How Much Emergency Fund Should You Really Have for FIRE

An emergency fund gives you the ultimate peace of mind on your path towards Financial Independence. Photo by Toa Heftiba on Unsplash.

Reading time: 7 minutes

How to Build the Right Emergency Fund for Your Financial Independence Journey

Why Every Financial Plan Needs an Emergency Fund

Emergency funds are one of the most fundamental—but often misunderstood—tools in personal finance. In this guide, we’ll break down exactly how much you need, where to keep it, and how to build one without derailing your Financial Independence goals.

After more than 70 articles on The Good Life Journey on Financial Independence, investment strategies, geoarbitrage, or withdrawal planning, it may seem strange that we haven’t yet covered one of the basics on personal finance—the emergency fund.

Despite being widely discussed, it remains one of the most important—and often overlooked—foundations of a stable financial plan. I continue to see frequent examples of people asking how much they should save for their emergency fund or whether their emergency fund setup is actually solid.

At its core, an emergency fund offers protection. We can see it as our first line of defence when life throws an unexpected bill or situation our way. Whether your car breaks down, your heating system needs changing in the middle of winter, or you suddenly lose your job, having this buffer in place will not only give you peace of mind but allow your finances to progress smoothly.

Think about it as insurance. But, unlike insurance, it’s immediately available for you and doesn’t require paperwork to access. The psychological aspect can be just as important as the financial one—knowing you can cover several months of expenses brings you peace of mind and confidence. Both are essential, whether or not you are pursing FIRE (Financial Independence, Retire Early).

Today, we’ll walk through how much you really need, where to put it, and how to balance the existing tradeoff between peace of mind and Financial Independence optimization. Along the way, we’ll also cover some of the main misconceptions related to emergency funds.

Here’s what an emergency fund actually is—and why you’ll absolutely need one.

Your path to Financial Independence. Step 1: Build an emergency fund. Step 2: Optimize your savings rate. Step 3: Automatize your low cost, internationally diversified index fund investments. Step 4: Enjoy the ride. Photo by Patrick Hendry on Unsplash.

What Is an Emergency Fund & When Should You Use It

As the name implies, an emergency fund is an amount of cash we set aside for emergencies. These are unexpected, high-priority expenses that fall outside of your monthly budget and therefore are tricky to address without serious disruptions in your spending. It’s not intended for concert tickets, vacations, or impulse buys, but for when the roof leaks, the car breaks down, or the job ends.

You can see it as part of what it takes to be financially resilient—and even better, to design a plan that becomes antifragile, gaining strength from unexpected events instead of just withstanding them. By keeping a relatively small liquid buffer, you avoid going into debt or potentially selling off investments at a loss. The former is important, given that high-layoff environments tend to occur in parallel of poor stock market performance.

Think about all the 2008 financial crisis layoffs and how many people had to sell part of their portfolios at a substantial loss to weather the storm and stay afloat.

It’s important to note that an emergency fund is not about returns—but about availability. In fact, it’s the very opposite of investing: it sits quietly, relatively unproductive but ready to use when you need it most. It does its job precisely at the moment when all other financial instruments can’t help you.

3–6 Months of Savings: One-Size-Fits-All or Outdated Rule?

The standard recommendation—to save 3–6 months of living expenses—raises the following question: is 3 months really enough for an emergency fund?

It’s important to remember that the 3-6 rule—like so many personal finance rules of thumb floating around—comes largely from US-based financial planning. It assumes a high-risk job loss environment and, at least from a European perspective, relatively poor unemployment support, combined with expensive healthcare.

In the US, unemployment insurance varies by state but often tends to cover around 40-50% of your previous gross salary for up to 6 months. That leaves a substantial gap for most people, especially if they’re not covered by other employer benefits. This is where the 3-6 month buffer comes in—it can help you bridge the gap until you find your next source of income.

Croatia (location unknown). Looking to retire early abroad? Check out or ranking of best destinations to retire early in Europe. Photo by Kemal Christian Catovic on Pexels.

In contrast, there are more robust safety nets in Europe. Take Germany, for examples, where unemployment benefits cover 60-67% of your net take-home pay for up to 12 months—twice as long as in the US. On top of that you retain your health insurance during this period.

Should someone living in Germany or elsewhere follow the same rule of thumb as someone living in the US? I’ve been unemployed in Germany once and was still able to cover my monthly expenses with the unemployment benefits—another advantage of pursuing FIRE and being used to maintaining a high savings rate or adjusting spending as needed.

Although we’ve never had to use our emergency fund—even while unemployed—I realize that doesn’t mean we won’t have to in the future. Still, sometimes I struggle to see what type of emergencies could arise for us. We choose not to own a car—and bike, use public transport, and car sharing instead. We’ve also chosen to rent, since buying property where we live would significantly derail our path to FI.

Despite having strong safety nets, we still keep around 4 months of take-home pay in our ‘Tagesgeldkonto’—a high-yield savings account (HYSA)—because having a cash buffer can reduce stress more than accelerating your path to FIRE.

Personally, I feel like I could reduce this amount in half—to 2 months’ worth—but respect my partner’s lower-risk tolerance profile. Further below, we’ll provide an example to see whether these amounts are really as significant as we think, i.e., whether they have any major impact on the timeline to Financial Independence.

The takeaway, though, is that you should consider your individual circumstances before following US-centric advise blindly. Where do you live and how do safety nets such as unemployment laws differ from those in the US? What types of ‘unexpected’ expenses might arise where you live, and how would they impact your financial stability?

Now that we’ve got context on how much cash to hold, let's explore how it affects your actual path to Financial Independence.

An emergency fund is a critical foundation on your path to Financial Independence. If it’s hard to save enough to allocate to an emergency fund, try starting out small with our 1% Savings Method. Photo by Michał Parzuchowski on Unsplash.

How a Cash Buffer Affects Your FI Timeline (+ Real Example)

Let’s talk numbers. Let’s say you spend $4,000 per month and are debating with yourself on whether to keep a 3 or 6-month emergency fund—$12,000 or $24,000 sitting in cash or in a high-yield savings account (HYSA). What is the opportunity cost over time of targeting a 6-month emergency fund instead of a 3-month one?

Using a compound interest calculator, if you invested the $12,000 over a 20-year horizon, it would grow to about $46,000, assuming a 7% real return on investments. This sounds like quite a substantial amount—and it is. But how does your timeline to Financial Independence change whether you decide to go for a 6-month emergency fund instead of a 3-month fund?

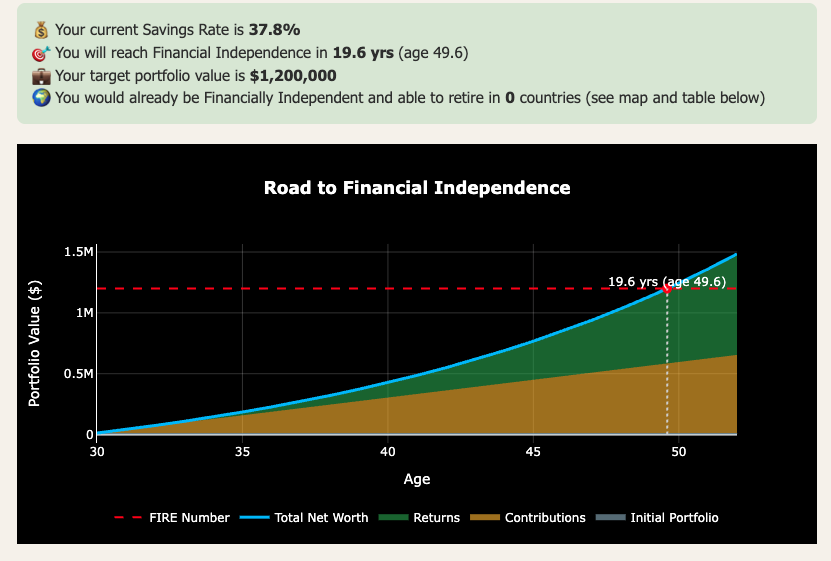

According to our Financial Independence Calculator below, implementing a more aggressive, 3-month emergency fund would accelerate your timeline to FIRE by about 4-5 months. Whether this amount of time seems worth optimizing for or not depends, again, on your risk tolerance and unique life circumstances. For some, this will be an easy tradeoff. But most will prefer to have the peace of mind over the 20 year timeline.

Figure 1: Screenshot of our Financial Independence Calculator—free if you subscribe to our email newsletter. Implementing a 3-month emergency fund instead of a 6-month one accelerates your path to Financial Independence by 4-5 months.

A 4-5 month difference is not very much over a 20-year FI timeline. Especially, when we consider that there are better levers to accelerate our path to Financial Independence—e.g., optimizing our savings rate. Unless you live in a country with very strong safety nets—think, Germany, Nordic countries, etc.—it’s difficult to put a price tag on peace of mind.

Indeed, having flexibility can be priceless. It gives you the freedom to leave a toxic job, relocate quickly, or simply take a break when life gets overwhelming. That kind of autonomy is hard to quantify, but it can make all the difference in the world—especially since the ultimate goal to optimize for should be life fulfillment.

For those tempted to “risk it”, who perhaps don’t live in a country with large safety nets, keep in mind that emergencies often come at the worst possible time—when markets are down, your expenses are up, or your life is most in flux.

If you’re looking for a simpler framework to help you decide whether 3 or 6 months applies to your situation—or something in between—the 3–6–9 rule might offer clarity.

Your emergency fund is determined by your life circumstances. A family of 5 in the US should certainly not implement a 3-month emergency fund. Photo by Jessica Rockowitz on Unsplash.

Other Useful Frameworks: The 3–6–9 Rule Explained

There are other approaches that help us think through this problem—a popular one is the 3-6-9 rule. Instead of defaulting to the 3-6 month rule, you can also consider tailoring your emergency fund to your personal and professional situation.

3 months represents the starting point—your essential buffer. A 3-month buffer may be sufficient if you’re in a low-risk situation. For instance, you rent your home, don’t have children or other dependents, have stable jobs, and enjoy reliable safety nets. For young professionals with little responsibilities and wishing to optimize their FI path as much as possible this lean setup could make sense. They can always increase their buffer as life over time as circumstances change—our emergency fund is certainly larger now than it was 5 years ago.

6 months represents a stronger, more resilient buffer. It also represents the most commonly-cited goal. This may be appropriate if you have children, if you’re a homeowner, if your family relies strongly on a single earner, or if you live in a country with weak safety nets. In this context, saving 6 months of living expenses buys you peace of mind.

Finally, a 9-month emergency fund seems like an overly-conservative approach for most, but does apply well in some circumstances. For instance, those with a very low risk tolerance, workers who are self-employed, do freelance, or contract work, or workers with highly variable or seasonal income.

With fluctuating incomes, larger buffers help insure against slow months or project gaps. Most importantly, it can help you protect your career flexibility—you’ll be less tempted to abandon your business for a “safer” 9-to-5 job just because of temporary income volatility.

In the end, if a 2 or 4‑month emergency fund feels safer, that’s perfectly valid. Trust your gut—it often is informing you of your risk tolerance. But this 3-6-9 framework is a solid starting point to help you think about it.

Remember that anything in between is also an option—as mentioned, we have a 4-month buffer in a high-safety-net situation. The important thing is to build a buffer that matches your lifestyle, supports your goals, and lets you move through life with confidence and peace of mind.

Once you decide your target amount, step two is choosing where to keep it.

Your emergency fund doesn’t go in a pirate chest and it doesn’t go under the bed either. Place it in a checking account and a liquid, high-yield savings account (HYSA). Photo by Immo Wegmann on Unsplash.

Where You Should Keep Your Emergency Fund

The priority is to keep your emergency fund liquid. You want fast access to the money when you need it. In Germany and many other countries, a ‘Tagesgeldkonto’ (high-yield savings account) is ideal. It's more flexible than a fixed-term account, offers better interest than a checking account, and you can usually access the funds within a day.

Globally, the equivalent would be any instantly accessible high-yield savings account (HYSA) or flexible money market account with no withdrawal penalties. Some people like to keep 1–2 months in checking and the rest in savings for slight interest gains.

There are other more complex strategies out there, e.g., “tiered emergency fund” strategies. The idea is that you split your cash across checking, HYSA, and bonds in a laddered approach. For example 1 month of expenses in your checking, 2 months of savings in your HYSA, and 3 months worth in short-term bonds.

You get the idea. Although you’d get more interest over time doing this, it’s also a more complex approach and very hands-on approach.

For most, though, unless you enjoy optimizing every single cent, a simple set-and-forget approach is preferable: your emergency fund is for emergencies, not for chasing yield. Focus on reliability and availability first. Most can easily build their emergency fund with a combination of checking and HYSA.

The more frugal you are the easier you will find saving towards an emergency fund. If you’re struggling to save, try the 1% Savings Method. Photo by Clay Banks on Unsplash.

How to Build Cash Reserves Quickly, Even If You’ve Fallen Behind

Many find it difficult to save enough to start out their emergency fund. If you don’t have one yet, don’t start out by focusing on the 3 or 6-months landmark—which can feel like a lot of money. Instead, aim for one month of expenses as your first milestone.

If you’re having a hard time finding what to cut back from your budget, a solid approach is to follow the 1% Savings Method. It’s the same approach we propose for those struggling to increase their savings rate—the most important lever on our path to Financial Independence. Increase your savings rate each month by 1%.

It’s a gradual, frictionless way to build both your emergency fund and generally your savings muscle. cut one small recurring expense and redirect it into your emergency fund. Perhaps it’s a subscription, a dinner out, or some app you barely use.

These small “sacrifices” compound quickly. Focus on locking in the savings at the beginning of the month—as the salary comes in, transfer the small amount to your HYSA and focus on not overspending your remaining monthly budget.

Redirect as well all non-recurring sources of income until your emergency fund is full. Whenever you receive a bonus, a tax refund, or any unexpected income, allocate at least a significant portion of it to your fund. Windfalls are the quickest way to build a cash buffer without affecting your lifestyle.

Does an Emergency Fund Still Matter After FIRE?

Once you’ve reached Financial Independence, you’re withdrawing from your portfolio and you’re no longer reliant on a paycheck. You already have massive in-built flexibility—do you still actually need an emergency fund?

In the classic sense, probably not. If your car breaks down or you need to fund some other unexpected expense, you have the flexibility of withdrawing from your portfolio. If you’ve reached FI you have the discipline required to acknowledge that if you withdraw much more than your strategy suggests, then you need to compensate a bit in the following months by being more careful with discretionary spending.

What you do need post-FIRE is a buffer or cash wedge to avoid withdrawing from volatile investments during severe market downturns. But that’s more about managing Sequence of Return Risk (SORR)—for instance, by implementing a “bond tent” strategy.

Still, beyond whatever strategy you choose to address SORR, a small buffer in cash post-FIRE can be useful for day-to-day flexibility and peace of mind. But generally, it doesn’t serve the emergency fund anymore in its classical sense.

Looking to retire early abroad? Check out or ranking of best destinations to retire early in Asia. Photo by Mayur on Unsplash.

Final Thoughts: Finding Comfort and Confidence with Your Own Buffer

As mentioned, at the moment I personally keep 4 months worth of living expenses in cash—a blend of checking account and HYSA. For my personal situation—living in a country with extensive safety nets—this feels more than enough to sleep well at night.

Would holding a smaller emergency fund help me hit FIRE a little bit earlier? Sure—as we calculated, perhaps by a few months. But the psychological comfort of knowing we are well covered, and keeping my lower-risk tolerance partner on board our financial journey, is worth every cent.

Ultimately, your emergency fund isn’t just a financial decision—it’s also a life decision, and one that can be part of a wider strategy to move from resilience to true antifragility in your finances. How much stress are you willing to carry in exchange for squeezing out slightly better returns?

Either way, if you haven’t already, it’s important to get started as soon as possible on building your emergency fund as a foundation of financial stability on your journey to Financial Independence.

Once that foundation is set, the next question could be how your broader asset mix—especially the share you hold in bonds—shapes both your comfort level and the years it takes to reach FI.

💬 I'd love to hear your thoughts—how are you considering your emergency fund setup? Was anything in today’s post unclear? Please let us know in the comments!

👉 New to Financial Independence? Check out our Start Here guide—the best place to begin your FI journey. Subscribe below to follow our journey.

🌿 Thanks for reading The Good Life Journey. I share weekly insights on money, purpose, and health, to help you build a life that compounds meaning over time. If this resonates, join readers from over 100 countries and subscribe to access our free FI tools and newsletter.

Don’t miss our rabbit-hole article on Starting your Financial Independence journey or our Jack Bogle-inspired post on how to invest your hard-won savings. Didn’t find what you were looking for? Check out our latest articles below.

Disclaimers: I am not a financial adviser, and the content in this website is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

Three months of expenses might be enough if you rent, have no dependents, and a stable job. It’s a lean option suited for those with strong safety nets and high risk tolerance. You can always expand your buffer later as life circumstances change.

-

The 3–6 month emergency fund guideline is common in US-based financial advice. It reflects an environment with weaker unemployment benefits and costly healthcare. For countries with stronger safety nets—like Germany—it may be overly conservative. Tailor your fund to your country, lifestyle, and risk profile.

-

The 3–6–9 rule helps you align your emergency fund with your situation. 3 months if you’re single, renting, and have stable income. 6 months for those with kids, mortgages, or single-income households. 9 months is ideal for freelancers or people with highly irregular income streams.

-

Holding a larger emergency fund does slightly delay your Financial Independence timeline. But as shown in the article, investing an extra $12K (vs. holding it in cash) might only speed up FIRE by a few months months. That’s a small tradeoff for peace of mind, especially during market downturns or job loss.

-

Accessibility is key—use a high-yield savings account or equivalent (e.g., Tagesgeldkonto in Germany). You want liquidity without risk. Some use a “tiered” setup: part in checking, part in savings, and a bit in short-term bonds. But simplicity and instant access should be your top priorities.

-

Once you reach FIRE, your cash reserve serves a different role. You’re not reliant on a paycheck, so you can draw from your portfolio directly for surprise costs. Instead of a classic emergency fund, focus on a cash buffer or “bond tent” to manage market downturns and Sequence of Return Risk. So, you still need liquidity, but it now serves a completely different function.

-

Start with one month of expenses and build from there. Use the 1% savings method: increase your savings rate by 1% each month and redirect small wins. Add any windfalls—bonuses, tax refunds—to grow your buffer faster. Small consistent progress beats waiting for the “perfect” time.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: