Why People Bet on Unicorn Startups—And Why Most Don’t Get Rich

Today we explore why people chase after “moonshoots” in their careers and investing to build their wealth. Moonshots refer to a high-risk, high-reward financial strategy. Photo by SpaceX on Unsplash.

Reading time: 9 minutes

Moonshots vs. Reality: Why People Invest in Unicorn Stocks and Risky Strategies

Most people don’t invest in risky startups or chase hot stocks out of greed—they do it because it feels like their only shot. In this article, we’ll unpack why unicorn investments and stock-picking feel rational, the data on how often they actually work, and how these strategies stack up against a disciplined savings and index investing approach. We’ll look at the startup lottery, the illusion of stock-picking skill, and smarter alternatives like entrepreneurship and boring-but-powerful math.

Why Investing in Unicorn Stocks—or Working for Them—Feels Rational

We all know friends and acquaintances who are actively chasing the next unicorn or crypto rocket. This often isn’t some irrational impulse—it’s often the only remaining lever they feel they have at their disposal when pursuing wealth accumulation.

As we’ve examined in previous articles, savings rates across most developed countries are persistently low, and this isn’t always because people are spending recklessly. In many economies, wage growth has stagnated while inflation has quietly eaten away at any potential increases in savings or purchasing power.

In some countries and sectors, salaries simply haven’t kept pace with rising costs, especially in low-productivity or mature economies. But at the same time, lifestyle inflation—most of the times unconsciously—creeps in when increases in salary do present themselves. People are generally quick to upgrade their houses, cars, gadgets, or holidays to keep up with their peers and friends, influenced often by a subtle or unconscious status competition.

Over time, both these structural and behavioral factors combine to squeeze any savings capacity, leaving people with little room to build wealth through consistent saving and investing. That’s why many turn to unicorn stocks or risky investments—they hope a single outsized return will make up for a lifetime of modest savings.

Early in my career, I remember looking at my modest savings and feeling like index funds were “far too slow.” I pictured myself picking hot-tech stocks and even joining a startup—not out of greed, but because I couldn’t see another way to accelerate the process. That feeling is more common than we’d like to admit. I’m thankful now that I didn’t give in to that urge at the time.

The psychological appeal of chasing a “moonshot”—i.e., a single, massive financial win that could change everything—comes from this sense of constraint. As we covered in Morgan Housel’s The Psychology of Money, people’s financial behaviors often reflect the world they grew up in, not some rationally optimized model. If your environment feels like steady saving will never get you there, then swinging for an extraordinary home run can feel like the rational choice.

We tell ourselves that one massive win is all we need to leapfrog the structural and behavioral barriers, especially when viral stories in social media constantly highlight people who made it early through one well-timed investment or start-up job. When all you see are unicorn stories and 100x crypto headlines, survivorship bias is quickly ignored and fades into the background.

The moonshot strategy offers an emotionally comforting narrative: why grind for decades when one “big bet” well placed could shortcut our path to Financial Independence? The problem here is that while the narrative is certainly compelling—who hasn’t thought of short cuts at some point—as we’ll see today, the underlying probabilities don’t look good at all.

People aren’t crazy—they’re simply responding rationally to their perceived constraints. Unfortunately, as we’ll cover in this post, the statistical foundation on which these strategies rest is weak at best.

The startup lottery: approximately 90% of startups fail, only 0.5–1% ever reach unicorn status, and likely well under 0.1% of employees will receive life-changing payouts. Photo by Austin Distel on Unsplash.

The Startup Lottery: How Many Startups Become Unicorns

Joining an early-stage startup in hopes of life-changing wealth is possible, but a lottery ticket with very poor odds. Approximately 90% of startups fail within the first five years. Only about 0.07% of startups ever reach unicorn status (i.e., a $1B+ valuation), and even among VC-backed companies, the figure is typically well below 1%. And for employees, the odds of a life-changing payout are even slimmer.

Even if you’re lucky enough to land in the right startup, most employees don’t necessarily get rich. Common reasons for not cashing out despite being in the right place are that company equity can be diluted across funding rounds; vesting schedules can expire before liquidity events; or IPOs and acquisitions can take much longer than expected initially.

The bottom line is that for every headline story or friend-of-a-friend becoming rich from their startup stock, there are countless other employers whose options expire worthless or whose company simply didn’t make it. You have to be in the right place at the right time—something that depends far more on luck than skill. Very few companies will ever reach unicorn status, but only a subset of employees will still be lucky enough with the timing and process to cash out big.

For every headline about someone retiring off their startup stock, there are countless employees whose options expired worthless. The statistics are simply discouraging—”getting rich through someone else’s startup” is not a reliable strategy. If only you could jump around after 6 months or a year from one to another—then perhaps you’d increase your chances on landing in the right place, at the right time. Unfortunately, as mentioned above, you normally have to stay around for several years to see how things play out.

The timing is particularly tricky. Please don’t join a unicorn too early, since it can mean years of underpaid work and high risk with no payout if the company fails. But also watch out with joining your unicorn too late, since your equity may be worth very little.

Both variables—picking the right start up and timing—are largely out of your control. This doesn’t necessarily make startup jobs bad—they can be exciting to many, and a high-growth environment with learning opportunities. Many still receive a good salary and find the work more interesting—even if there is no major cash out in the end. However, as a core wealth strategy—especially if you are not a good saver—this looks closer to buying a lottery ticket than executing a thoughtful plan.

Founding your own business is a different story though. Although it’s far more work and involves real risk, it offers more control and the potential for outsized income relative to an employee’s salary. You don’t need to aim for unicorn status to have a very successful business. Many folks in the FI space build modest but profitable businesses that provided cash flow and equity value over time.

Importantly, FI folks successful in this route generally paired entrepreneurship with disciplined saving and investments—the consistency that allows you to reach the FIRE crossover point. Unlike joining someone else’s startup, founding gives you agency over your time and can be emotionally rewarding, but also demands more risk and responsibility in return.

Startups aren’t the only lottery. The same dynamic plays out in the stock market.

The Stock-Picking Mirage: Why Index Funds Beat Active Investors

The second lever many people try to pull is trying to beat the market through stock-picking or timing the market. Again, a generally low savings rate forces people to look beyond the average 7% stock market return. Given their low monthly contributions, they actually need higher returns to accumulate meaningful wealth that they could retire with.

The evidence here is devastating—whether you try stock picking vs index funds through active management or doing it yourself.

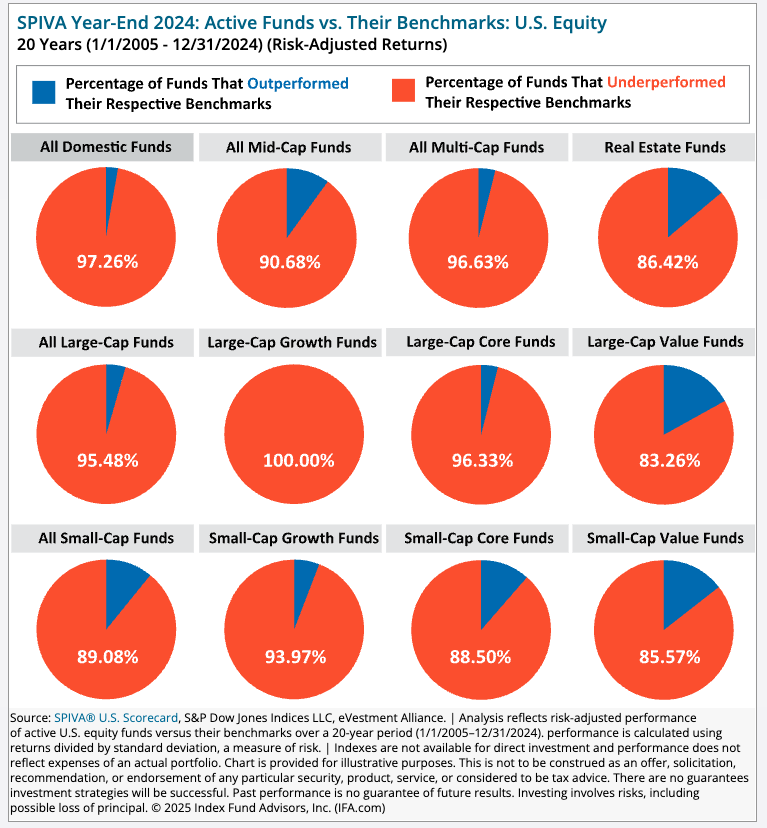

To put this into context, the SPIVA (S&P Indices Versus Active) Scorecards track how actively-managed funds perform against their benchmarks over time. As illustrated in the figure below, according to the SPIVA Scorecards actively-managed funds vastly underperforms holding a simple index, especially over long periods.

Figure 1: Pie charts show the percentage of actively-managed US equity-funds that underperformed their respective benchmarks for the 20-year period ended Dec. 31, 2024. Source: IFA

If you’re a regular reader of the blog, this won’t be too surprising. Jack Bogle—the founder of index funds—also documents this extensively over previous decades. After accounting for fees, taxes, and transaction costs, even professional managers rarely beat simple index funds. It’s not surprising that individual investors typically fare worse—they trade more often than they should, chase recent winners at already high valuations, and succumb to psychological biases like loss aversion and overconfidence.

An important reason for why it’s so hard to stock-pick is that stock market returns are extremely skewed—only 4% of listed stocks accounted for nearly all stock market wealth creation since 1926. It really is looking for a needle in a haystack.

This means successful stock-picking needs to identify the tiny sliver of winners in advance, while avoiding the vast majority of stocks that present poor returns. Even most retail value investors don’t have the time or bandwidth to evaluate the entire stock market in detail. For the vast majority of retail investors, stock-picking—whether themselves or through the managers of actively-managed funds—is a losing game.

Of course, some argue that careful value investing or concentrated strategies can work. A handful of investors do outperform the index. But these are statistical exceptions, not repeatable models for most people—and even Buffett advocates index funds for the average investor.

So, let’s come back again to someone who has perhaps $50,000 invested in their portfolio and a low savings rate. Trying to double or triple their portfolio quickly through individual stock picks or speculative strategies is a strategy with very poor odds. Even if they are lucky and pick a few winners, the chances of doing so consistently over decades is extraordinarily small.

This is why Bogle’s index-fund investing approach is so powerful. Instead of trying to find the next unicorn, just own the whole market cheaply and let the actual unicorns reveal themselves over time.

The vast majority of stock-picking retail investors will underperform a simple index fund. So do most actively-managed funds. Photo by Kaysha on Unsplash.

The Alternative: Savings Rate, Index Investing, and Entrepreneurship

The alternative paths to stock-picking or working for future unicorns isn’t as glamorous, but is far more effective. Instead of focusing on chasing outsized returns, focus on increasing your savings rate and the amount you contribute to your portfolio each month. That is under your control and a far more effective lever to accumulate wealth and reach Financial Independence.

This is exactly why Warren Buffett and Jack Bogle have long advocated for low-cost index funds over mutual funds or stock picking—the data is clear: simple beats sophisticated.

By sustaining a healthy savings rate over time and investing into internationally-diversified, low-cost index funds, you harness the power of compounding reliably instead of depending on luck. As your portfolio grows, your wealth trajectory becomes less dependent on finding the next big thing and more about steady accumulation.

You could also consider taking risks further down the line. For example, once you reach CoastFIRE—the point at which your existing investments would grow to support your retirement without further contributions—your risk profile may change. Now you can afford to make some speculative bets to try an capture the upside, rather than out of necessity.

That is exactly what I did recently—quitting my stable job and going down a more entrepreneurial route. I did so before reaching full Financial Independence, but with the backing of being on this journey for seven years with a very high savings rate. Although there is substantial uncertainty as to whether my entrepreneurial route—part time consultant, part time influencer—will work out or not financially, I’m certainly enjoying life and work much more now that I have control over my schedule and what I do.

As mentioned earlier, entrepreneurship can fit well into a FIRE strategy when approached carefully. Building your own business doesn’t require unicorn status to be transformative. A profitable small business can accelerate wealth-building far more effectively than chasing someone else’s startup unicorn. It offers, though, emotional rewards, control, and potentially a higher income compared to company employees.

If paired with consistent saving and investing, this can be a sound pathway too. In some ways, I wish I’d taken this route myself at a younger age and not waited until my late thirties to try it out.

Slow and steady wins the race. The vast majority of retail investors are better off focusing on increasing their savings rate and investing consistently in internationally-diversified, low-cost index funds. Photo by Stan Versluis on Unsplash.

Putting It All Together: From Lottery Hopes to Financial Agency

It’s easy to look at someone chasing crypto, unicorn startups, or hot stocks and dismiss their strategy as naïve or reckless. But, as Morgan Housel reminds us, financial decisions are shaped by each person’s experience, environments, and narratives they’ve told themselves—not by spreadsheet optimizations.

If someone’s economic reality feels structurally or behaviorally constrained—either wages not keeping up with costs or peers upgrading their lifestyles in front of you—then aiming for home runs in the form of stellar market returns or unicorn startups can feel like the only option. In that light, lottery-style strategies are emotionally rational responses to very real pressures, not foolish delusions.

The problem is that while these strategies are exciting and their narrative emotionally compelling, their statistical foundations are very thin. Whether it’s joining a startup, picking the next Nvidia, or timing the next bull run, the odds depend on tail events that are rare and unpredictable.

Remember, the startup lottery requires being lucking twice—being at the right place, at the right time. Stock picking requires identifying the needle in the haystack and also being right twice— with the buying and the selling. For most, it simply won’t work out—not because of lack of effort or intelligence, but because the odds of the game itself are completely stacked against them.

Hope is a powerful story, but a fragile strategy to build long-term wealth.

The alternative is to shift from hope to agency: increase your savings rate and automate your investment contributions. For some, building something entrepreneurial on your own terms can also be a rewarding path—provided you don’t forget about the savings rate part of the equation.

This path isn’t flashy and won’t get viral headlines, but it reliably compounds over time, and gives you control over the lever that actually matters.

💬 Have you ever considered working for or investing in a startup as part of your wealth strategy? What made you excited — or cautious — about the “unicorn” route? Share your experience below.

👉 New to Financial Independence? Check out our Start Here guide—the best place to begin your FI journey. Subscribe below to follow our journey.

🌿 Thanks for reading The Good Life Journey. I share weekly insights on money, purpose, and health, to help you build a life that compounds meaning over time. If this resonates, join readers from over 100 countries and subscribe to access our free FI tools and newsletter.

Disclaimer: I’m not a financial adviser, and this is not financial advice. The posts on this website are for informational purposes only; please consult a qualified adviser for personalized advice.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

Many people turn to unicorn startups or speculative investments because stagnant wages, lifestyle inflation, and low savings rates make traditional wealth-building feel out of reach. A single big win seems like a shortcut, even if the odds are slim.

-

Unicorn stocks refer to privately held startups valued at $1 billion or more. These are rare—under 0.1% of startups reach this status—and most employees don’t get rich from them.

-

Fewer than 1% of startups ever reach unicorn status. According to CB Insights and Crunchbase, about 0.1–1% make it, and most of those do not result in large payouts for employees.

-

Some do, but most don’t. Equity often gets diluted, vesting schedules expire, and IPO timing is unpredictable. For every headline success, many employees end up with worthless options.

-

No. SPIVA reports show over 85% of active funds underperform their benchmarks over 15 years. Stock returns are skewed—just 4% of stocks create all net wealth—making consistent outperformance extremely difficult.

-

Many believe they need higher returns to compensate for low savings, or they’re drawn to exciting stories of big winners. Behavioral biases and narratives often override simple math.

-

Index funds have lower costs, less turnover, and reliably capture market returns. Most active funds lag their benchmarks after fees, taxes, and trading costs.

-

Startups can offer great experience, but the odds of striking it rich are low. You have to be lucky twice: picking the right company and joining at the right time.

-

Many feel it’s their only shot at outsized returns. Others are influenced by media success stories. But risky stocks are, statistically, more likely to underperform than to create wealth.

-

Only about 0.5–1% globally. Most startups fail within five years, making the unicorn route more lottery than plan.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: