Money, Meaning, and Mental Health: Why Financial Security Shapes the Gen Z Work Mindset

Only 6% of Gen Zs list reaching leadership positions in their company as primary objectives. Photo by Dominic Sansotta on Unsplash.

Reading time: 9 minutes

TL;DR — Gen Z, Money, and Meaning at Work

💰 Nearly half of Gen Zs (48%) and Millennials (46%) feel financially insecure

🧠 Happiness = Money + Meaning + Well-Being

💼 Only 6% aspire to leadership—most seek financial independence and work-life balance

📉 Financial insecurity is linked to stress, burnout, and disengagement

🚀 Financial stability enables purpose and mental health long before financial independence

Money, Meaning, and Mental Health: How Financial Security Shapes Gen Z and Millennial Work Values

Most people assume Gen Z and Millennials are chasing meaning above all else. But look closer, and a different picture emerges: purpose only thrives once financial stability is in place. In this article, we’ll unpack how money, meaning, and mental health intertwine to shape happiness in and beyond the workplace—and why, in a world where only about 6% of young workers still aspire to leadership roles, success is quietly being redefined around freedom, balance, health, and independence.

The Life-Satisfaction Equation: How Money, Meaning, and Well-Being Interact

Without a sense of financial stability, it’s very difficult to achieve overall life satisfaction. The 2025 Deloitte Global Gen Z and Millennial Survey—in its 14th edition, with over 23,000 respondents across 44 countries—illustrates how deeply financial well-being, purpose, and mental health are interconnected.

Deloitte frames overall life satisfaction—simplified as “Happiness”—as financial stability (“Money”) plus “Meaning” (also understood as purpose) and “Well-being” (good mental health). Simplified, this is what the general equation looks like:

Happiness = Money + Meaning + Well-being

This formula obviously simplifies reality—happiness isn’t a tidy equation. External factors like health, relationships, social context, genes, or even luck play large roles. But the framework is useful because it helps isolate how financial stability interacts with purpose and well-being, and why money so often becomes the bottleneck for both (Figure 1).

Money (or financial stability) tends to be a necessary pre-condition for achieving both meaning and well-being. This is intuitive to understand—it’s simply difficult to build a sense of meaning or well-being when you’re financially stressed.

Likewise, having a sense of Meaning is also important for Well-being. With money but without a sense of purpose most humans feel rudderless—there’s no shortage of rich, unhappy people struggling with mental health issues.

Finally, and complicating things further, Well-being has a long-term feedback loop with the other two variables. When you’re in a good mental spot, over the long-term you’re more likely to find meaning and you’re likely to perform better financially in your career as a more productive worker.

Figure 1: Deloitte’s life satisfaction formula, edited to account for the enabling relationships across variables. The arrows don’t necessarily mean one factor “leads” to another; it’s better to interpret them as enablers: for example, being financially secure is a pre-condition or enabler for finding meaning or achieving well-being.

Unfortunately, according to the Deloitte survey, nearly half of Gen Zs (48%) and Millennials (46%) say they don’t feel financially secure—a sharp increase from a year earlier (30–32%). This is not a promising starting point given how foundational financial security is to meaning, well-being, and overall happiness.

This framework, supported by Deloitte’s data, sends a clear message: financial stability is one of the enabling building blocks we should prioritize. Some (but not all) of today’s burnout and disengagement (i.e., quiet quitting) can also be traced back to financial stress. It’s nearly impossible to build a sense of meaning when your financial foundation feels shaky.

As Naval Ravikant puts it, “Let’s get them rich, let’s get them fit and healthy. Then, let’s get them happy” Seen from this lens, pursuing Financial Independence isn’t about chasing wealth for its own sake—it’s about creating the freedom and mental space required to redesign your life around what truly matters and, if needed, to take bold moves that will increase your sense of purpose, mental well-being, and overall life satisfaction.

So what does this equation mean in real life? Let’s look at how financial security translates into tangible psychological benefits.

Both Gen Zs and Millennials prioritize achieving Financial Independence (1st) and work-life balance (2nd) as top career goals. Of course, Financial Independence may mean something different to survey respondents as it does to readers of The Good Life Journey. Photo by Annie Spratt on Unsplash.

Financial Independence as the Psychological Foundation of Well-Being

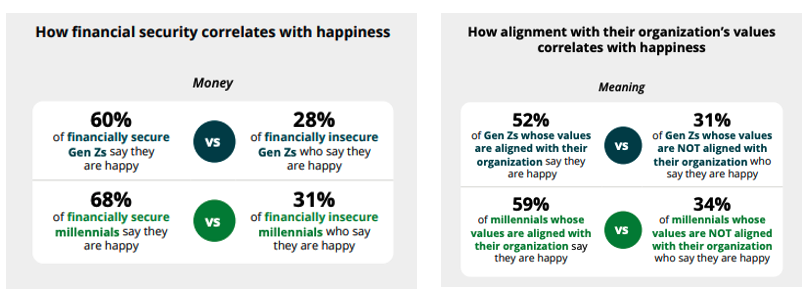

The Deloitte report shows that financial security correlates strongly with happiness—60% and 68% of financially secure Gen Zs and Millennials say they’re happy, versus only 28% and 31%, respectively, who are financially insecure (Figure 2).Of course, correlation doesn’t imply causation—some people may simply feel secure because they already have traits like optimism or strong support systems. Still, the causal link seems more than plausible in many cases.

This suggests that while money may not directly buy happiness, it certainly enables it by freeing mental bandwidth and lowering daily stress. For both Gen Z and Millennials, financial stability clearly correlates with happiness and better mental health, supporting research that financially stable people are happier and more productive. Financial Independence shouldn’t be seen as the finish line, but as the psychological runway that allows people to build mental well-being and discover purpose.

In the FIRE community, financial independence is narrowly defined as the amount of money saved and invested that allows you to be independent from paid employment, i.e., the “crossover point” But this is a very narrow definition that is even unhelpful in many contexts.

Financial independence is not only about reaching your $2M portfolio, but about progressively achieving a subjective sense of safety. For me, that sense arrived years before full FI—after many years of saving over half my income, I noticed my anxiety drop and my willingness to take creative risks grow.

Figure 2: correlations of Money and Meaning with Happiness. Source: Deloitte.

For some, that could mean being debt free and able to handle an emergency without any stress. This relatively low level of financial independence already enables some to make bolder choices in life and work to increase their chances of enjoying a sense of purpose and mental and physical wellbeing.

For others, though, it could mean hitting a certain savings milestone that lets them relax enough to face some of the deeper questions in life. In the context of work, once you feel financially secure, you may start to question whether your work truly aligns with your values and lifestyle preferences or whether you’re having a significant positive impact on the world around you.

This is simply very hard to do when you’re living paycheck to paycheck—there’s simply no breathing room for such questions. But once money no longer dominates your mental bandwidth, purpose finally has room to breathe.

Interestingly, 22% of Gen Z and 20% of Millennials list “achieving financial independence” as their top career goal (Figure 4). This may not seem like a large amount, but it’s the top reason, ahead of all others. I think it demonstrates that younger workers are more pragmatic than we think; while Gen Zs and Millennials are certainly more values and purpose-driven than older generations, they instinctively understand the importance of a solid financial foundation.

Unfortunately, financial insecurity is on the rise, suggesting that the goal feels increasingly out of reach. As costs of living and housing skyrocket in major urban areas, many younger workers are forced to trade meaning for stability in the short term, potentially leading to unfulfilling careers. As we’ve covered previously, nearly four fifths of global workers feel disengaged from their current role—with many of them “quiet quitting”.

Figure 3: Which of the following best describes your primary career goal? Source: Deloitte.

How Gen Z and Millennials Redefine Purpose and Work-Life Balance

For younger generations, purpose has become the defining aspiration of modern work: 89% of Gen Z and 92% of Millennials say a sense of purpose is essential to job satisfaction. This may be one of the reasons why only a fifth of global employees feel engaged today in the workplace—they simply are not finding purpose in the workplace.

But the report also reveals some nuance. Not everyone defines “purpose” or meaning as “changing the world”. For some, it means stability and time for personal growth; for others, meaningful contributions through their craft or community. In this sense, younger generations may be less idealists and more pragmatic than at first glance or than that their stereotype would suggest (especially for Gen Zs).

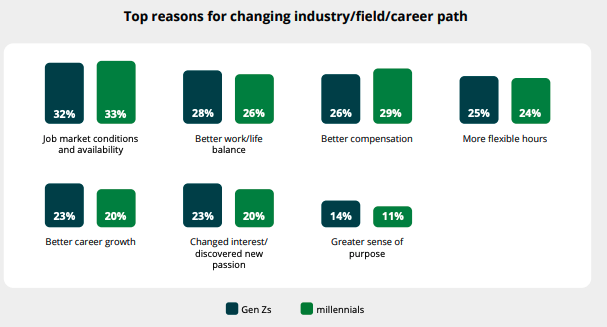

This pragmatism shows in job-hopping trends—searching for jobs with a “greater sense of purpose” comes last in the reasons disclosed. Instead, workers seeking to change jobs are driven by job market conditions, work-life balance, and better compensation. This means that, in practice, young workers are not blindly searching for meaning—they’re trying to secure the conditions that allow for meaning to emerge. Perhaps they understand that purpose without stability burns out fast.

Historically, Boomers and Gen X were the generations that treated work more transactionally—security first, often without even considering purpose or fulfillment—something seen as a luxury then. For younger generations raised amid economic crises and social instability, the bar has shifted: stability is generally not enough without meaning, but meaning is impossible to pursue without some stability.

These elements don’t exist in isolation, though—they reinforce each other in both positive and negative cycles.

Figure 4: Top reasons for changing jobs. Surprisingly, “Greater sense of purpose” comes last. Source: Deloitte.

The Feedback Loop Between Money, Meaning, and Mental Health

Deloitte’s findings suggest these forces don’t act in isolation—they form a self-reinforcing system among financial security, purpose, and well-being: money enables meaning and well-being, while meaning and mental health strengthen financial performance over the long term.

When people feel stable financially, they’re less anxious and more motivated to engage meaningfully with work (less likely to be “quiet quitters”). In turn, meaningful engagement boosts confidence, mental health, and productivity—all of which strengthen one’s ability to earn and save. It’s a positive feedback loop that compounds over time, much like investment returns.

Of course, this loop also works in reverse. Financial instability triggers chronic stress, which narrows mental headspace and erodes motivation. Disengagement follows, leading to poorer performance and fewer opportunities—which deepen financial insecurity. Over time, this is a spiral that devastates both meaning and well-being. From this perspective, financial stability can be seen as the psychological infrastructure that allows the other elements to flourish.

One of the most telling findings in the report is that those with good mental well-bing are three times more likely to report happiness (64% of Gen Z and 67% of Millennials) than those with poor mental well-being (19–20%). Mental health and money are mutually enabling items, not separate pillars. This is often the engine behind the FIRE concept: by taking control of your finances early, you reclaim the mental space needed to live more intentionally.

Once that loop turns positive, financial stability evolves into something richer—an enabler of personal growth.

Financial stability enables well-being and bigger-picture questions related to meaning. Photo by Brooke Cagle on Unsplash.

From Financial Stability to Flourishing: Designing a Meaningful Life

In the end, the goal isn’t to amass wealth for its own sake—it’s to reach a level of “financial calm” that lets you ask the deeper questions. What would I work on or like my day-to-day to look like if I didn’t need the paycheck tomorrow? What would my life actually look like if I could chose to design it free from restrictions?

This transition—from survival mode to “lifestyle redesigning” mode—is the moment many on the path to FI describe as transformative. It can be the moment when work-life balance and mental health finally align, showing that Financial Independence creates the space for well-being to emerge.

At the same time, Financial Independence isn’t some magical portal to meaning. Too often you hear of FIRE folks reaching their FI number, and, after a few months or years out of their job, report feeling just as miserable—or even worse—than before.

The reason is that Financial Independence is a necessary but not sufficient condition. For those without a math background, it means that meaning won’t just appear by itself once you are FI. There are many other factors that affect it, and it’s this very reason why one should focus on building meaning and purpose as soon as possible, not after they reach FI in 10 years.

Personally, I’ve come to realize that I wouldn’t simply stop working completely when I reached FI in 5-6 years. I enjoy writing, researching, engaging with ideas, and helping others. So, even if I had $10M, I would still seek to design my day-to-day to do productive things I enjoy. At the same time, I certainly wouldn’t choose to work in a conventional workspace, drowning in Zoom meetings and superficial office politics. In fact, I’ve already left that already.

This realization—that I will always work, at least part time—has psychologically enabled me to make more drastic choices today. If I wish to work—under my conditions and schedule—for the foreseeable decades ahead (and continue to earn more money), then what’s the point in staying today in a job I dislike just to sprint to the FI finish line? I recently transitioned to part-time freelance consultant and influencer. I’m only 6 months in, but the change it has made to my day-to-day experience has been transformational.

As the Deloitte report suggests, the Gen Zs and Millennials that will make up 74% of the global workforce by 2030 are already redefining what success means to them. Only 6% of them are even aiming for leadership positions in the future, suggesting they strongly prioritize financial security and work-life balance. They understand there is much more to life than work.

Employers and policymakers should take note. Given the impact of financial stability on meaning, well-being, and overall life satisfaction, policymakers should strive to enable more financially literate societies—financial education should be included more prominently in school curriculums. Germany’s recent Frühstart-Rente child pension is an example of what these shifts could look like—embedding long-term financial literacy and security into the fabric of society from day one.

Employers obviously have even more levers to enable their employees to thrive. Not pushing their employees down certain career paths they don’t want is certainly a good starting point; but equally, they have an important role to play in improving employee well-being at work and creating the conditions that minimize worker disengagement and quiet quitting.

💬 If money, meaning, and well-being truly feed each other—where do you need to begin? Is it time to double down on your financial foundation, or to finally use your partial FI to build a life that feels more purposeful and free?

👉 New to Financial Independence and looking to retire early? Check out our Start Here guide—the best place to begin your FI journey.

👉 Would you like to retire in your mid-40s from your conventional career? Find out exactly how to do it here.

🌿 Thanks for reading The Good Life Journey. I share weekly insights on personal finance, financial independence (FIRE), and long-term investing — with work, health, and philosophy explored through the FI lens. If this resonates, join readers from over 100 countries and subscribe to access the free FI tools and newsletter.

Disclaimer: I’m not a financial adviser, and this is not financial advice. The posts on this website are for informational purposes only; please consult a qualified adviser for personalized advice.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

They see work less as a lifelong career ladder and more as a tool for balance and autonomy. Purpose, flexibility, and mental health rank above leadership ambitions, reflecting a pragmatic approach to financial stability.

-

Yes. Deloitte’s 2025 survey shows Gen Z ranks work-life balance as a top reason for job changes—above compensation and far ahead of purpose alone. They view balance as a precondition for purpose.

-

According to Deloitte, financially secure Gen Zs and Millennials report roughly twice the happiness levels of those who aren’t secure. Financial stability reduces stress and allows more meaningful engagement with life and work.

-

Financial independence reduces anxiety, expands choices, and increases perceived control—three psychological levers tied to mental health. Once money stops dominating thought, well-being and creativity expand.

-

They prioritize flexibility, fair pay, and psychological safety. Only about 6 % want leadership roles; most want stability and meaningful impact without burnout.

-

Their demand for balance and purpose pushes employers to offer flexible schedules, mental-health benefits, and transparent compensation. Stability and autonomy are replacing prestige as status signals.

-

Deloitte defines happiness as Money + Meaning + Well-being—three connected drivers. Financial security enables meaning, meaning fuels well-being, and well-being reinforces both over time.

-

Yes. Once basic financial needs are met, people gain the mental bandwidth to design their day around health, family, and purpose. Money buys freedom, not happiness directly.

-

They associate traditional leadership with burnout, bureaucracy, and loss of autonomy. Instead, they seek personal mastery and balance—success defined by time, not titles.

-

FI isn’t only about retiring early—it’s about reaching the mental calm that makes purpose and creativity possible. Financial security becomes the foundation for long-term happiness.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: