LeanFIRE vs FatFIRE: Which Financial Independence Path Fits You?

LeanFIRE vs FatFIRE—which path to Financial Independence are you following? Photo by Georgiana Pop (Avram) on Unsplash.

Reading time: 9 minutes

Understanding FIRE: What It Means and Why It Matters

LeanFIRE vs FatFIRE: Two Opposite Paths to Financial Independence

Want to retire early—but not sure how much money you'll actually need? In this post, we break two popular Financial Independence paths: LeanFIRE and FatFIRE. You'll learn how they differ, how to calculate your target number for each, and real-life examples of what each lifestyle looks like.

We’ll also explore practical FIRE alternatives and share my personal FIRE journey to help you identify the path that fits your lifestyle. I've been pursuing Financial Independence since 2019, and writing about FIRE with a data-driven lens for the past three years.

Each path to FIRE will vary substantially from person to person. Your ability to save and your own journey to Financial Independence will not only be affected by a very unique set of circumstances—e.g., salary, age, degree of dependents, location, or cost of living—but also by your desired lifestyle and philosophical outlook on life.

There isn’t a one-size-fits all FIRE philosophy. Although some of the early adopters and louder voices of FIRE—who propagated the concept through books and blogs—did share a common philosophy of life, it’s reasonable to assume that, even from the beginning, people implemented FIRE differently—adjusting the broad concept to fit their own unique set of circumstances.

Today, the FIRE movement has splintered into LeanFIRE, FatFIRE, and everything in between. This includes “Regular” FIRE (or Standard FIRE), CoastFIRE, BaristaFIRE, or ChubbyFIRE. Although these five are clearly the most common flavours, other niche FIRE groups include ExpatFIRE (or GeoarbitrageFIRE, including seasonal geoarbitrage), slowFIRE, or FlamingoFIRE. Check back in a couple of years and I’m sure there will be more…

The takeaway is that there are tons of way to implement FIRE. What all these versions have in common is that they resulted from clever and creative ways to adjust FIRE so it aligns with specific personal circumstances and values.

The FIRE flavor you choose should fit your philosophy and desired lifestyle. If you are curious, towards the end of the post I will share my journey and which flavor of FIRE I’m currently following.

Pursuing FI/FIRE to break free from the 9-to-5, unfulfilling grind? Photo by Victor Rodriguez on Unsplash.

What Is FIRE? A Clear Definition of Financial Independence

Financial Independence (FI) represents that point in time when your investments or passive income cover your living expenses. At this point, you’ve reached the Financial Independence “Crossover Point”, where work becomes optional, not necessary.

Whether you choose to retire (FIRE), continue working part-time, volunteer, or start a new business, FI grants you the freedom to do so from a position of strength—without being financially dependant on a job. We covered in a previous post some of the most common misconceptions of FI that could be holding you back on your financial journey.

FIRE is often described as both a lifestyle movement and a financial strategy built on simple math. To reach FI, your annual expenses must be covered by the product of 1) your total invested assets, multiplied by 2) your Safe Withdrawal Rate (SWR)—typically 3.5–5%, depending on who you ask and the underlying assumptions. But what does this look like in practice?

If you need $40,000 a year to live comfortably, and assuming you choose a very conservative 4% SWR, you would need a portfolio of roughly $1,000,000 ($40,000/0.04). Using lower or higher SWR, your target portfolio would almost certainly fall somewhere in the $0.8-1.2M range.

But, beyond the math, the FIRE movement also emphasizes intentional living, smart saving habits, and financial freedom to reclaim autonomy over how you spend your time.

Although many envision early retirement as a permanent vacation, FIRE isn’t about sitting around doing nothing—but about pursuing what matters to you. Whether that’s traveling the world, writing a novel, or building a small business, FI provides you the freedom to choose your own path.

It even grants it before reaching there—or at least it did for me. The backing of “partial” FI gave me the courage to pursue another career trajectory several years before reaching full FI.

Depending on your values and lifestyle goals, there are many different ways to get there—from the ultra-frugal LeanFIRE to high-spending FatFIRE. We’ll examine their differences, how to calculate your number for each, and help you choose the right FIRE method that aligns with your lifestyle and goals.

Santorini, Greece. Looking to retire abroad with LeanFIRE? Check out our ranking of the best places to retire early in Europe. Photo by orva studio on Unsplash.

LeanFIRE and FatFIRE Compared: Spending, Savings, and Lifestyle

FIRE exists on a spectrum, from very frugal approaches to luxurious lifestyles. On one end, we have LeanFIRE, which is focused on simplicity, minimalism, and an early escape from the traditional 9-to-5 (or worse) grind. On the other side of the spectrum, FatFIRE represents financial freedom at a much higher spending level—which we’d mostly associate to an upper class lifestyle. How well you manage lifestyle inflation and creep often determines where you end up on this spectrum.

In practice, most people fall somewhere in between, depending, again, on personal circumstances, income, values, and vision for the future. There is no correct or incorrect version of FIRE—different versions simply appeal to different personality types and lifestyles.

One person may feel energized by the challenge of embracing frugality and minimalism in their 20s or 30s, while others may value comfort, security, or luxury in their 50s. The most important thing is that your FIRE strategy is aligned with our common, overarching goal of optimizing for life fulfillment—whatever the strategy, it should align with our needs, goals, and personal philosophy.

Once you’ve identified the FIRE flavor that best fits your values and lifestyle, the next logical step is to understand what savings rates and timelines can actually get you there—especially if your goal is to reach Financial Independence by 45.

LeanFIRE is a Financial Independence method based on maintaining a very low-cost lifestyle—normally in the $20,000-30,000 per year range. It means, targetting a smaller portfolio—think $500,000-$750,000, assuming a 4% SWR—and a shorter timeline to get there.

In contrast, FatFIRE means achieving FIRE with a significantly higher level of annual spending, normally around $150,000. Of course, this requires a much larger nest egg (around $4M) and a longer accumulation phase.

It’s important to note that these numbers are conditional to location—some of these numbers are commonly used estimates for the US. Of course, if you live in a lower cost-of-living (COL) country, the range of lean to fat will look different.

Attracted to a minimalist lifestyle? LeanFIRE is likely for you. Photo by Clay Banks on Unsplash.

LeanFIRE Explained: How to Retire Early with a Frugal Lifestyle

We can understand LeanFIRE as the art of living well on less. It’s about building a fulfilling life around low spending needs, so you can retire faster with a smaller investment portfolio. As mentioned, this approach normally targets a $20-30,000 spending range, depending on location and lifestyle.

Many LeanFIRE followers commonly present one or more of the following characteristics: they are typically young, live in lower COL areas, strongly prioritize needs over wants, are highly skilled and independent problem solvers, and/or share a passion for simple living for environmental concerns or other philosophical reasons.

You can certainly find LeanFIRE followers in high COL locations, but then they are likely to be very frugal and good at solving problems without spending money—enabled either by their own acquired skills or a strong community network that supports each other.

Imagine a 30-year-old living in a modest home or sharing an apartment in a low COL area—perhaps somewhere in the Midwest, Appalachia, or a small town in Texas. They drive an older used car because they are aware of the incredible depreciation cost and terrible investment that cars actually are. They shop second-hand, cook at home, and keep discretionary spending very low. With a carefully budgeted annual spend of $25,000, they would target a portfolio of around $625,000 (assuming a 5% SWR).

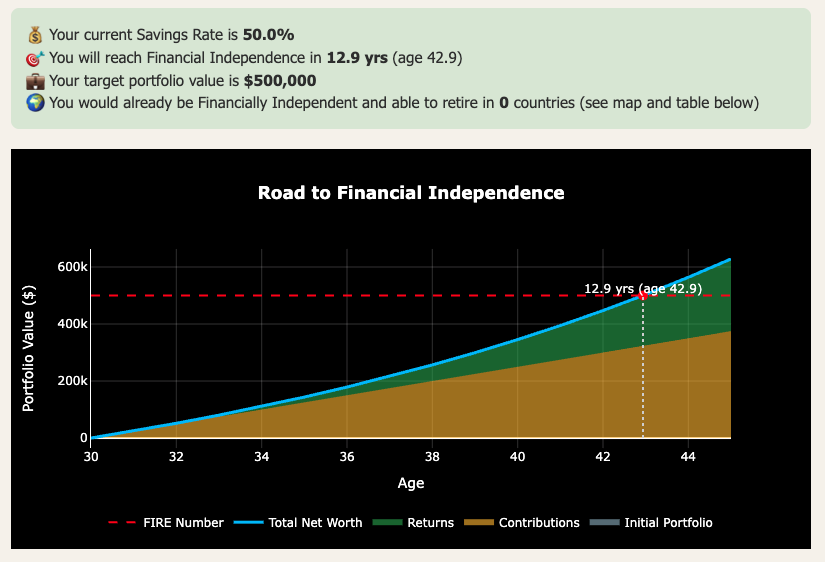

Considering a $50,000 annual net salary, and that they invest into a low-cost, diversified index funds with a 7% real return, they could hit their $500,000 LeanFIRE number in approximately 13 years at age 43 (Figure 1). This assumes starting out with a $0 net worth. The results are produce by our Financial Independence Calculator below—which is free to use for subscribers to our email newsletter.

Figure 1: Timeline to Financial Independence as per our FI Calculator—free for our newsletter subcribers. Under the assumptions of this case study, the worker would reach LeanFIRE in about 13 years at age 43.

Traits of LeanFIRE: Is It Right for Your Personality and Budget?

Key traits of LeanFIRE normally include:

Suited to naturally frugal people—those who find joy in simplicity and dislike clutter or excess often thrive on LeanFIRE. It feels natural to them—it doesn’t feel like deprivation, so why work more years than you have to?

More accessible to lower income earners. The good news is that you don’t need to be a six-figure income earner to pursue LeanFIRE. It’s all about controlling spending and increasing the savings rate—the single most important lever on the path to FI.

Enables earlier freedom—especially great for those who dislike their job. If you are part of the 77% of global workers who don’t find engagement or meaning in their jobs, then LeanFIRE provides the quickest escape hatch—just live well beneath your means and you’ll find an early exit.

Encourages resilience, DIY skills, borrowing/sharing culture. As illustrated in ‘Your Money or Your Life’, LeanFIRE folks often build strong community ties, fix things themselves, and embrace borrowing tools or clothes instead of owning everything. It’s certainly true that you can enjoy life and the services gadgets provide us without having to own them. Think for example of the increasingly common car sharing schemes in cities—“own the ride, not the car”.

Often aligned with minimalism, stoicism, or environmental values. LeanFIRE frequently overlaps with broader life philosophies. Whether driven by climate or environmental concerns, Buddhist or Stoic principles, or a desire for more intentional living, many LeanFIRE adherents see reduced consumption as a form of liberation rather than deprivation.

LeanFIRE can also foster what Nassim Taleb would call antifragility. By building a life with low overhead, minimal dependence on systems, and a community-oriented mindset, LeanFIRE practitioners often become more resilient to external shocks—whether that’s economic downturns, job loss, or inflation. Instead of constantly chasing more, they’ve chosen to need less. Although it’s not for everyone, that’s real power, and, arguably, a deeper, more sustainable kind of freedom.

This version of FIRE echoes the roots of the movement—think of Vicki Robin’s Your Money or Your Life, Jacob Lund Fisker’s Early Retirement Extreme, or Mr. Money Mustache’s early blog posts. All three emphasized intentional living, reduced consumerism, and aligning your spending with your values rather than pursuing status and conforming to social expectations. Ultimately, LeanFIRE it’s about designing a life where fulfillment isn’t dependent on income or possessions.

Interestingly, though, none of these famous writers and bloggers continue to write regularly. It doesn’t seem like anyone has clearly stepped up to take the baton and carry the LeanFIRE movement forward.

For some personality types or certain moments in life, less spendy lifestyles can be very liberating. Photo by Sean Gatz on Unsplash.

Downsides of LeanFIRE: What to Watch Out For

Despite some of the advantages illustrated above, LeanFIRE also has its drawbacks. Despite their potentially larger resilience, market downturns can hit hard when the plan was too tight. LeanFIRE normally has a very narrow buffer between spending needs and a portfolio’s returns. An ultra-lean FIRE budget can make even minor market downturns stressful.

LeanFIRE practitioners, unlike those with a larger retirement portfolio, have limited flexibility during prolonged bear markets. A strong drop could force an unplanned part-time work. They simply have less wiggle room during times of uncertainty.

Life doesn’t always follow the spreadsheet. Medical emergencies arise, aging parents, or a family member in need hold the potential to disrupt a tight LeanFIRE budget. Late-life care costs can also become a meaningful wildcard, especially in systems where long-term care isn’t fully socialized. While a LeanFIRE budget might cover your own frugal needs in a best-case scenario, real life can be messy.

More importantly, pursuing LeanFIRE can lead to stress or regret if the lifestyle was adopted purely for financial reasons. Some people pursue LeanFIRE because its the quickest math to get to FI, not because they genuinely enjoy a low-consumption lifestyle.

Over time, the tension between a desired lifestyle and the budget reality can wear you down. That’s why it’s important to understand why you are choosing to LeanFIRE—be sure you’re not just sprinting to the finish line but there is some stronger philosophical reasons for pursuing this path.

Pursuing LeanFIRE can be challenging for families. While a single, young person may successfully enjoy pursuing LeanFIRE, a partnership with different spending habits or a growing family with changing schooling and housing considerations may find it more challenging.

Your family may not share your passion for frugality, and tight margins can potentially create friction. While raising kids on a LeanFIRE budget is possible, it requires deep planning, aligned values, and flexible thinking, particularly in higher COL locations.

Alicante, Spain. Looking to retire abroad with LeanFIRE? Check out our ranking of the best places to retire early in Europe. Photo by Dean Milenkovic on Unsplash.

What Is FatFIRE? Retire Rich Without Downsizing

FatFIRE is a FIRE strategy where you reach Financial Independence while maintaining a high-income lifestyle and associated annual spending target—usually anywhere above $150,000+ in the US. It’s FIRE for those who don’t want to sacrifice comfort, luxury, or convenience along the way.

This path is normally pursued by, and only available for, high earners. The stereotype are workers who are in tech, finance, or healthcare—who are either willing to work longer or already have a high savings rate and can hit their number fast. For example, a dual-income couple in the US making $350,000 combined and saving aggressively could retire early on a $4-5M portfolio and spend $150,000-200,000 without worry.

Individuals or households pursuing FatFIRE often want to maintain a high standard of living after retirement—a spending pattern most of us would associate with upper class. Perhaps they want luxury travel, private schools for children, dinning out many times per week, or owning real estate in high COL locations.

Some may not dislike their jobs and would be fine with grinding it out a few more years to enable a more comfortable retirement. Others may feel a bit trapped with their current high-spend lifestyle—making it difficult to target a FIRE number that produces a lower income than they are used to. In this case, it’s not so much about financial security, but about lifestyle continuity.

FatFIRE tends to appeal to those who value optionality and prefer not to “downsize” their life to retire early. FatFIRE followers typically place less emphasis on minimalism or environmental values than LeanFIRE adherents. It’s a more “mainstream-friendly” FIRE path that maintains social norms—for instance, conforming to consumerism—while still delivering Financial Independence.

Some FIRE aspirants “fall” into FatFIRE after repeatedly falling into the “one more year” syndrome. They’ve achieved their FIRE goals, yet find it difficult to step away from such a well paying job. “Should I really leave now—at the peak of my career and earning potential?”

They think one additional year of investment contributions and portfolio compounding will surely inflate their nest egg beyond what was originally planned. And they are certainly right.

The problem with the “one year more” syndrome is that it can snowball into many more years. Sure, you have a larger portfolio now and can live a spendier life, but you also lost some of you healthier, energetic years to a job you are (mostly) not passionate about. Was it a good tradeoff? According to Bill Perkin’s Die With Zero, this is something that could haunt you when you look back on your life later on.

The FatFIRE path is aligned with a higher spend, upper class lifestyle. Photo by Allison Huang on Unsplash.

FatFIRE Example: Retiring Early in a High Cost of Living City

Let’s return to our earlier example—but this time, imagine our 30-year-old isn’t living in a modest home or sharing an apartment in a low-cost-of-living area. Instead, they’re living in a high-COL city like San Francisco or Los Angeles.

They value comfort and convenience, enjoy dining out regularly, travel several times a year (sometimes business class), and perhaps send their kids to private school. Rather than downsizing, this individual plans to maintain or elevate their lifestyle after retirement.

Let’s say they want to spend $150,000 annually in retirement, which puts them squarely in FatFIRE territory. Using a 4% Safe Withdrawal Rate, they would need a portfolio of at least $3.75 million to support that level of spending.

Assume the household earns $250,000 per year after tax, and is living on $150,000, and invest the remaining $150,000 annually in low-cost index funds. With a 7% annual return and starting from zero, they could reach their FatFIRE number in 19 year at age 49 (Figure 2). Much of this longer timeline simply reflects the compounding effect of lifestyle inflation.

Figure 2: Timeline to Financial Independence as per our free FI Calculator. Under the assumptions of this case study, the worker would reach fatFIRE in about 19 years at age 49.

Compared to the LeanFIRE example, this path required a higher income and a longer runway—it took them 6 years longer to get there because their savings rate was lower. But it delivers a lifestyle with more luxuries, optionality, and financial buffer. It also allows for more room in case of emergencies, poor market returns, or unexpected lifestyle inflation.

This path may not be for everyone, but for high earners who don’t mind working longer or love their careers, it can provide—in their eyes, at least—the best of both worlds: Financial Independence and an affluent lifestyle.

How FIRE Has Changed: From Minimalism to Wealth Optimization

As hinted earlier, the FIRE concept has undergone a major transformation over the past two decades. In its earlier grassroots days, it represented a philosophically-driven niche that emphasized minimalism, environmentalism, and lifestyle design over financial mechanics.

Today, FIRE is a mainstream Financial Independence movement discussed globally. As we mentioned last week, the FI term reached an all-time high in mid-2025 (Figure 3). What started as a niche personal finance concept discussed in early internet forums has grown into a global movement—just the top few FIRE (Financial Independence, Retire Early) subreddits now have more than 4 million members combined (not counting total readers).

Figure 3: Relative interest over time (0-100) of the term “Financial Independence”. Source: Google Trends. As observed, in mid-2025 we reached the all time high.

Although you still get some philosophical discussions, the majority of conversations have shifted from “How can I design a meaningful life?” to “What’s your savings rate?”, “When do you hit your number?”, or “Do my numbers look good enough to pull the trigger?”

I think the idea of FIRE going mainstream is a good thing. Despite having experienced incredible productivity increases over the last decades, we continue to overwork ourselves unnecessarily as a species, mostly for intangibles like status or prestige, but also due to inequality and other factors.

FIRE principles help you escape the traditional 9-to-5 career grind and gain control over your time. It returns a bit of power to the worker—making work optional and, over time, hopefully questioning the very nature of our workplace.

However, it seems like something important has shifted along the way. In the earlier days FIRE was more than just about money—it was a gateway to rethinking your values, time, and purpose. Today, it has become more transactional—a focus on numbers, timelines, and benchmarks often overshadows any deeper introspection that pursuing FI once encouraged.

The risk is that when FIRE is seen purely as a math problem, it can become another form of hustle/grind culture. If you don’t use the journey itself to really reflect on what matters to you, you risk reaching your FI number only to face a new crisis: “Now what?”

Thankfully, not everyone fits neatly into LeanFIRE or FatFIRE extremes. In the following section, we’ll explore some middle-ground paths—like CoastFIRE and Barista FIRE—that could offer better flexibility and philosophical balance, especially for those who value optionality and a more balanced approach.

Bali, Indonesia. Looking to retire abroad with FIRE? Check out our ranking of the best places to retire early in Asia.

Other FIRE Variants: CoastFIRE, BaristaFIRE, and Regular FIRE

Not everyone will with into the lean and fat extremes. Let’s discuss some of the middle-ground options—where Regular FIRE, CoastFIRE and BaristaFire come in.

CoastFIRE involves saving aggressively early on—typically in your 20s or 30s—until you’ve built up enough of a portfolio that, with compound interest, will grow on its own to support you by traditional retirement age.

After reaching this point early on, you no longer need to save—but could coast with a part-time or passion-driven work. Moving forward, you let your portfolio compound in the background while you focus “only” on covering your expenses.

A CoastFIRE example could be young professional who managed to aggressively save and invest $250,000 by age 30. She targets a $60,000 retirement income and, using a CoastFIRE calculator, understands she could stop saving now and let compound interest do the heavy lifting for her. The $250K portfolio will compound to over $1.5M at age 65.

In contrast, BaristaFIRE occurs when you save and invest enough to cover most—but not all—of your needs, and then supplement the rest with part-time work—such as becoming a barista, a teacher, or part-time freelancer. This allows you to leave a high-stress work environment while still earning something to delay drawing down from your portfolio.

A BaristaFIRE example could be a 42-year-old who has built a $0.5M portfolio, but wants out of his high-stress, low meaning corporate job. He wants to maintain a lifestyle that costs $40,000 per year. Using the 4% rule (of thumb), the portfolio could reasonably generate around $20,000 annually.

To cover the difference, they take on a part-time, low-stress role that covers the remaining $20,000 or more—allowing him to semi-retire without drawing down the portfolio too aggressively. Assuming a 7% real return on investments, the portfolio would continue to increase in the background, allowing him to reach full FIRE at age 55 with a $1M portfolio.

Finally, we should also not forget about “Regular” FIRE, which covers the remaining gap between LeanFIRE and FatFIRE—typically $1M to $2-3M, depending on who you ask (and your location). In contrast to LeanFIRE, this pathways allows for a more comfortable early retirement, without reaching the extremes of FatFIRE.

LeanFIRE, CoastFIRE, BaristaFIRE, FatFIRE, or Regular FIRE—each of these strategies may suit different personalities, risk tolerance, age, and life priorities. What matters in the end is picking one that fully aligns with your personal values and your idea of freedom.

Enjoy the ride, not the destination. It’s completely possible to pursue Financial Independence while growing a family. Photo by Jessica Rockowitz on Unsplash.

My FIRE Journey: Lean Values, Balanced Practice

Personally, I’ve always resonated slightly more with the LeanFIRE ethos. I naturally find the concept of minimalism appealing and have always shied away from high levels of consumerism. Left to my own devices, I’d choose simplicity over luxury every time. And yet…

I don’t live in a vacuum and neither am I left “to my own devices”. I have a wife and kids, and a life full of real-world tradeoffs. While my fairly frugal partner is supportive of FIRE—which I’m extremely grateful for—she’s not frugal in the LeanFIRE way. While I lean toward LeanFIRE philosophically, our actual lifestyle aligns more closely with Regular FIRE due to our family needs.

So, our FIRE path and target isn’t lean or fat—but falls more in the Regular FIRE category. It reflects a life of intentional spending—aligned with what brings us joy, including a level of comfort, travel, and family needs that would not classify as LeanFIRE.

And that’s okay—most people simply don’t live on the extremes. What matters to us is designing a lifestyle that brings fulfillment to the whole family, not just catering to my personal preferences or optimizing for speed and efficiency.

Final Thoughts: aligning your fire path to your desired lifestyle

As we’ve seen, there’s no universal formula for Financial Independence. It’s not only about hitting a certain number, but about aligning your money with your values and crafting a life you don’t want to escape from. For some, that means easing off the gas a little—what I call “the middle path to FI”—a slower, more intentional route that lets you live many of the benefits of freedom long before you reach full independence.

When choosing your FIRE path, consider:

Your values: What kind of lifestyle really brings you joy? What does freedom mean to you?

Your income trajectory: Can you save aggressively, or do you need a leaner model?

Family dynamics: Are your loved ones on board? Do they have your same outlook on life as you do?

Risk tolerance: Are you comfortable with lean margins, or do you prefer a large buffer?

Life stage: Is it time to sprint, coast, or slow down?

What does freedom actually mean to you? Your answer may shape your FIRE journey more than any spreadsheet ever could.

If you made it this far, I’d love to hear from you. What’s your FIRE flavor? Lean, Fat, or somewhere in between? Leave a comment and share your story.

🌿 Thanks for reading The Good Life Journey. I share weekly insights on money, purpose, and health, to help you build a life that compounds meaning over time. If this resonates, join readers from over 100 countries and subscribe to access our free FI tools and newsletter.

👉 New to Financial Independence? Check out our Start Here guide—the best place to begin your FI journey.

Enjoyed this post? Don’t miss our in depth discussion of BaristaFIRE vs CoastFIRE or the power of mini-retirements on your path to Financial Independence. Didn’t find what you were looking for? Check out our most recent articles further below.

Disclaimer: I am not a financial adviser, and the content in this website is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Tulum, Mexico. Looking to retire abroad with FIRE? Check out our ranking of the best places to retire early in Asia. Photo by Spencer Watson on Unsplash.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

LeanFIRE is a Financial Independence path based on a frugal lifestyle, typically requiring $20,000–$30,000 in annual expenses. It allows you to retire earlier with a smaller portfolio (around $500K–$750K). FatFIRE, on the other hand, is designed for those who want to maintain a high standard of living after retirement—often spending $100K–$200K+ per year and needing about $3M–$5M to retire comfortably. The main difference lies in lifestyle expectations and portfolio size.

-

To calculate your LeanFIRE target, first estimate your expected annual spending in retirement—say $25,000 per year. Then divide that number by your assumed Safe Withdrawal Rate (SWR), typically 4%. For example: $25,000 ÷ 0.04 = $625,000. This means you’d need a portfolio of $625K to retire early while maintaining that spending level.

-

LeanFIRE typically refers to retiring early with an annual budget between $20,000 and $30,000. It emphasizes frugality, minimalism, and intentional living—often requiring you to live in a low-cost-of-living area or maintain a modest lifestyle. LeanFIRE is ideal for people who value simplicity over luxury and want to achieve Financial Independence as soon as possible.

-

To achieve FatFIRE, you typically need a retirement portfolio between $3 million and $4 million, depending on your annual spending and where you live. If you aim to spend $150,000 per year and use a 4% withdrawal rate, you’d need about $3.75 million ($150,000 ÷ 0.04). However, your actual number may vary based on cost of living, lifestyle expectations, and the financial buffer you want to build into your plan.

-

FatFIRE investors often rely on high savings rates and diversified portfolios of low-cost index funds. Many also invest in real estate or hold larger equity positions. The key is maximizing contributions while maintaining a high income, so the portfolio compounds quickly. It’s not unusual for FatFIRE followers to invest $100K+ per year toward their FIRE goal.

-

Imagine someone earning $50,000 annually, living in a low-cost U.S. town, and spending just $25,000 a year. They save the rest, invest in index funds, and over time grow a portfolio of $625K. At a 4% withdrawal rate, that portfolio generates $25,000 per year—enough to cover all their modest living expenses and retire early.

-

Picture a household earning $250,000 after taxes and living in a high-cost area like California. They want to retire early while spending $150,000 per year. They save aggressively—about $100K–$150K annually—and invest in index funds. After 18–20 years, they build a $3.75M+ portfolio, allowing them to retire very comfortably without downsizing.

-

CoastFIRE involves saving aggressively early on (often in your 20s or early 30s) until your portfolio is large enough to grow on its own and reach your retirement target without future contributions. After that, you just “coast” by earning enough income to cover current expenses. Unlike LeanFIRE or FatFIRE, you don’t retire early—you stop saving early.

-

It depends on your values, income, location, and family situation. If you prefer simplicity, can live on less, and want to exit work quickly, LeanFIRE may fit you best. If you enjoy a more comfortable lifestyle and can earn a high income, FatFIRE might be more appealing. Many people fall somewhere in between—choosing CoastFIRE, BaristaFIRE, or Regular FIRE based on their balance of freedom and flexibility.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: