In my case, I’ve chosen not to talk about it with my parents or in-laws. They’re already retired, and mentioning early retirement often triggers concern or confusion. Older generations tend to have a fixed idea of what a “normal” career should look like, and that can create unnecessary tension. Sometimes silence isn’t secrecy—it’s choosing peace.

-

For some, privacy equals safety—financially and emotionally. Depending on where you live, talking too openly about money can invite unwanted attention or even envy. It’s also about culture: in Spain, where I grew up, money talk can seem tasteless, while in Germany it’s perfectly normal. Finding the middle ground that fits your environment is key.

-

That’s common. When I first told friends about FI, most dismissed it—“nice idea, but not for me.” Over time, as they saw the consistency and trade-offs, some became more curious. FI isn’t about luck or huge salaries—it’s about discipline, saving, and living below your means. The more people see that, the more respect they likely develop for it.

-

The best way to prevent envy is transparency. If you’ve been open about the process—years of saving, simple living, and trade-offs—then people understand what it took. When envy appears, it’s often self-reflection, not resentment. They might just wish they’d started earlier, and that’s okay.

-

Yes, at least once. I tried sharing FI early on with my friends—most ignored it—but years later, some came back interested. Life stages change perspective; what sounds unrealistic at 30 can feel urgent at 40. If you plant the seed now, it may grow later, and at least you’ll know you tried.

-

’ve learned to mention it casually and let curiosity lead. When people ask what I do, I say something like “I write about personal finance, investing, and early retirement.” That often triggers follow-up questions naturally. You don’t need to convince anyone—just be open when they’re ready to listen.

-

Helping others make real progress. Recently, I helped a friend of my wife start investing her savings—just a simple MSCI World ETF—and now she’s gaining confidence. Another friend used my FI tool to map out his timeline. Moments like those remind me that being honest about FI helps people live better lives.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: