Best Nordic Countries to Retire (2026 Rankings & Costs)

Reinebringen on the Lofoten islands, Norway. Photo by Joshua Kettle on Unsplash.

Reading time: 9 minutes

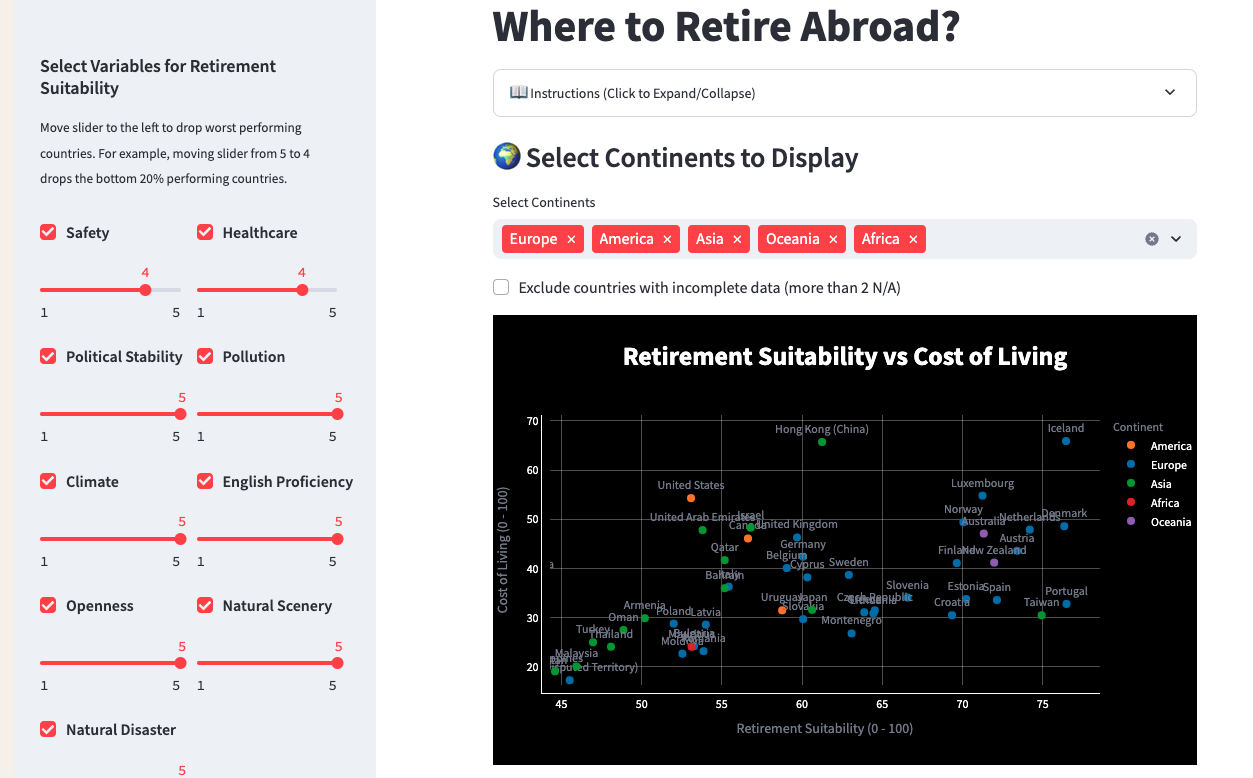

Author’s note: Over the past three years, we’ve developed a data-driven framework—now built into our Retirement Relocation Tool—that compares over 100 countries across ten variables, from cost of living to healthcare and safety. This methodology has already been applied to our Europe, Asia, and Latin America rankings. Today’s article builds on this to examine the best Nordic countries to retire.

Quick answer (2026): The best Nordic countries to retire depend on what you optimize for. In our data-driven index, Iceland and Denmark lead on overall “retirement suitability,” while Sweden and Finland are the most affordable options in the region. Taxes can shift the decision—especially Norway’s wealth tax—so this guide includes a practical tax overview alongside cost-of-living.

What you’ll get from this guide ❄️

✔ A ranking of Denmark, Norway, Sweden, Finland & Iceland using a 9-factor retirement suitability index

✔ Cost-of-living comparison across the five Nordics (and relative to US/Germany)

✔ A retiree tax overview: capital gains, wealth tax, inheritance, and exit-tax considerations

✔ The key trade-offs: safety vs cost, climate vs lifestyle, integration vs bureaucracy

✔ A quick “best fit” summary so you can decide fast (Table 1)

TL;DR — Best Nordic Countries to Retire (2026)

🇮🇸 Iceland — Safest Nordic country with unmatched natural scenery, ultra-clean air, and high political stability (but the highest cost of living)

🇩🇰 Denmark — Best overall ease of living, combining top-tier healthcare, safety, mild climate, and strong expat integration

🇳🇴 Norway — World-class scenery and English proficiency, ideal for active retirees who can afford higher daily costs

🇫🇮 Finland — Best value option, offering air quality, excellent healthcare, and lower Nordic living costs

🇸🇪 Sweden — Most affordable Nordic country, with strong English and urban-nature balance, but weaker safety metrics in some cities

📌 Bottom line: All Nordic countries offer stability, clean environments, and strong public services—but the right choice depends on whether you prioritize safety, ease, nature, or affordability.

Want this ranking personalized to you?

Costs, safety, climate tolerance, healthcare, and more—small changes on indicator preferences flip the Nordic ranking fast.

👉 Use the Retirement Relocation Tool to see your best-fit country in under 2 minutes (email access, no cost)

Best Nordic Countries to Retire: Data-Driven 2026 Ranking

This guide ranks the five Nordic countries—Denmark, Norway, Sweden, Finland, and Iceland—for retirement using a 9-factor “retirement suitability” index that is composed of the following ingredients: safety, healthcare, climate, pollution, English proficiency, openness, political stability, scenery, and natural disaster risk.

We then layer in cost of living and a practical tax overview—covering capital gains, wealth, inheritance, and exit considerations—to show how each Nordic country compares in real retirement terms. The analysis highlights both the strongest all-around options and the most budget-friendly choices, as well as how easy it is for foreign retirees to integrate. In some cases, seasonal living strategies could also reduce costs without requiring a full year-round relocation.

Note: “Nordic” includes Denmark, Norway, Sweden, Finland and Iceland; “Scandinavian” commonly refers to Denmark, Norway, and Sweden. In this article we assess in detail all five countries.

Copenhagen, Denmark. Photo by Nick Karvounis on Unsplash.

How to Choose the Best Nordic Country to Retire (Denmark, Norway, Sweden, Finland & Iceland)

Before diving into country-by-country results, here’s how to interpret the rankings and tailor them to your own priorities.

We use our Retirement Relocation Tool (email unlock) to compare countries across multiple dimensions—such as cost of living, healthcare quality, safety, climate, and openness—rather than relying on a single headline ranking.

The tool is presented as an interactive dashboard. Sliders let you tighten or relax requirements for each factor depending on what matters most to you. One retiree might prioritize healthcare and safety, while another may care more about affordability or English proficiency. The results update dynamically to reflect those choices.

Swedish farmhouse in the countryside. Photo by Daniel Diemer on Unsplash.

How Our Retirement Relocation Tool Helps You Compare the Best Nordic Countries to Retire

Our Retirement Relocation Tool helps prospective retirees compare countries across the factors that matter most for long-term quality of life. Each country receives a retirement suitability score, calculated as the average of nine core variables that consistently shape the retirement experience:

Safety

Healthcare quality

Political stability

Pollution levels

Climate

English proficiency

Openness

Natural scenery and

Natural disaster risk

These 9 factors were further described in a detailed post introducing the tool’s methodology.

Figure 1 below shows a screenshot of the interactive Retirement Relocation Tool. The sliders next to the variables on the left-hand side of the dashboard allow the user to remove countries from the analysis that don’t perform well for a given factor.

For example, moving the safety slider from 5 to 4 would drop the bottom 20% performing countries for this variable. If we move it all the way to 1, the interactive plot would show only the top 20% safest countries. The tool also lets you limit the view to certain continents and also whether to exclude from the analysis countries with more than 2 missing variables.

The graph maps countries according to cost of living (y axis) and retirement suitability (x axis). The retirement suitability score is the average score across the variables considered by the user, while the cost of living is based on 2025 Numbeo data. Ideally, if you are looking to protect your budget you want to consider countries appearing in the bottom right of the plot—it means they have a good balance between retirement suitability score and a reasonable cost of living.

We built this retirement suitability index as part of our data-driven Retirement Relocation Tool, now applied to Europe, Asia and Latin America. Using consistent, comparable variables across regions helps us surface trade-offs you can actually act on.

Figure 1. Screenshot of the Retirement Relocation Tool (email unlock; PC only).

Try Our Retirement Relocation Tool—Find Your Ideal Destination Now!

Can foreigners retire in Nordic countries? Generally yes, but routes and paperwork differ by citizenship (EU/EEA vs. non-EU). We summarise key lifestyle, cost, and tax considerations in this article, but always confirm visa and residency rules with official sources and consider how they align specifically with your own situation.

Top Nordic Countries to Retire in 2026: Healthcare, Safety, Costs & Taxes

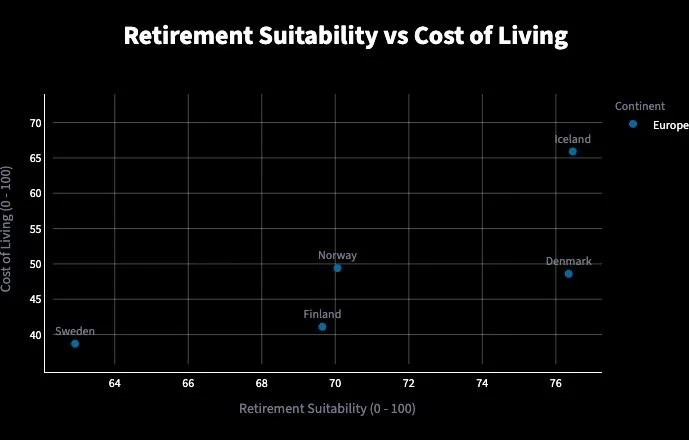

As observed in our chart (Figure 2), Iceland and Denmark form a virtual tie for the top overall retirement suitability score in the Nordics (x axis), followed by Norway, Finland, and, further behind, Sweden.

The cost of living—depicted by the y axis—varies widely in the region: Sweden and Finland are the more budget-friendly, Denmark and Norway are high but still relatively manageable, while Iceland is the most expensive by a clear margin. If your priority is the most affordable Nordic country to retire, Sweden and Finland consistently come out cheapest in our data.

In practice—as we’ll cover below in more detail—choosing one country over another entails making different trade-offs. Perhaps you trade budget for scenery/safety (Iceland/Norway) or prioritize ease-of-living and healthcare (Denmark), or stretch your euros further in Sweden/Finland without giving up clean air and urban amenities.

Below we dive into each country’s results across each of these 5 Nordic retirement locations. How did they score across each of the variables compared to the other 40+ European countries in our dataset? What does their cost of living look like in practice and what are the tax considerations to keep in mind?

Figure 2. Screenshot of our Retirement Relocation Tool. Which are the best Nordic countries for retirement? Denmark, Norway, Sweden, Finland, and Iceland plotted across the Retirement Suitability score—average of 9 different variables (x axis)—and cost of living (y axis). If you are interested in examining other regions, check out our ranking of the best countries to retire in Asia, Europe, and Latin America.

With the framework in place, here’s how each Nordic country stacks up for retirees—pros, cons and costs, from #5 to #1. The figures shown in this ranking are part of the broader European dataset used for this analysis—see the full Nordic comparison table further down.

#5 🇸🇪 Sweden—Clean Air, High English Proficiency & City–Nature Balance

Sweden blends modern urban comfort with vast stretches of wild nature—something many retirees looking north in Europe find compelling. Stockholm’s 30,000-island archipelago allows you to kayak among pine-fringed islets by day and enjoy Michelin-starred dining or other city attractions by night.

If you prefer smaller cities, Gothenburg’s canals, Malmö’s renaissance squares, or the university town of Uppsala all provide cultural richness without the sprawl of larger capitals. Sweden ranks 4th in Europe for low pollution (ranks 3rd across Nordic countries—after Finland and Iceland), so even in its biggest cities the air feels crisp and invigorating.

Language is rarely a barrier: with 5th-best English proficiency in Europe (2nd across Nordic countries, only trailing Norway), Sweden makes it easy for expat retirees to handle everything from doctor’s visits to dinner parties without needing fluent Swedish right away. For foreign retirees, Sweden’s high English proficiency eases integration, even if you don’t speak Swedish at first.

Political stability is another strength (though 5th across Nordic countries), ranking 7th in Europe. Although it’s not immune to some of the political changes affecting major European countries, the country’s long tradition of consensus politics creates a calm, predictable backdrop for retirees’ plans.

Stockholm, Sweden. Photo by Emil Widlund on Unsplash.

Natural scenery ranks 10th in Europe (3rd across the Nordics, after Norway and Finland) and ranges from the high peaks of the Kebnekaise massif to the gentle lakes and birch forests of Småland, offering outdoor opportunities in every season.

Still, there are trade-offs to consider. Sweden’s safety ranking is 38th in Europe, which is concerning and noticeably lower than its Nordic neighbours. By global standards it remains a safe country, but some urban centres—particularly parts of Stockholm and Malmö—have seen a rise in petty crime and isolated gang violence.

For retirees accustomed to small-town tranquility, this is worth weighing when choosing a location. Of course, safety varies by neighbourhood and city; retirees who choose quieter districts or smaller towns typically report very low day-to-day risk.

Its healthcare, ranked 16th in Europe (4th across Nordic countries—ahead of Iceland), delivers high-quality outcomes, yet long waiting times for non-urgent care can test patience. In practice, many expats choose supplemental private coverage.

Climate is a consistent challenge across all Nordic countries—though perhaps not for many readers of this post looking to retire in this region! Sweden ranks 27th in Europe for climate (2nd across Nordic region, behind Denmark) , with long winters and dramatic shifts in daylight: in December Stockholm enjoys only about six hours of light.

On the other hand, summer days stretch late into the evening, creating an almost festive atmosphere. Retirees who embrace the rhythm—joining locals in winter sports, enjoying fika (the daily coffee break), and travelling south during the darkest months—often find the seasonal variation to be part of Sweden’s charm.

Finally, Sweden’s cost-of-living index is about 28.7% lower than the United States and around 8.7% lower than Germany. Please note though that these are broad national averages; costs in Stockholm differ from those in smaller university towns, and, of course, there is a huge variation in COL across US, too. Consult city-level COL data to tailor the estimate to your preferred location.

#4 🇫🇮 Finland—Elite Air Quality and Strong Healthcare at Softer Prices

Finland consistently ranks among Europe’s healthiest environments, scoring 1st in Europe for low pollution. Whether you’re strolling through Helsinki’s waterfront parks or hiking in the forested Lakeland region, the clean air is a daily gift.

Finland also boasts a robust healthcare system: it ranks 5th in Europe, offering excellent outcomes and efficient preventative care (2nd best across Nordic countries—only trailing Denmark). Private services are available but many retirees find the public system sufficient, especially in or near major cities.

Safety and governance are equally strong. Finland is 9th in Europe for safety (3rd regionally, after Iceland and Denmark) and 5th for political stability (3rd after Denmark and Norway), providing the kind of predictability many retirees value.

Its natural scenery, ranked 11th (4th across the five, ahead of Denmark), is quintessentially Nordic: more than 180,000 lakes, dense boreal forests and the occasional spectacle of the Northern Lights. Cities such as Helsinki, Tampere, and Turku mix a vibrant design culture with manageable size—perfect for retirees who enjoy café life and cultural events without big-city overwhelm.

Helsinki, Finland. Photo by Veikko Venemies on Unsplash.

The country is also relatively budget-friendly by Nordic standards. While not inexpensive compared to southern Europe, Finland’s housing and daily expenses are typically lower than in Denmark, Norway, or Iceland. English proficiency ranks a solid 14th in Europe (behind Norway, Sweden, and Denmark; no data for Iceland), enough to manage daily tasks and social life in urban areas.

Among the Nordics, Finland may be the best value pick for retirees balancing affordability with strong healthcare and safety.

Openness, at 20th (3rd after Denmark and Sweden; no data for Iceland), reflects a reserved social style rather than unfriendliness. Joining community activities—from sauna clubs to cross-country skiing groups—can help to quickly build connections.

Finland’s main hurdle is its 39th-place climate ranking—the coldest among the five. Winters are long, with only a few hours of daylight in the far north. Yet locals embrace the season—ice-swimming, skiing, and of course the national obsession with sauna. Retirees who adopt these traditions often find that the dark months become a time of community and cozy hygge, while the endless summer days—when the sun barely sets—feel all the more special.

Finally, Finland’s cost-of-living index is about 24.3% lower than the United States and roughly 3% lower than Germany. As we have mentioned before, though, these are country-level averages and costs can vary significantly between Helsinki and smaller towns, so consult city-level COL data to fine-tune your retirement budget.

Cross-skiing in Ruka, Finland. Source: Timo Newton-Syms on Flickr.

#3 🇳🇴 Norway—World-Class Scenery, Top English, Higher Living Costs

For retirees who dream of jaw-dropping landscapes and nature, Norway is the Nordic showstopper. Its 4th-place European ranking for natural scenery is easy to understand once you’ve sailed through the Geirangerfjord or stood beneath the midnight sun on the Lofoten Islands. For many, Norway is the best Nordic country for nature-led retirement—if budget allows.

Clean air is almost a given—Norway ranks 5th in Europe for low pollution (4th across the Nordic countries)—and outdoor recreation is woven into daily life. Hiking trails begin practically at the edge of cities like Bergen or Trondheim, making it simple to maintain an active, healthy retirement.

Norway also scores high for liveability: healthcare ranks 8th in Europe (behind Denmark and Finland), English proficiency is a remarkable 4th (best in the region), and political stability ranks 4th in Europe (only behind Denmark).

Safety is strong—17th in Europe (4th in region, ahead of Sweden), excellent by global standards—and social trust remains high. Retirees often remark on how effortless it feels to navigate bureaucracy or access medical care, especially in the larger cities.

Fjords in Norway. Photo by Richard Hatleskog on Unsplash.

However, these strengths come with costs. Norway is among the most expensive countries in Europe, and while public healthcare is heavily subsidised, everyday expenses—from groceries to housing—are significantly higher than in Sweden or Finland.

Similar to other countries in the region, climate—ranked 35th in Europe—brings long, cold winters, and brief daylight hours, particularly above the Arctic Circle. Coastal areas such as Bergen are milder but rainier, while inland regions can see deep winter freezes.

Openness (22nd in Europe; 4th in region) reflects a typically reserved social culture. Like Finns, Norwegians warm up quickly once you join local activities—think of ski clubs or hiking groups as great entry points. For retirees with the budget and a love of the outdoors, Norway offers a lifestyle where nature isn’t just scenery—it’s a daily companion.

Finally, Norway posts a cost-of-living index about 9% lower than the United States and roughly 16.5% higher than Germany. As mentioned previously, these numbers are country-wide averages and actual costs will depend on where you settle—Oslo and Bergen are noticeably more expensive than rural areas—so be sure to check city-level COL data.

Hamnøy, Norway. Photo by Benoît Deschasaux on Unsplash.

#2 🇩🇰 Denmark—Best Overall Ease: Healthcare, Safety & Mildest Climate

Denmark and Iceland are extremely close in our index; we rank Iceland #1 mainly due to safety and scenery, while Denmark is the best all-around “easy mode” choice of the Nordics: a country where everything works with minimal friction. It ranks 2nd in Europe for healthcare quality (best in the region), offering reliable public care and quick access to specialists.

Safety is equally impressive at 5th (only behind Iceland), while political stability ranks 3rd (best in the region), creating a secure environment for long-term planning.

The climate is the mildest among these five nations—19th in Europe—which, combined with superb cycling infrastructure and flat terrain, makes daily life pleasant and active. You can bike from Copenhagen’s historic centre to sandy Amager Strandpark in 20 minutes, or spend weekends exploring the windswept dunes of Jutland.

English proficiency is 8th in Europe (3rd in region after Norway and Sweden), and openness ranks 15th (best in the region), particularly strong in cosmopolitan Copenhagen and Aarhus where expat networks are well established.

I can personally attest to locals’ friendly nature. I recently returned from exploring Denmark’s islands and coastal towns and could easily imagine a retirement base there—mild climate, easy biking, and a community feel that’s harder to find in larger cities.

Main street in Ærøskøbing, Ærø island, Denmark. Source: https://kulturringen.dk/

Denmark’s compact geography means you’re never far from a coast or cultural hub. Its natural scenery—14th in Europe (5th in the region)—leans towards gentle coastal landscapes and picturesque islands rather than dramatic fjords and other outstanding scenery of its regional counterparts.

Perhaps Denmark’s greatest selling point is its ease of living. Efficient public transport, strong public services, and a society built around balance—captured in the concept of hygge—make integration straightforward. For retirees seeking a low-stress, high-quality lifestyle in the Nordics, Denmark is the natural first look.

Finally, Denmark’s costs are high but generally lower than in Norway or Iceland. Its cost-of-living index is about 10.5% lower than the United States and roughly 14.6% higher than Germany. As we mentioned before, these figures represent country-level averages and your own experience can vary widely depending on city and lifestyle. Be sure to check city-level COL data—Copenhagen costs more than provincial towns—before making any long-term retirement plans.

Blåvand Strand, Blåvand, Dänemark. Photo by Stefan Pasch on Unsplash.

#1 🇮🇸 Iceland—Safest Nordic Country & Pristine Landscapes

Iceland ties with Denmark for first position in our ranking—it literally had the same weighted score across the 9 variables we looked at.

Iceland delivers a retirement experience that feels almost mythical. It ranks 4th in Europe for safety (1st in region), 2nd for low pollution (2nd in region after Finland), and 6th for natural scenery (2nd after Norway)—think lava fields, glacial lagoons, and geothermal hot springs you can soak in year-round. It’s the safest Nordic country to retire, but also the priciest.

Political stability, at 6th in Europe (4th in region in front of Sweden), provides a reliable environment, while its 15th-place natural-disaster risk reflects a well-managed reality: volcanic and seismic activity is carefully monitored and warning systems are robust.

Healthcare is solid, ranking 17th in Europe but 5th in region, and while specialist services are concentrated in Reykjavik, routine care is accessible even in smaller towns. Many retirees appreciate the country’s strong community health programs and preventive care culture.

English is widely spoken even though no formal European ranking is available, making daily life smooth for newcomers. Social interactions are famously warm once you break the initial ice—pun intended.

Reykjavík, Iceland. Photo by Einar H. Reynis on Unsplash.

The two main challenges are cost and climate. Iceland is by far the most expensive country in the Nordics—everyday goods, housing, and even utilities carry a premium due to its remote location. The climate, ranked 34th in Europe (3rd in region, behind Denmark and Sweden), is cool, windy, and dark in winter.

Yet, like in other countries of the region, locals embrace it, with geothermal pools and cosy cafés turning the long nights into an art of comfort. Many retirees adopt a “dual-base” strategy, spending part of the winter abroad while enjoying Iceland’s bright, endless summers.

For those who value safety, purity, and awe-inspiring nature above all else—and are comfortable with higher living costs—Iceland likely offers a retirement experience like no other. It is a place where the extraordinary is part of the everyday and where clean air and untouched landscapes become a daily source of inspiration.

Finally, Iceland’s cost-of-living index is about 21.3% higher than the United States and a striking 55.4% higher than Germany. As we highlighted earlier, these are national averages and living expenses can vary by region; always review local-level COL data before making a retirement decision.

Compare the Nordic Rankings at a Glance

Table 1 below summarizes how Denmark, Sweden, Norway, Iceland, and Finland rank across the nine non-financial variables used in our Retirement Relocation Tool (lower numbers = better). Rather than focusing on a single headline winner, this “best-fit” view helps you quickly see which Nordic country aligns best with your own priorities—whether that’s safety, healthcare, climate tolerance, or affordability.

Table 1: Ranking of Nordic countries across 9 retirement suitability variables in relation to 40+ European countries. Source: our Retirement Relocation Tool.

| Country | Safety | Healthcare | Political Stability | Pollution | Climate | English Proficiency | Openness | Natural Scenery | Natural Disaster Risk |

|---|---|---|---|---|---|---|---|---|---|

| Denmark | 5 | 2 | 3 | 6 | 19 | 8 | 15 | 14 | 4 |

| Sweden | 38 | 16 | 7 | 4 | 27 | 5 | 18 | 10 | 25 |

| Norway | 17 | 8 | 4 | 5 | 35 | 4 | 22 | 4 | 21 |

| Iceland | 4 | 17 | 6 | 2 | 34 | — | — | 6 | 15 |

| Finland | 9 | 5 | 5 | 1 | 39 | 14 | 20 | 11 | 12 |

Ranks out of 40+ European countries (lower number = better). Source: Retirement Relocation Tool, 2025.

Lifestyle isn’t the whole story though—your portfolio matters too. Here’s how the tax landscape compares in Nordic countries.

Nordic Taxes for Retirees & FIRE Portfolios (CGT, Wealth, Inheritance)

Before finalizing our assessment, it’s worth taking a quick look at how the Nordic tax system affects long-term investors living off their portfolios. Below we compare CGT in the Nordics, wealth tax in Norway, and inheritance/exit taxes—key issues for FIRE portfolios.

While headline capital-gains tax (CGT) rates differ across countries, the effective tax burden on a FIRE portfolio is usually lower than it first appears—and rarely is it, in my view, a complete deal-breaker. People tend to overestimate substantially how much they end up paying in CGT.

For instance, in a previous article we saw that the effective CGT on a FIRE portfolio in Denmark was about twice that of Germany. That sounds like a lot, but it’s still manageable if Denmark is your preferred destination for other reasons. To address this increase in tax cost you may need to work—all else equal—in the order of one additional year to cover those extra tax expenses in relation to Germany.

And keep in mind that Denmark has the highest headline CGT in Europe (42%). Therefore, CGT shouldn’t necessarily constitute a make-or-break decision. In my view, other financial and non-financial variables should weigh more heavily on your decision to retire somewhere.

All five Nordic countries tax investment gains, but the way they do it varies:

Denmark has the highest rates in Europe—about 27% on annual gains up to roughly DKK 67,500 (€9,000) and 42% above that.

Norway taxes realised gains and dividends at an effective rate of 37.84% (achieved by taxing a deemed gain of 1.72 times the realized gain at the standard 22% capital gains tax rate). A small shielding allowance lowers the taxable portion of share returns. Other capital gains (e.g., some bonds, bank interest) are generally taxed at 22%.

Sweden levies a flat 30% on realised gains, unless you opt into the investment savings account (ISK). Sweden’s ISK, available to Swedish tax residents, charges a small annual deemed-return tax (≈0.888% of account value in 2025). As of 2026, the first SEK 300,000 in an ISK will be tax-free. Depending on the size of your portfolio and your annual withdrawals one or another will make sense.

Finland applies 30% on realised gains up to about €30,000 per year, then 34% above that.

Iceland taxes capital gains at a flat 22%, the lowest of the group.

Landmannalaugar, Iceland. Photo by Joshua Sortino on Unsplash.

The only Nordic country with a wealth tax is Norway, where net assets above roughly NOK 1.7 million per person (≈€145k) face a municipal + state wealth tax totalling about 0.95–1.1% annually (depending on municipality). For a FIRE portfolio this does represent an important drag, and means you need to carefully re-calibrate your safe withdrawal rate or target a substantially larger portfolio before retiring.

Most of the region has no classic inheritance tax—Finland does (7–33% depending on relationship and size), but Denmark, Sweden, Norway, and Iceland have either abolished it or levy only minor fees on estates.

Finally, none of the five Nordic countries imposes—at present—the kind of punitive exit tax you see in France or Spain. Leaving with your investments does not, at present, trigger a one-time wealth levy beyond the normal capital-gains rules.

High Nordic headline taxes sound daunting, but for FIRE planners the reality is more nuanced. Capital-gains tax—even Denmark’s—may mean working an extra year, but it seldom breaks the maths of early retirement. The real outlier is Norway’s wealth tax, which requires careful planning and can materially lower a sustainable withdrawal rate.

With the exception of Norway’s wealth tax, taxes shouldn’t necessarily represent a key driver of your relocation decision. Cost of living likely matters much more from a financial perspective, and aligning your preferences with the myriad of non-financial factors and lifestyle preferences presented earlier in the article makes most sense.

Swedish countryside. Photo by Jessica Pamp on Unsplash.

Best Nordic Country to Retire: Key Takeaways & Next Steps

All five Nordic countries deliver clean air, solid healthcare, and stable institutions—the differences are price, climate severity, and day-to-day ease. If you want frictionless living with excellent healthcare and gentler winters, Denmark is the natural first look. If breathtaking scenery and English-everywhere simplicity top your list—and budget allows—Norway is extraordinary.

If you’re value-sensitive and want elite air quality with strong healthcare, Finland stands out. If you prefer city culture plus nature access and lower Nordic costs, Sweden works well—just go in eyes-open about its relative safety in some city areas. If you’re seeking safety, purity, and wonder, and you’re comfortable with high costs and a sub-Arctic climate, Iceland is incomparable.

Whichever you choose, though, the Nordic region offers retirees with strong portfolios a rare combination of natural beauty and social stability, making it one of the most appealing corners of Europe for a fulfilling, worry-free retirement.

As always, treat this ranking as a launchpad, not a blueprint. The data narrows your options; your preferences make the final call. If a country intrigues you, test it: rent an apartment for a few weeks in winter and summer, ride public transit, try a GP visit, join a local club, and see whether daily life feels like ease or effort.

Next steps:

👉 Want this personalized? Try the Retirement Relocation Tool (2 minutes, email access)

👉 New to Financial Independence? Start Here with the core concepts

👉 Subscribe for free tools + monthly insights (one-click unsubscribe)

💬 What’s your ideal Nordic retirement base—coastal Denmark, fjord-side Norway, lake-dotted Finland, Stockholm’s islands, or Iceland’s lava fields? Share your thoughts below—I’d love to hear what you’re weighing and why.

🌿 Thanks for reading The Good Life Journey. I share weekly insights on personal finance, financial independence (FIRE), and long-term investing — with work, health, and philosophy explored through the FI lens.

Disclaimer: I’m not a financial adviser, and this is not financial advice. The posts on this website are for informational purposes only; please consult a qualified adviser for personalized advice.

Interested in finding the best location to retire abroad? Also check out our ranking of the most affordable countries to retire in Asia, Europe, and Latin America.

About the author:

Written by David, a former academic scientist with a PhD and over a decade of experience in data analysis, modeling, and market-based financial systems, including work related to carbon markets. I apply a research-driven, evidence-based approach to personal finance and FIRE, focusing on long-term investing, retirement planning, and financial decision-making under uncertainty.

This site documents my own journey toward financial independence, with related topics like work, health, and philosophy explored through a financial independence lens, as they influence saving, investing, and retirement planning decisions.

Check out other recent articles

Frequently Asked Questions (FAQs)

-

Denmark and Iceland top our 2025 suitability index. Denmark offers the best overall ease—elite healthcare, safety, and the mildest Nordic climate. Iceland is the safest and most pristine, with world-class air quality and scenery, but comes with the region’s highest cost of living.

-

Based on our data, Sweden and Finland are the cheapest Nordic countries overall. You’ll trade lower prices for colder climates and, in Sweden’s case, a lower safety ranking than Nordic peers. City choice (e.g., Helsinki vs. smaller towns) also changes your budget meaningfully.

-

Among the three Scandinavian countries (Denmark, Norway, Sweden), Sweden is generally the most affordable, followed by Denmark, with Norway the most expensive. If you widen to “Nordic,” Finland often rivals Sweden on value.

-

Yes, but routes differ by nationality. EU/EEA citizens have simpler paths; non-EU retirees generally need income/insurance proof and residence permits. Our guide compares lifestyle, taxes, and costs—always verify residency/visa rules with official government sites.

-

Denmark ranks #2 in Europe for healthcare quality, Norway #8, Finland #5, Iceland #17, Sweden #16 (Europe-wide ranks). All provide strong outcomes; wait times and private top-ups vary by country and city.

-

All tax investments differently. Denmark has high CGT; Norway adds a wealth tax; Sweden’s ISK can be tax-efficient for smaller portfolios; Finland uses tiered CGT; Iceland has the lowest CGT at 22%.

-

Norway, Sweden and Denmark rank very high in English proficiency. Finland is solid in cities. Iceland is widely English-friendly in practice. If language ease is critical, Norway/Sweden/Denmark are standouts.

-

Denmark has the mildest climate. Sweden and Finland bring colder, darker winters but glorious light in summer. Norway and Iceland are cooler and windier; in return, you gain epic nature. Seasonal strategies (travel, hobbies) make winters much easier.

Join readers from more than 100 countries, subscribe below!

Didn't Find What You Were After? Try Searching Here For Other Topics Or Articles: