Reach Financial Independence with the 1% Savings Method

Don’t know how to get your savings rate back on track? Try the 1% Savings Method. Photo by Robert Bye on Unsplash.

Reading time: 8 minutes

How the 1% Savings Method Can Help You Reach FI—No Matter When You Start

The Low-Stress Path to FI: Start Small, Build Fast

In today’s post, we will show you a simple strategy to not only turn your financial situation around, but also to reach early retirement much sooner than planned. Many people find it difficult to maintain the high savings rates often associated with achieving FIRE (Financial Independence, Retire Early). Of course, if you discover the concept of FIRE in your early twenties, it will be much easier to transition towards the pursuit of FI than if you make this decision already in your late thirties or forties. But, even if you arrived “late to the game”, there is plenty of opportunities to jump back in the game. With today’s article, we’ve got you covered!

If you stumbled across the concept of FIRE in your forties, it is likely that you have already acquired many different responsibilities (e.g., mortgage, family, etc.) that make it more difficult – or downright daunting – to implement a 20, 30, or 40% savings rate. Decades of spending habits and financial commitments can make high savings rates feel impossible. Much of this stems from years of unnoticed lifestyle creep steadily ratcheting up expenses.

Your savings rate plays a critical role in reaching financial independence and hitting the crossover point, where investments cover your living expenses.

In today’s post, we will review a low-effort, sustainable approach – the 1% Savings Method – that allows you to reach a high savings rates without having to implement dramatic sacrifices in the short term, allowing you to transition towards the FI journey in a very soft way. Today, we will provide examples of how micro changes can lead to macro impacts, and how you can leverage the power of hedonic adaptation in your favor to retire a decade (or more) earlier than everyone else.

With this method, anyone can get started and take the first step towards financial independence, no matter where they’re starting from.

Why Your Savings Rate Is the Most Powerful FI Metric

As explained in detail in previous posts, your savings rate is the single most important factor for achieving financial independence. The savings rate can be defined as the percentage of your net take-home pay that you consistently save and invest. By using a Financial Independence Calculator, you can estimate what your retirement timeline is based on very simple input data such as your net annual income and expenses.

The key takeaway, as illustrated below in Figure 1, is that your savings rate (%) has a non-linear relationship with the timeline to reaching financial independence. Lowering your lifestyle costs helps you save and invest more and reduces the total investment needed for retirement. This dual effect is what creates the non-linear relationship.

If you’re looking for a simple starting point to boost your savings rate, our guide to the beginner-friendly 50/30/20 budgeting rule breaks down an easy budgeting framework you can implement right away.

Figure 1. Non-linear relationship between savings rate and years to Financial Independence (FI). Graph from Networthify early retirement calculator.

To illustrate, consider the example plotted in Figure 1. Someone implementing a 5% savings rate would take about 50 years to retire on their own means. In contrast, someone with a 25% or 50% savings rate would be able to step away from mandatory employment after only 32 and 17 years, respectively.

Most people focus only on how much they make. And to be clear, it is easier to reach FI with a high salary. But the real determinant of reaching FI is how high or low your savings rate is. A person earning $80,000 and living on $50,000 will reach financial independence faster than someone earning more but saving less.

What Is the 1% Savings Method and How Does It Work?

Some of the savings rate numbers displayed on the graph will feel daunting at first for many. I get that. It’s really difficult to make big changes when you are already carrying a large baggage–say, family, mortgage, and other obligations. In addition, people are running around with very busy lives–many people may feel like they don’t even have the headspace that is required to make meaningful changes to their finances.

Last week, we discussed the concept of hedonic adaptation in an article that questioned why we continue to work so hard as a species, despite the tremendous technological advancements, economic growth, and productivity increases experienced over the last century. Hedonic adaptation means we quickly adjust to changes, making new spending feel normal and harder to reverse. This mechanism is at the heart of lifestyle inflation, which makes expense cuts feel painful unless approached gradually.

It explains why the pleasure experienced from new comforts or luxuries is generally very short lived. These changes rapidly feel like the new normal, making it hard to achieve long-term satisfaction through material acquisition.

The good news here is that hedonic adaptation takes place in both directions. In other words, we also adapt very quickly to “negative changes”. So, what if instead of making dramatic shifts in our spending, we start out by making tiny, yet constant changes over time?

Instead of having to cut $1,000 overnight, the 1% Savings Method allows you to cut only 1% from your initial monthly budget. Each month, you simply cut spending by 1%, gradually aligning your budget with your early retirement goals. For example, if you live in a city, you could start by slightly reducing car usage each month, experimenting with car sharing or rentals on vacations instead of full ownership.

Thanks to hedonic adaptation, you’d adjust quickly to the new monthly budget and would barely notice the changes taking place in your spending. Over time, though, these small changes would add up, compound, and dramatically improve your finances and ability to retire much earlier.

To use this method, track your monthly expenses and savings rate. Before you stop reading here, please remember that this should not take more than 30 minutes at the end of each month. In return for this small inconvenience, you may unlock the possibility of retiring a decade or more earlier. I think it is worth the small inconvenience! How does this work in practice? Let’s check out an example.

Beach in Bali. Indonesia makes our top 3 Asian countries to retire to on a budget. Photo by setengah limasore on Unsplash.

1% Savings Method Case Study: How Small Changes Accelerate FI

Let’s consider for the example the following household case study with the following characteristics:

Country: US

Age: 38

Net household income: $88,000

Annual expenses: $79,000 (i.e., saving $8,000 per year or 10% savings rate)

Current investment portfolio value: $100,000

Assumed annual real returns from index fund portfolio: 7% (assumes investments in low cost, internationally diversified index fund portfolio)

Safe withdrawal rate: 4% (as per the 4% rule of thumb)

Annual expenses in retirement: same as annual expenses today. The assumption is that we want to fund the same lifestyle in retirement.

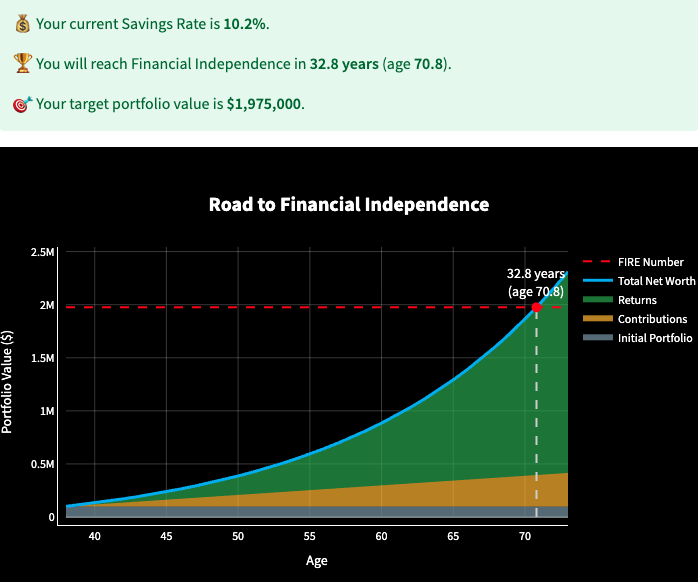

Using our Financial Independence Calculator—available for free for newsletter subscribers—with these assumptions, this US household is still 32.8 years away from reaching their Financial Independence number at age 71. As observed in Figure 2 below, this household currently saves 10% of their net take home pay (their savings rate), which wouldn’t seem too bad for some. However, under this scenario, they would need to accumulate a target portfolio of $1,975,000 in order to withdraw $79,000 annually in their first year of retirement (as per the 4% rule of thumb). They remain far from reaching the retirement savings needed to support their current lifestyle.

But what would occur over time if they implemented the 1% Savings Method instead?

Figure 2: Road to financial independence for case study presented above. With a net worth of $100,000 at age 38, a net household income of $88,000 and a 10% savings rate, this household would take over 32 years to reach financial independence at age 71. The calculation in our FI calculator assumes a 4% safe withdrawal rate (SWR) and 7% annual real returns from investments.

Let’s suppose that this household finds it difficult to make any drastic change to their finances but agree instead to follow the 1% Savings Method. In their baseline scenario, they used to save and invest $9,000 per year ($750 per month). Going forward:

In the first month of the experiment, they reduce their spending by 1% of their monthly expenses (1% x $79,000/12 = $65). So, instead of investing $750 dollars, now they invest $815 at the beginning of the month ($750+$65). Investing at the start of the month makes it easier to manage your spending with what remains. This is referred to as a “pay-yourself-first” budget. You would be left with $6,500 to spend for the rest of the month ($88,000/12 minus the $815 invested). Notice, that this may sound complicated, but essentially all you have to do in month one is to find a way to save and invest an extra $65!

If you haven’t been tracking your spending closely, there are likely many easy ways to optimize your monthly budget by $65. Check out our article with 50 different ideas to try out to reduce spending.

In the second month, you continue with the same approach. At the very beginning of the month, you invest $880 ($815 of the previous month + a new $65). We are repeating again the same procedure – all you need to focus on is finding a way in this second month to reduce your expenses by another $65.

Rinse and repeat–you get the idea. If you stay consistent in this approach, after 12 months, your monthly savings could reach $1,540–a big jump from where you started (the original $750 plus an accumulated $790). This is great, because it means that in only one year you have doubled your savings rate from 10.2% to 21.9%.

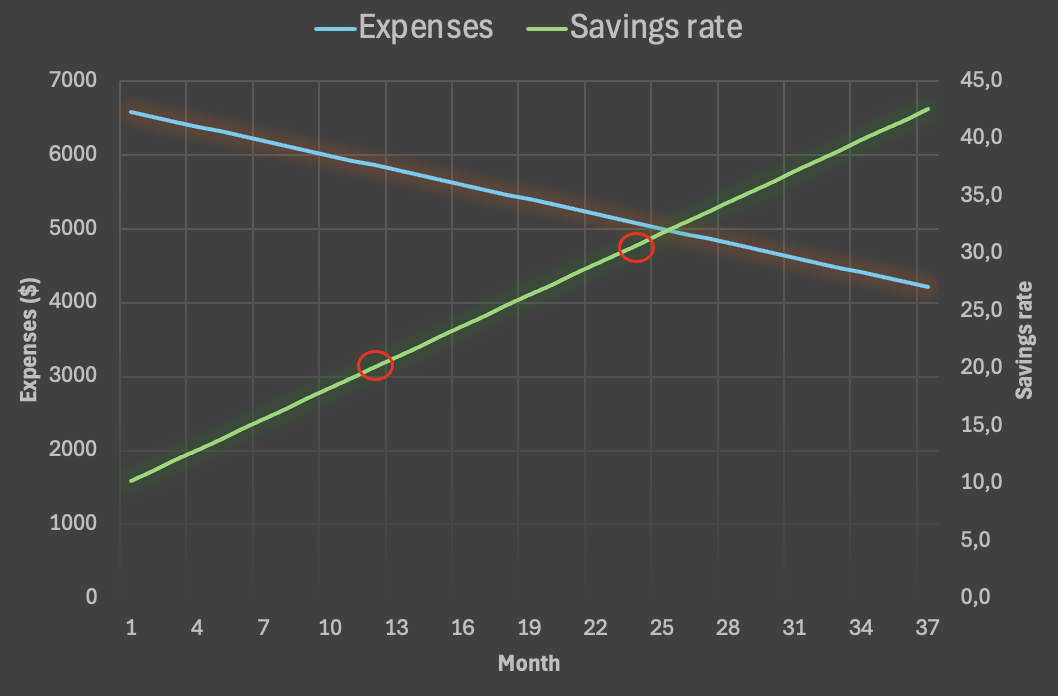

This process is illustrated in Figure 3 for the first 36 months. Notice that you reach a savings rate of 31.8% by year 2 and 42.5% by year 3.

Figure 3: Applying the 1% Savings Method over time. As observed, the household case study presented above more than doubles their savings rate (21.9%) after one year (first red circle in graph). After two years of implementing this gradual approach, the household would reach a 31.8% savings rate, accelerating their path to financial independence and early retirement (second red circle in graph).

When to Stop the 1% Method—and How It Impacts FI Timeline

You can stop increasing your savings rate whenever it feels unsustainable. At some point, it will become increasingly difficult to find an extra $65 to spare without it impacting your quality of life. In a previous post, we covered dozens of ideas of where to cut back without strongly affecting your lifestyle. Indeed, most of these actions feel like optimizing expenses, it shouldn’t feel like you are having to sacrifice yourself in any major way. It is more about being smart and refusing to pay more when you could be paying less.

What do these new savings rates mean in relation to the household’s path to financial independence? As we saw above, in the baseline scenario the household was on track to retire at age 71 after 32.8 more years in the workforce. If the household implemented the 1% Savings Method instead, after only one year they would have reached a 21.9% savings rate and the would be on track to retire at age 64 after 26 more years. That is retiring seven years earlier after just one year of moderate expenses optimization! If you decided to apply this method for two years you would reach a 31.8% savings rate that would allow you to retire at age 60, 11 years earlier than originally planned. Micro changes, macro impact.

Of course, all these results presented in today’s article are valid under the case study’s assumptions. What will be the result for you? I encourage you to use our Financial Independence Calculator (free if you subscribe to our email newsletter) and play around with how different levels of expenses may lead, based on your unique circumstances of age and net worth, to different early retirement timelines.

Final Thoughts: Start Small, Save More, Retire Sooner

Pursuing Financial Independence doesn’t have to require dramatic overnight sacrifices. Rather, it requires consistency, discipline, and the courage to start small. The 1% Savings Method leverages the power of hedonic adaptation to your advantage, allowing you to very gradually optimize your expenses and increase your savings rate without feeling deprived.

By cutting 1% of your spending each month and investing the difference at the beginning of the month, you can double and triple your savings rate over time without taking a huge lifestyle hit. As your savings rate grows, you don’t only invest more each month, but also reduce the portfolio size you require in retirement, shaving many years off your timeline to retirement. For a straightforward way to set your budget and stay on track, see our beginner-friendly 50/30/20 rule.

This strategy is especially powerful for those who feel like they may have “arrived late to the game”, for households with families, mortgages, and busy lives that simply haven’t taken the time to organize their personal finances. Some of these individuals may be in their late 30s, 40s, or 50s and may have no plans in place for retirement at all, let alone early retirement.

As we saw in today’s post, many nickels make a muckle. You don’t need to be perfect, just to keep going. It all starts with tracking your monthly expenses to set a baseline, and committing to small, yet steady progress. Small monthly savings changes can create major long-term financial benefits.

When do you want to retire? Let us know in the comments and consider joining the 1% Savings Method challenge. No matter where you're starting from, anyone can take the first step toward financial independence and early retirement.

🌿 Thanks for reading The Good Life Journey. I share weekly insights on money, purpose, and health, to help you build a life that compounds meaning over time. If this resonates, join readers from over 100 countries and subscribe to access our free FI tools and newsletter.

👉 New to Financial Independence? Check out our Start Here guide—the best place to begin your FI journey.

Disclaimer: I am not a financial adviser, and the content in this website is for informational and educational purposes only. Please consult a qualified financial adviser for personalized advice tailored to your situation.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Is Financial Independence also possible for families? Photo by Pixabay on Pexels.

Check out other recent articles

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: