How Long You’ll Really Live After Retirement (and How Much Is Healthy)

How long will you spend in meeting rooms and how long will you spend enjoying retirement in good health? Photo by Benjamin Child on Unsplash.

Reading time: 10 minutes

TL;DR — How Long You’ll Really Live After Retirement

👴 Men: ~15 years after official retirement, on average

👵 Women: ~20 years

❤️ Healthy years: only ~60–75% of total retirement years

🇺🇸 US: among the worst performers globally — just ~58% of retirement years spent in good health

🇩🇪 Germany example (my case): retire at 67 → ~14.4 years of life expectancy, ~9.4 healthy years

🗺️ Use the maps (Figures 1–4) to see how your country compares

🚀 Takeaway: invest in healthspan now, and pursue Financial Independence and early retirement

How Long Will You Really Live After Retirement? What the Data Reveals About Life, Health, and Freedom

Many of us imagine retirement as a 25-to-30 year window of relaxation, travel, and freedom. After all, a lot of financial planning implicitly assumes a 30-year retirement window when they use the famous 4% rule.

But the data tells a different story: even in wealthy nations, the average man/woman only lives 15/20 years after retirement—and only about two thirds of this time is spent in relatively good health.

In today’s article, we combine global data on retirement ages by country, life expectancy, and healthy life expectancy (HALE) to reveal how long retirees actually enjoy their freedom and how this varies across countries.

We’ll see where the gap between expectations and reality is widest—and why the best response isn’t waiting for traditional retirement or pension reform, but to pursue Financial Independence and invest early in your own healthspan.

I’m currently based in Germany, where the official retirement age is 67. According to this dataset, the average man in Germany has about 14.4 years of life after retirement—but only 9.4 of them in good health. Just nine healthy years after decades of grind. Realizing this tradeoff was one of the reasons I chose to leave a high-stress career, build my own business, and invest more deliberately in my health and time freedom.

Invest in your health like you invest in index funds. Together with diet and sleep, exercise—both aerobic and resistance training—is one of the key pillars of longevity. Photo by Alonso Reyes on Unsplash.

Retirement Ages by Country (Global Map)

Across the globe, official retirement ages have climbed steadily—in some countries faster than ever before. As governments face aging populations and shrinking pension pools, extending the working life has become the default solution in many developed countries. Nevertheless, the global map below (Figure 1) from the World Population Review shows that there still remain large differences across countries in terms of retirement age—ranging from 55 to 70.

As observed, much of Western Europe, North America and Australia already require workers to stay on their job until 66-67, while large parts of Asia, Eastern Europe, and Latin America still hover closer to 60.

Figure 1: When do people retire across the world and which countries have the earliest and oldest retirement ages? Retirement age by country as of 2025. The highest retirement age is found in Libya (70) and the lowest in Indonesia (58) and Sri Lanka (55). Source: World Population Review

Life Expectancy After Retirement by Country (Men vs. Women)

Retirement age alone doesn’t tell you how long you’ll actually enjoy life afterward. That’s where the breakdown of life expectancy across countries comes in (Figures 2 and 3).

Although there’s likely some correlation between official retirement age and life expectancy at 60, we also see stark differences across countries. For example, in Figure 2 below we observe that, although retirement age can be similar across countries—e.g., Russia (63), Colombia (62), and Norway (62), their citizens’ life expectancy at retirement can be very different—in this example, 11.2, 16.5, and 21.8 years respectively.

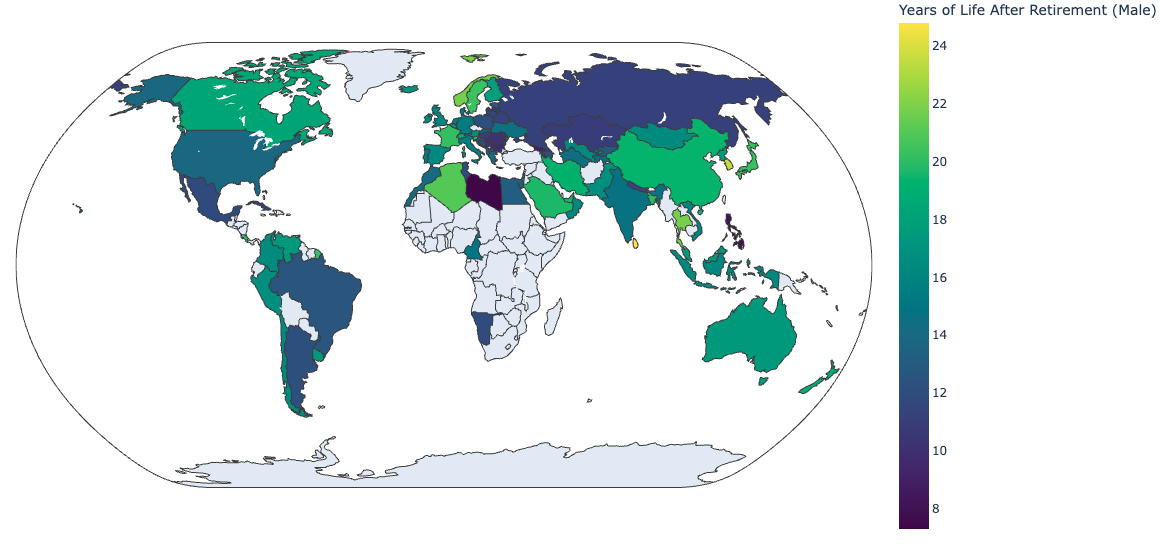

To compare adequately across countries, the following maps reveal the number of years of life remaining after the official retirement. For men and for the countries we have data for (Figure 2), the global average is around 15 years of life post-retirement; women enjoy about 5 more years on average (20 years). But how do retirement timelines change across countries?

Which countries’ men enjoy the longest retirements in practice? In Asia, men in Sri Lanka enjoy, on average, the longest amount of life post-retirement (24.8 years), followed by South Korea (23.6 years), Thailand (21.8 years); In Europe, the longest retirements are found in Norway (21.8 years), followed by Slovenia (20.8 years), and Sweden (20.4). In North and South America, Costa Rica makes the top list (20.1 years), followed by Canada (18.3 years) and Venezuela (17.4 years).

The US men only enjoy, on average, 13.9 years in retirement. There are 58 countries in the world where men enjoy more years of retirement.

Finally, this dataset does not offer much information for African countries, but we do see stark differences across countries for which data exist—for instance, between Algeria (21.0 years) and its neighbor Libya (7.3 years).

Figure 2. Years of life after retirement for men across countries in 2021. Source: The Good Life Journey calculation and chart, based on official Retirement Ages and Life Expectancy at 60.

When we look at women the picture changes in interesting ways. As observed in Figure 3 below, the longest retirements globally are found, on average in South Korea (28.4 years), China (28.1 years), and Sri Lanka (27.9 years). In Europe, Slovenia (25.0 years), Austria (24.6 years), and France (24.3 years). In the Americas, Venezuelan women enjoy the longest retirement (26.5 years), followed by Costa Rica (25.1 years), and Colombia (24.7 years).

It’s interesting to compare the color patterns of the two maps (men vs. women—Figure 2 and 3). In North America and most of Western Europe, the color code is similar—the differences in retirement years by females and males tends to be smaller than across Latin America and large parts of Asia.

Although women tend to live longer than men and there are differences in labor participation between males and females across countries, the main factor explaining these differences is simply that many countries have earlier retirement ages for women. It’s not uncommon for women to retire 3-5 years sooner in many countries across the globe.

Across the board, the largest gaps in life expectancy at retirement between women and men are found in Belarus (11.7 years longer life expectancy), followed by Georgia (10.2 years), Poland (9.9 years), Russia (9.8 years), and Viet Nam (9.6 years).

Figure 3. Years of life after retirement for women across countries in 2021. Source: The Good Life Journey calculation and chart, based on official Retirement Ages and Life Expectancy at 60.

Longevity isn’t the whole story, though—how much of it is healthy matters more. The next section and Figure 4 shows this metric clearly.

The Healthspan Gap — How Long You Stay Healthy After Retirement

The first shock may be to find that retirement is shorter than many expect. Remember, in personal finance, traditional retirement planning often assumes a 30-year retirement timeline. The often-used 4% rule, which defines the amount of assets a retiree is aiming to retire with, is often based on this longevity assumption. But as observed above, the majority won’t make it even close to a 30-year timeline, especially if retiring at the official retirement ages of 65-67.

But the second realization is even more sobering. Despite this shorter-than-expected life expectancy, much of it isn’t even spent in good health. Globally, men enjoy, on average, 11.1 years in retirement in good health, while women enjoy 14.4 years. Indeed, the WHO’s Healthy Life Expectancy (HALE) data shows that for most countries, retirees spend between 60% and 75% of their post-retirement life healthy and active—the rest is marked by chronic conditions, reduced mobility, or dependency (Figure 4, displayed for men).

As observed, the share of healthy years in retirement varies dramatically across countries—from 81% to 41%. In some nations, about four out of every five years of retirement are lived in good health, while in others—including in the US—It’s less than half.

In many countries, millions of people are working longer, only to spend their hard-earned “golden years” managing chronic illness instead of enjoying freedom. Seen from this lens, pursuing Financial Independence isn’t just about retiring early, but about retiring into good health.

These numbers should be a wake-up call: without deliberate investment in your health now, the fantasy of decades of energetic retirement is unrealistic.

While life expectancy tells you how long you’ll live, healthspan tells you how long you’ll truly live well. Investing in that metric—through exercise, sleep, nutrition, and stress management—delivers more return than any pension tweak or later retirement age ever could. That’s why, at The Good Life Journey, we encourage readers to invest in healthspan like they invest in index funds: early, steadily, and with compounding effects that last.

Figure 4. Percent of retirement spent in good health across countries. Source: The Good Life Journey calculation and chart, based on official Retirement Ages, Life Expectancy at 60, and HALE at 60.

Regional Patterns in Healthy Retirement

When comparing the percentage of retirement years lived in good health, striking regional differences emerge. East Asia leads the world in health-adjusted longevity: retirees in Indonesia, Sri Lanka, or China spend close to 80% of their retirement years in good health.

Much of Latin America—Peru, Uruguay, Costa Rica, and Venezuela—also performs well, suggesting that moderate retirement ages combined with strong community ties and active lifestyles may extend functional health.

At the other end of the spectrum, a handful of countries across regions show particularly low levels of healthy retirement. In Europe, Latvia, Hungary, and Poland only enjoy 65% of their retirement in good health. Across Asia and the Middle East, Nepal stands out as an outlier—with only 64% of the retirement spent in good health, while Libya marks the lowest overall ratio in the world—barely 40% of retirement years spent in good health.

The United States ranks among the lowest globally: American retirees spend only about 58% of their post-retirement years in good health—the second-worst figure in the dataset. Wealthy European nations such as Germany, Italy, and the Netherlands also score slightly below global averages despite their relative wealth and advanced healthcare systems.

It makes sense that workers who are retiring later should expect to experience a lower share of their retirement in good health. Although cultural habits, work-life balance, and preventive care certainly matter, the majority of these results are simply explained by the retirement age—if you retire later, like in many parts of western Europe, you naturally will have a lower share of your retirement years spent in good health.

With exercise and sleep, diet is one of the key pillars of health and longevity. Photo by Brooke Lark on Unsplash.

The Real Lesson — Freedom and Healthspan Go Hand in Hand

The data paints a sobering picture: across much of the world, people are working longer careers, only to enjoy shorter and less healthy retirements. Extending the official retirement age may keep pension systems afloat, but it does little to expand the time people actually live freely and well.

While this article doesn’t quantify it, it’s likely that the retirement age is going up at a faster rate than life expectancy. Perhaps, an interesting topic to look into in another article.

At an individual level, the takeaway for anyone on the path to FI is stark. Pursuing Financial Independence isn’t simply about quitting work earlier—it’s about reclaiming the healthiest and most vital years of your life. Your “freedom years” could begin when you decide it, not when a government declares you eligible for a pension.

Consider the irony: surveys show that roughly 80% of global workers report being disengaged or unhappy at work, yet Americans plan to labor into their mid-late sixties only to enjoy about 14 years of retirement, of which barely half—roughly seven years—will be lived in good health.

We’re not only working in jobs that harm our physical and mental health today—we’re also retiring into years we may not be healthy enough to enjoy. That’s madness.

Your journey to Financial Independence is also about health. Photo by Salmen Bejaoui on Unsplash.

The better equation is simple:

First, start by taking care of your health now—it really is all you have: move daily, sleep well, eat real food, and manage stress. Health is the compound interest of habits, and each year invested in good habits returns illness-free time today and more healthy freedom later.

Second, take control of your time. If you can, do work that drives you—or at least work fewer hours in something that doesn’t drain you. The worst trade you can make is sacrificing health and happiness for a paycheck that funds a future you may not fully enjoy.

Finally, plan for Financial Independence not as a luxury, but as a health strategy. The earlier you reach autonomy, the more of your life you’ll live on your own terms—and in relative good health. Freedom isn’t about when you stop working—it’s about when you start living on your own terms.

💬 How many healthy years do you think you have after your own retirement age? What would you change today—your savings rate, your diet, your stress levels, or your FI timeline?

🌿 Thanks for reading The Good Life Journey. I share weekly insights on money, purpose, and health, to help you build a life that compounds meaning over time. If this resonates, join readers from over 100 countries and subscribe to access our free FI tools and newsletter.

👉 New to Financial Independence? Check out our Start Here guide—the best place to begin your FI journey.

Disclaimer: I’m not a financial adviser, and this is not financial advice. The posts on this website are for informational purposes only; please consult a qualified adviser for personalized advice.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

Across countries in our dataset, men live ~15 years after the official retirement age and women ~20. That varies by country and by policy: places with lower retirement ages and higher life expectancy at 60 deliver longer retirements.

-

On average, ~60–75% of post-retirement years are lived in good health. That’s measured by WHO’s HALE at 60, which adjusts life expectancy for years lived with disability or poor health.

-

Among mapped countries, Sri Lanka (55) and Indonesia (58) are among the lowest. Libya (70) is the highest. Retirement age interacts with life expectancy at 60 to determine years lived after retirement.

-

In our dataset: Sri Lanka (~24.8 years), South Korea (~23.6), and Norway (~21.8) lead their regions. The U.S. averages ~13.9 years for men—below many peers.

-

South Korea (~28.4), China (~28.1), and Sri Lanka (~27.9) top the list. In Europe, Slovenia (~25.0) and Austria (~24.6) rank high; in the Americas, Venezuela (~26.5) and Costa Rica (~25.1).

-

Earlier retirement ages + strong life expectancy at 60 help. Culture, prevention, activity, sleep, and stress also influence how much of retirement is lived in good health.

-

Roughly 58% of the average American’s retirement years are in good health—one of the lower shares in the dataset—underscoring the value of investing in healthspan early.

-

Women typically live 3–5 more years post-retirement and usually have more absolute healthy years—though their percentage of healthy years can be similar or slightly lower than men, depending on the country.

-

Use the maps as a reality check: plan for realistic total and healthy years, pursue FI to reclaim earlier, and stack the deck for healthspan (movement, diet, sleep, stress).

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: